Ford Investors Will Have to Be Tough When It Comes to Their Dividend

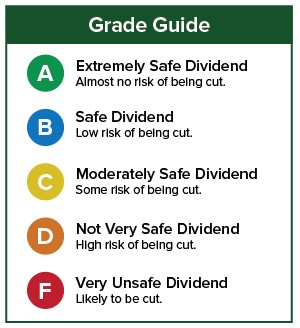

I covered Ford Motor Company (NYSE: F) in this column a year ago. At the time, the automaker got a “D” for dividend safety because of falling cash flow and a payout ratio that was too high.

We’re in the same situation today, though now things appear a little worse.

Ford is going through a reorganization as it invests a lot of money into electric vehicles (EVs).

Ford plans to invest $11 billion in developing EV technology. It may ultimately pay off as EVs become more popular.

The company has also already invested $1 billion into autonomous driving car technology and is likely to add more funds to the project, partnered with Volkswagen.

In the long run, that is likely positive news. Ford is investing in the latest trends and is not only keeping up with the times but also attempting to be a leader.

Currently, however, the situation isn’t great. The company’s bonds were recently cut to junk by Moody’s.

That makes it much more expensive for Ford to borrow money, which it does quite a bit. It has $103 billion in long-term debt.

If management wants to improve its bond ratings, keeping more cash available by cutting the dividend could be an option. The cash likely won’t come from decreasing spending on research and development.

Ford has paid the same $0.15 per share quarterly dividend since 2015. It has paid a special dividend twice during that time as well.

It cut the dividend in 2001, 2002 and 2006, although those cuts happened too far in the past to affect Ford’s current dividend safety rating.

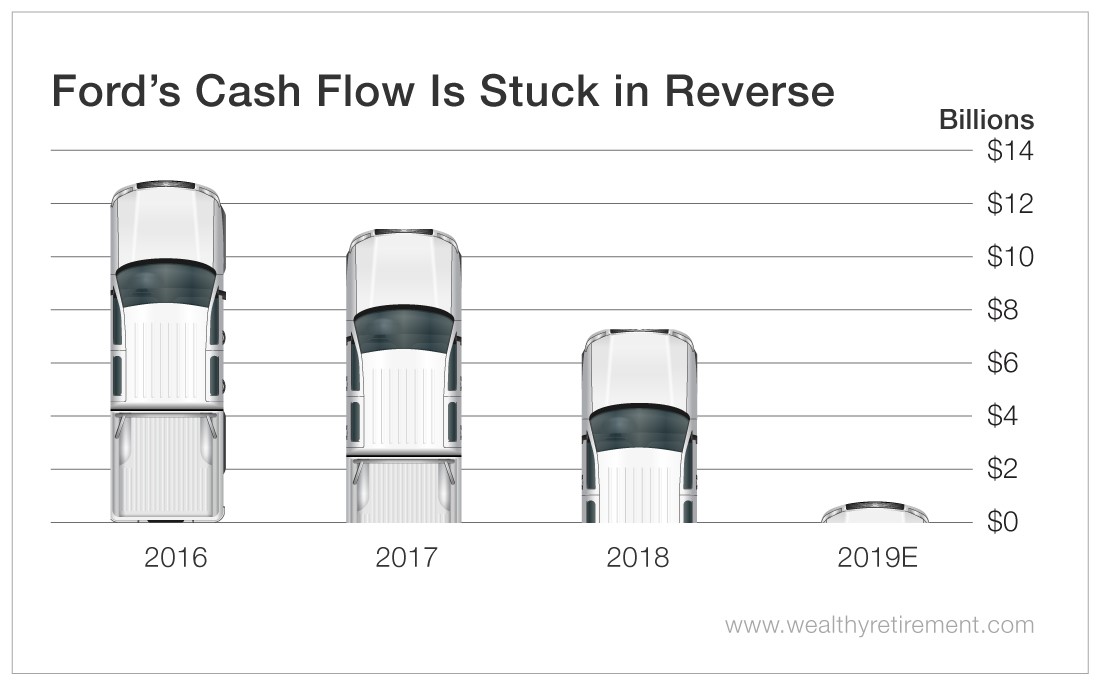

The problem is free cash flow is falling, and this year it’s projected to nose-dive 90%.

SafetyNet Pro does not look kindly on companies with shrinking cash flow.

And this year, if Wall Street’s forecasts are right, the company will pay more than three times as much in dividends as it will generate in free cash flow.

Considering that the bond rating agencies are breathing down its neck and Ford’s plummeting cash flow won’t cover the dividend, I’d expect a dividend cut in the near future.

Ford’s $0.60 per share annual dividend comes out to an enticing 6.6% yield. But management is going to have to look under the hood for ways to preserve cash, and the dividend is likely to be a casualty.

Shareholders who invested in Ford for the dividend should buckle their seat belts.

Dividend Safety Rating: F

If you have a stock whose dividend safety you’d like me to analyze, leave the ticker symbol in the comments section.

About Marc Lichtenfeld

Marc Lichtenfeld is the Chief Income Strategist of Investment U’s publisher, The Oxford Club. He has more than three decades of experience in the market and a dedicated following of more than 500,000 investors.

After getting his start on the trading desk at Carlin Equities, he moved over to Avalon Research Group as a senior analyst. Over the years, Marc’s commentary has appeared in The Wall Street Journal, Barron’s and U.S. News & World Report, among other outlets. Prior to joining The Oxford Club, he was a senior columnist at Jim Cramer’s TheStreet. Today, he is a sought-after media guest who has appeared on CNBC, Fox Business and Yahoo Finance.

Marc shares his financial advice via The Oxford Club’s free daily e-letter called Wealthy Retirement and a monthly, income-focused newsletter called The Oxford Income Letter. He also runs four subscription-based trading services: Technical Pattern Profits, Penny Options Trader, Oxford Bond Advantage and Predictive Profits.

His first book, Get Rich with Dividends: A Proven System for Earning Double-Digit Returns, achieved bestseller status shortly after its release in 2012, and the second edition was named the 2018 Book of the Year by the Institute for Financial Literacy. It has been published in four languages. In early 2018, Marc released his second book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners, which hit No. 1 on Amazon’s bestseller list. It was named the 2019 Book of the Year by the Institute for Financial Literacy.