Saving for Retirement

You should be saving for retirement no matter if you are 20- or 60-years-old. Warren Buffet once said, “Do not save what is left after spending, but spend what is left after saving.”

Millions of Americans with both low and high paying jobs are still living paycheck-to-paycheck. Why is that? A recent GOBankingRates survey found an astonishing 34% of Americans have no savings at all.

How Much Should You Be Saving for Retirement?

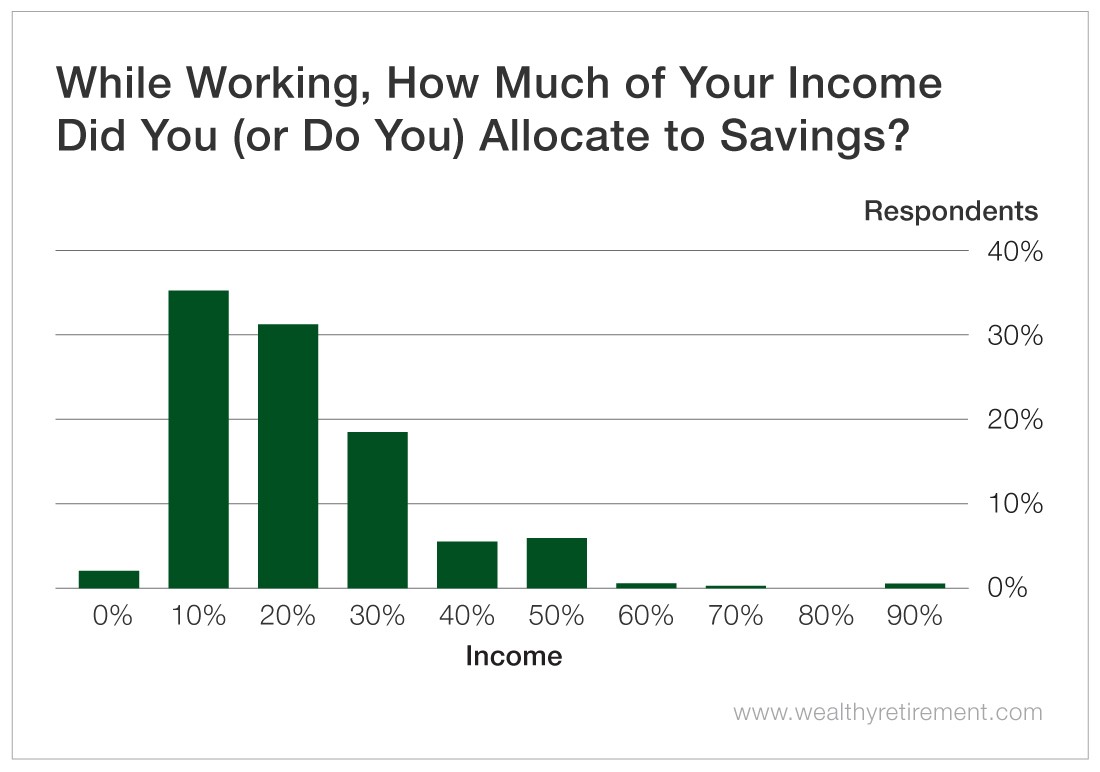

We asked readers how much income they set aside while they were working. The majority of our respondents reported setting aside between 10% and 20% of their income.

Others reported setting aside between 30% and 50%, and a few readers even reported saving 60% or more – an impressive effort. No matter where you are on your journey to financial freedom, setting aside more today will set you up for a much happier and more secure retirement.

6 Retirement Savings Habits to Implement Today

1. Set Goals

If there is one thing to learn in life, it’s that everyone needs something to work towards. Everyone needs goals. They are what drives us, gives us hope for the future and keeps us focused. Only you can decide when you’ll be ready to retire. But if you need a little help, consider using our retirement readiness calculator here.

2. Take Full Advantage of Your 401k

Our experts recommend you put 10% – 15% of your income into your 401(k) each year. Make sure you understand the tax bracket you’re in as well as the maximum contribution amount. In 2022, the maximum contribution tops out at $20,500.

Also make sure you understand your employer 401(k) match. Gone are the days when most companies had a very attractive match. The average 401(k) match is roughly around 6% this year. Even so, you’ll want to maximize your total contribution so it’s enough to take full advantage of the employer match.

3. Pay Off All Your Debt

When a large portion of your income is going towards debt each month, it becomes very difficult to save anything at all. Getting rid of credit card debt, car loan debt, student loans and anything else you have weighing you down is absolutely essential when saving for retirement. You may want to consider pausing your retirement savings temporarily (for no more than a few years) while paying off your debts. The reason for this is the percentage of negative interest you are paying towards debt is likely greater than the positive interest you are saving for retirement.

Again…pausing your retirement contributions should only be done to expedite the process of paying off your debt. Once all of your debt (except your mortgage if you have one) is paid off, you will have much more to put towards your retirement savings each month.

4. Set a Budget

This one goes without saying. We hope you’ve been using a budget all along, but if you haven’t, start today! Setting a budget will make sure you don’t overspend each month and can contribute more towards savings. Every little bit helps. The more you save each month, the more you can invest. In addition to not overspending, look to increase your earnings. The skills you develop over the course of your life can be extremely powerful assets when saving for retirement.

Spend less and earn more are the two of the most basic principles when saving: Click here to learn more.

5. Maximize Social Security Benefits

If you’re getting close to retirement age, understanding the nuances of Social Security is absolutely critical. Social Security Administration (SSA) benefits can be the equivalent of as much as a million-dollar retirement portfolio. Yet most people don’t take the time to understand even the most basic elements of the plan.

A recent survey we conducted showed that only 49% of respondents knew the earliest you can cash in Social Security – depending on your birth year – is at either 66 or 67. Before that age, you take a cut in benefits. Additionally, those who wait until 70 can receive the highest payment per month. You can find more information here.

6. Focus on Building Wealth…Not on Retirement

Lastly, how do you respond when someone says, “I’m not interested in retiring?” Simple…change the word “retirement” to “wealthy”. You see, saving for retirement does not mean you HAVE to retire. It just means that you CAN retire if you want to. Many people love what they do and are extremely happy to work until the day they die. That freedom is an amazing feeling. We have even talked about this in some of our F.I.R.E. (Financial Independence, Retire Early) articles.

Becoming financially independent is the goal. Early retirement or retirement in general is an option you unlock if you reach that goal. Many people hear the word retirement and think of some old couple moving to Florida and sitting on a beach all day. And while that may be an accurate picture of many retirees, it doesn’t have to be your retirement.

Want More Tips on Saving for Retirement?

Whatever your dream is for the future, we hope this list of simple action items can help you save for retirement. Setting reachable goals is crucial no matter what you are working towards.

Feel free to continue exploring our free research and check out our other articles on retirement and retirement planning.