Will This 27% Yield Last? It Depends on Who You Listen To

Washington Prime Group (NYSE: WPG) has an incredibly high 27% dividend yield. That’s because the stock sports a $0.25 per share quarterly dividend but just a $3.70 share price.

That’s an awfully high yield to continue to pay out. Can Washington Prime do it?

I covered this owner and operator of shopping malls in April. At the time, the stock received a “D” rating for dividend safety. However, looks can be deceiving.

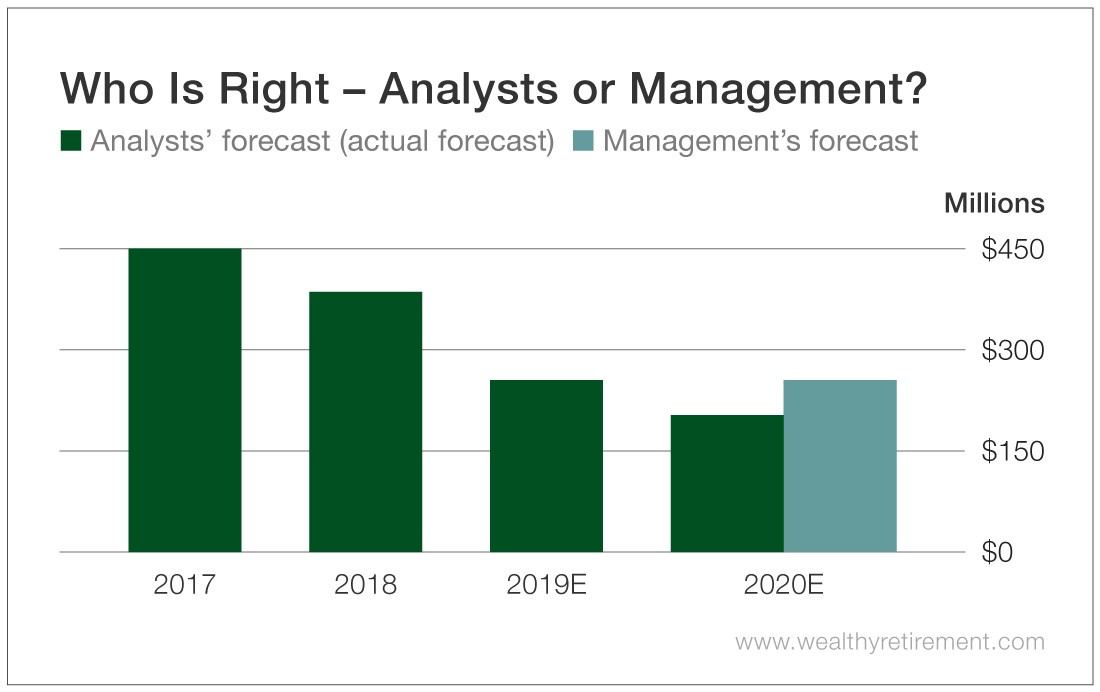

At the time, the issue was that analysts expected funds from operations (FFO), which is a measure of cash flow for real estate investment trusts (REITs), to fall.

FFO not only was forecast to drop, but also was expected to be lower than the amount the company would pay in dividends.

However, management disagreed with the analysts’ estimates and said FFO would cover the dividend.

As it turns out, management was right.

When it reports for 2019, the company will likely have generated more than $255 million in FFO – far more than the $224 million analysts projected back in April.

Washington Prime Group paid out about $187 million in dividends in 2019, with the same figure projected in 2020.

Today, we’re up against the same problem as last time. Do we believe the analysts or management?

To be honest, I don’t trust either.

In 2020, analysts expect Washington Prime Group to generate $205 million in FFO – far less than last year. However, on the third quarter conference call, management implied FFO would grow in the coming year.

On the call, management would not commit to an unchanged dividend, saying instead that the company doesn’t comment on its dividend policy. However, the company did state that its 2019 dividend policy remains in effect.

It’s not very common that management and analysts are so far apart in their forecasts.

And in 2019, management was right and analysts were wrong.

The good news is that even if the analysts’ expectations of lower FFO are right, that figure still covers the dividend. But keep in mind, SafetyNet Pro uses analysts’ predictions as part of its model.

This puts us in the same predicament as last year. Using the analysts’ estimates of lower FFO (and taking into account that FFO has declined over the past few years), the dividend would not be considered safe.

If management is right and FFO grows, the dividend should be safe.

The way the SafetyNet Pro model is designed, Washington Prime Group gets a low mark for dividend safety. If the analysts are right, a dividend cut wouldn’t be surprising.

But keep an eye on the company’s financials as they get released each quarter. If FFO is tracking higher than Wall Street expects, that rating may be too low.

Dividend Safety Rating: D

If you have a stock whose dividend safety you’d like me to analyze, leave the ticker symbol in the comments section.

About Marc Lichtenfeld

Marc Lichtenfeld is the Chief Income Strategist of Investment U’s publisher, The Oxford Club. He has more than three decades of experience in the market and a dedicated following of more than 500,000 investors.

After getting his start on the trading desk at Carlin Equities, he moved over to Avalon Research Group as a senior analyst. Over the years, Marc’s commentary has appeared in The Wall Street Journal, Barron’s and U.S. News & World Report, among other outlets. Prior to joining The Oxford Club, he was a senior columnist at Jim Cramer’s TheStreet. Today, he is a sought-after media guest who has appeared on CNBC, Fox Business and Yahoo Finance.

Marc shares his financial advice via The Oxford Club’s free daily e-letter called Wealthy Retirement and a monthly, income-focused newsletter called The Oxford Income Letter. He also runs four subscription-based trading services: Technical Pattern Profits, Penny Options Trader, Oxford Bond Advantage and Predictive Profits.

His first book, Get Rich with Dividends: A Proven System for Earning Double-Digit Returns, achieved bestseller status shortly after its release in 2012, and the second edition was named the 2018 Book of the Year by the Institute for Financial Literacy. It has been published in four languages. In early 2018, Marc released his second book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners, which hit No. 1 on Amazon’s bestseller list. It was named the 2019 Book of the Year by the Institute for Financial Literacy.