Municipal Bonds: The Power of Tax-Free Income

Editor’s Note: Today, Mable will take a deep dive into one of the market’s often overlooked characters: municipal bonds.

These tax-advantaged offerings can make a big difference for your portfolio the next time Uncle Sam comes knocking.

But they’re only one of many ways to lessen what you lose each year to taxes…

For tips on how to optimize your return, check out Chief Income Strategist Marc Lichtenfeld’s video series called Sticking It to the Tax Man.

Click here to watch the first episode.

Then, read on to learn more about the investing vehicle that may become your portfolio’s first line of defense against the IRS.

– Rachel Gearhart, Associate Franchise Publisher

Municipal Bonds

Municipal bonds (or munis for short) fund public projects, like highways and public transportation. They’re issued by the state or city that is planning the projects the bond covers.

They include revenue bonds, which (like it sounds) add revenue to the state’s coffers. And general obligation bonds, which finance projects that don’t produce revenue for the state.

Both are solid options for bond investors who are simply looking for low-risk income. And one key factor makes them especially handy this season…

Municipal bonds are tax-free. Yet many investors overlook them and miss out on the benefits.

This is because it can be tricky to imagine how these bonds enrich investors’ lives. Not to mention how they interact with the market and how they can be assessed.

But it’s hard to deny that with their essential applications and tax-exempt status, munis can be a powerful tool for your portfolio and even a blessing in your everyday life.

Applications of Municipal Bonds

Take, for example, a series of municipal bonds issued by the Wealthy Retirement editorial team’s home state of Maryland…

The Department of Transportation of Maryland Consolidated Transportation Bonds Series 2016 (CUSIP 574204d34) is used to fund transportation projects in the state. This bond from the series rewards bondholders with a 5% coupon for their support and matures in November 2026.

The Department of Transportation is currently using the bonds to fund its Consolidated Transportation Program (CTP), a series of infrastructure projects, from fiscal year 2020 to fiscal year 2025.

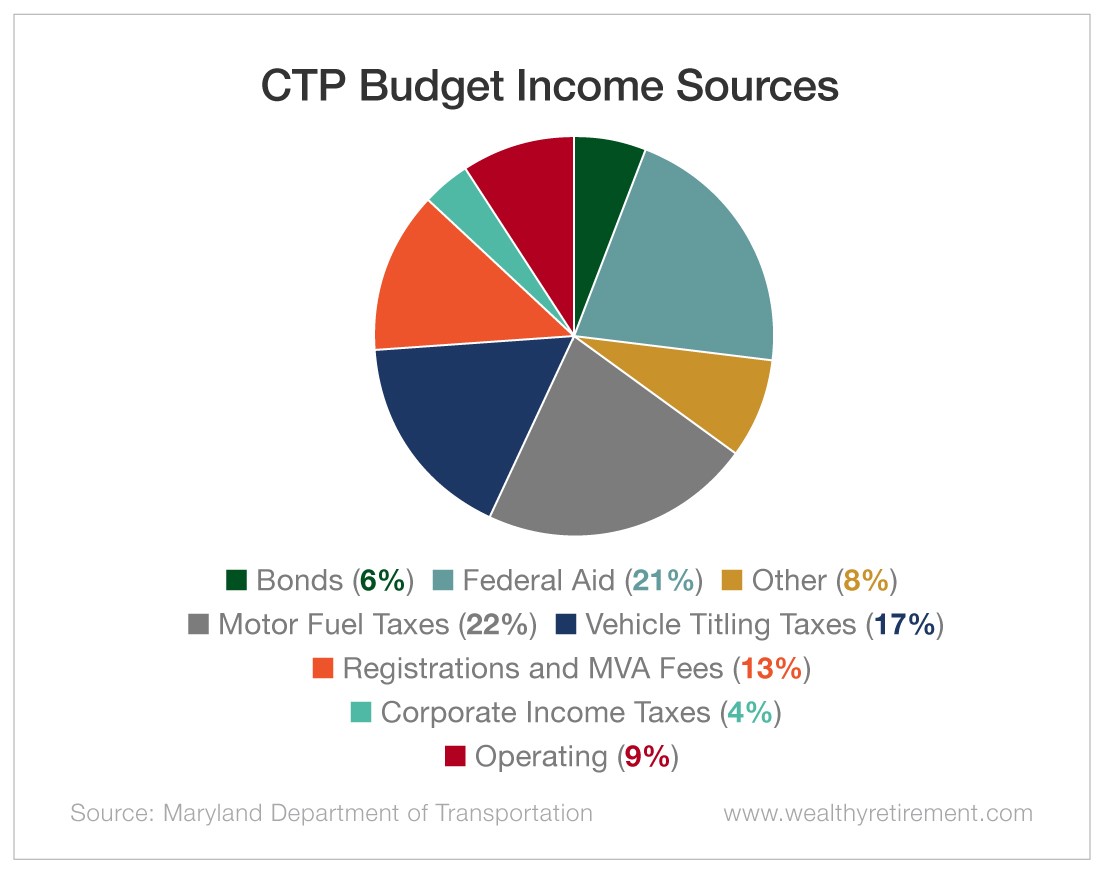

The bonds account for 6% of the program’s overall budget.

The state budget covers things like the regular maintenance of roads, highways, and the Metro and Light Rail systems.

So using Maryland as an example, if you’ve flown into the Baltimore/Washington International Thurgood Marshall Airport and not lost your luggage or if you’ve driven on Interstate 695 and skated right through tolls with an E-ZPass, you’ve interacted with projects funded by municipal bonds.

While accounting for only 6% of the program’s total budget, these bonds are critical for making these projects possible.

And because the bonds fund contracted projects and are fulfilled by the government, they sport an AA+ rating.

But for investors in the bonds, there’s more to the story…

How to Assess a Municipal Bond

These Series 2016 transportation bonds also serve as a good example of what criteria are important when choosing a muni.

They vary slightly from the criteria used to assess a corporate bond, and for good reason…

When investing in a corporate bond, the value of the bond is contingent on the value of the underlying company.

But when investing in a municipal bond, the asset in question is the municipality itself – in this case, the state of Maryland.

So where we would normally lift the hood on a company’s debt or management, we’ll lift the hood on Maryland’s ability to make good on its debts from a few different metrics.

Metrics

- Gross domestic product (GDP). Maryland’s GDP is higher than the national average, indicating that the state has an above-average ability to pay back its debts.This high level of cash flow contributes to the safety of the bond – and its AA+ rating.

- Unemployment statistics. The state’s ability to pay back its transportation bonds also depends on the revenue it collects from taxing its citizens.Maryland’s unemployment rate is on par with the seasonally adjusted national average, suggesting that its tax revenue is healthy – another positive sign for its bonds.

- Housing market statistics. Less integral for the Department of Transportation, but still applicable to Maryland’s credit, is its current housing market.Sales and price are up over last year, while active inventory is down. This suggests that property tax revenue will also support Maryland’s ability to pay down its debt.

In the municipal bond world, the citizen becomes the investor and the municipality becomes the company. Maryland’s GDP, unemployment statistics and housing market statistics are akin to an earnings report.

In this case, it speaks well for members of this transportation bond series that those numbers are healthy – and you can use similar criteria for taking a surface look at any municipality, county or state in the U.S.

Municipal bonds are a powerful way to use savings to create the world you want – and generate some tax-free income while you’re at it.