MicroStrategy (Strategy) Stock Forecast: A Leveraged Bitcoin Play With Massive Upside Potential

MicroStrategy (Nasdaq: MSTR), now rebranded as Strategy, has evolved from an enterprise software company into a bold, Bitcoin-centric investment vehicle. Under the leadership of Executive Chairman Michael Saylor, Strategy has become the largest corporate holder of Bitcoin in the world — and its stock is now seen as a high-beta proxy for BTC itself.

But with the crypto market heating up again in 2025, does MicroStrategy stock represent a compelling opportunity… or an over-leveraged speculation?

Let’s break it down.

🚀 Bitcoin Holdings Update: Over 531,000 BTC and Counting

As of April 2025, Strategy holds 531,644 BTC, acquired at a total cost of $35.92 billion. This translates to an average purchase price of approximately $67,556 per Bitcoin.

The company’s latest Bitcoin purchase was announced in mid-April, when Strategy acquired 3,459 BTC for $285.8 million funded through an equity sale. The total market value of its BTC holdings now exceeds $45 billion, depending on price fluctuations — a staggering position that dwarfs the size of its legacy business operations.

| Date | BTC Holdings | Avg Purchase Price | Total Cost (USD) | Market Value (at $83K BTC) |

|---|---|---|---|---|

| Apr 2025 | 531,644 BTC | $67,556 | ~$35.9 billion | ~$44.1 billion |

📈 MSTR as a Leveraged Bitcoin Bet

Because Strategy has funded many of its Bitcoin purchases using debt and equity dilution, the company effectively acts as a leveraged Bitcoin ETF. When BTC rises, Strategy’s balance sheet inflates dramatically. When BTC falls, losses are amplified.

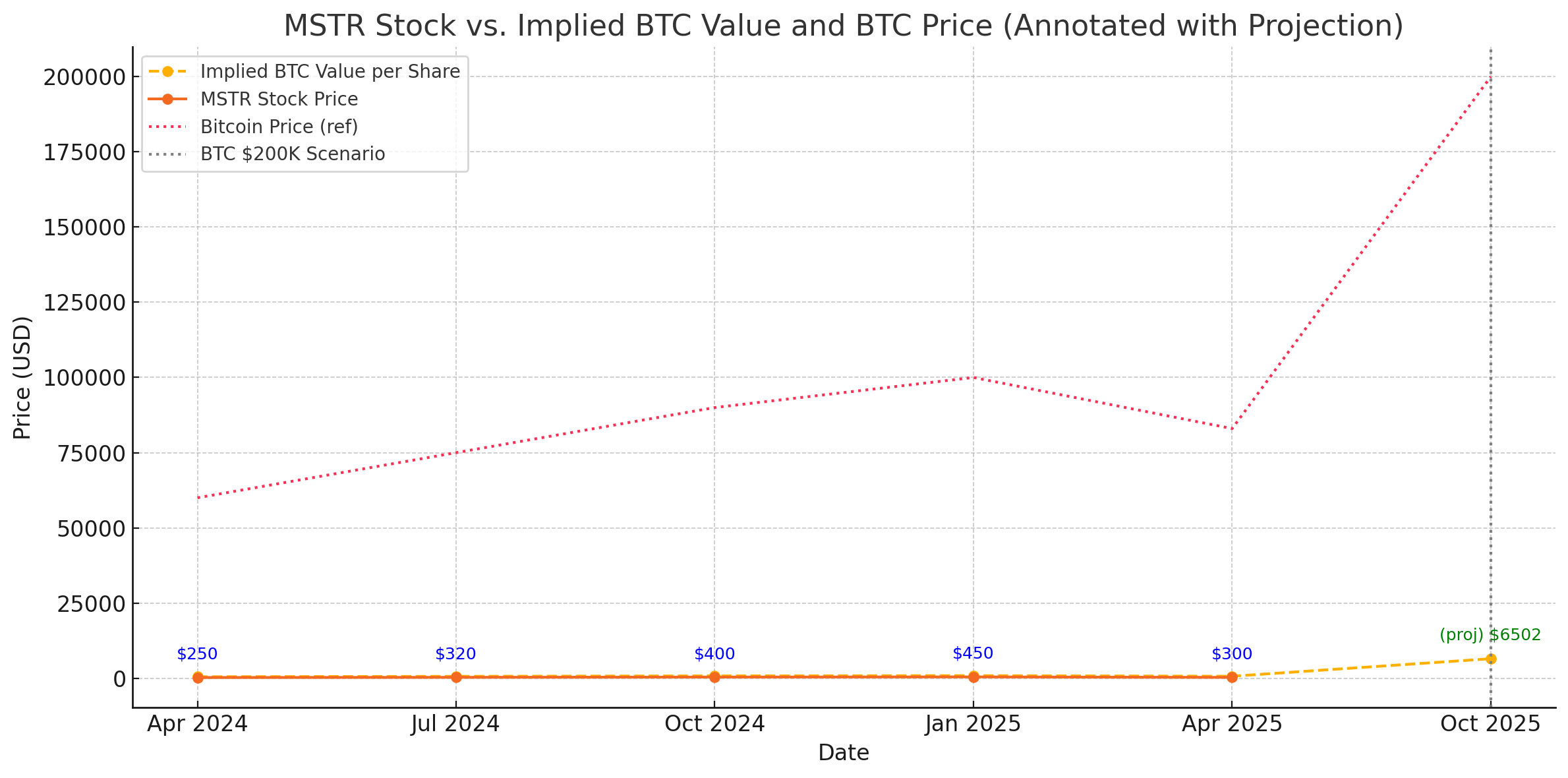

A recent chart (see below) comparing MSTR stock price with Bitcoin and the implied per-share value of Strategy’s BTC holdings shows how closely the stock tracks BTC — though not on a 1:1 basis:

💡 Implied Valuation: What Happens If Bitcoin Hits $200K?

Let’s explore a bullish scenario: What if Bitcoin hits $200,000 in this cycle?

If that happens, Strategy’s 531,644 BTC would be worth over $106 billion. After subtracting estimated debt of ~$2.3 billion and dividing by ~16 million shares, the implied net asset value (NAV) per share would be:

📌 Implied NAV/share = ~$6,500

That’s more than 2x the current stock price.

| BTC Price | BTC Value (B) | Implied NAV/share |

|---|---|---|

| $83,000 | $44.1B | ~$2,615 |

| $200,000 | $106.3B | ~$6,500 |

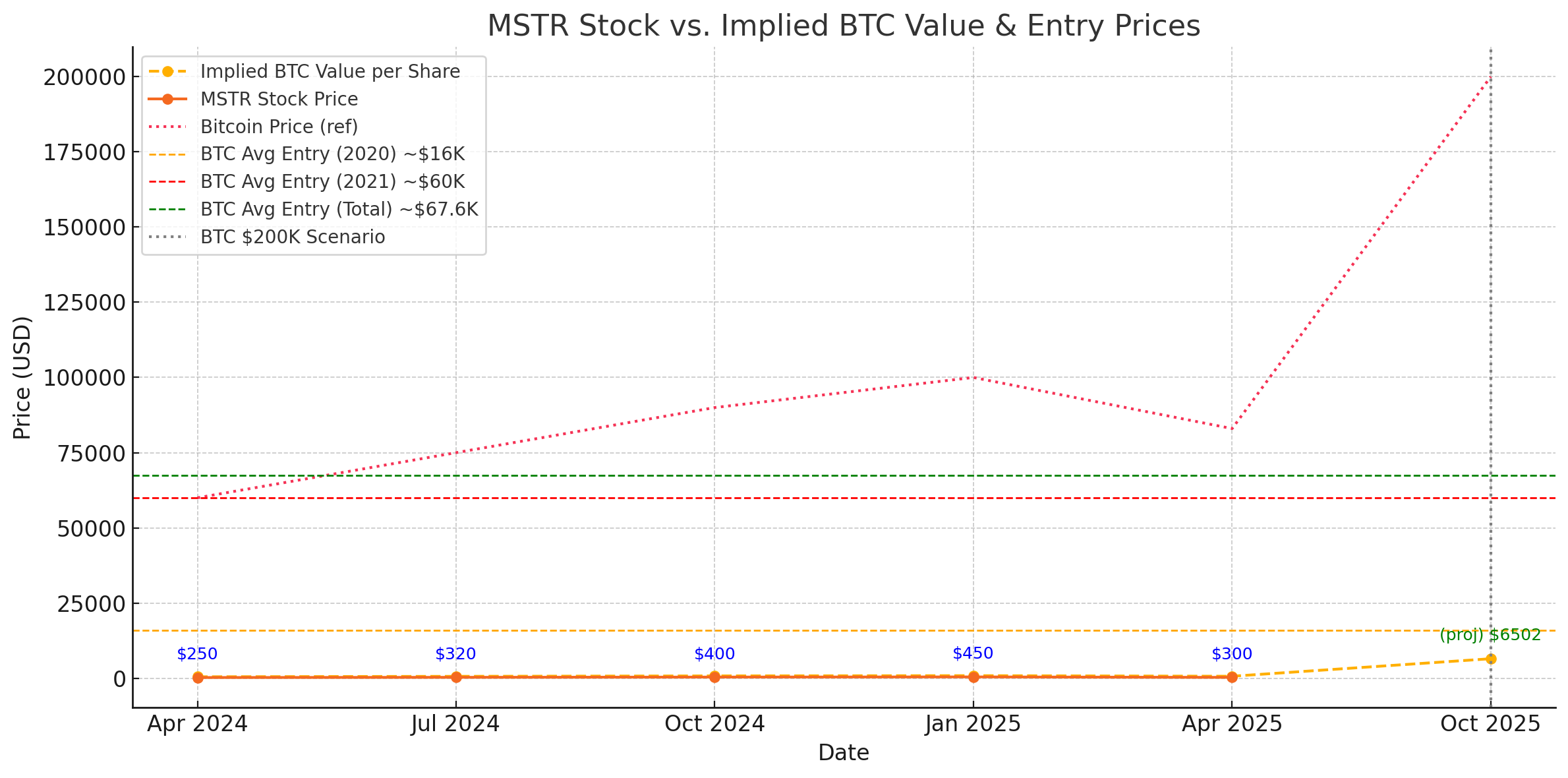

📊 Relative Valuation & Entry Price Context

To further understand the risk/reward profile, it’s helpful to examine Strategy’s BTC entry points:

-

🟧 2020 Entry: ~$16,000

-

🔴 2021 High Buys: ~$60,000

-

🟩 Blended Average: ~$67,556

Strategy’s average entry price suggests that at current Bitcoin levels (~$83,000), the company is already in strong profit territory — especially for its early purchases. If BTC trends higher, the return on holdings could be exponential.

⚠️ Risks and Caveats

While the upside potential is enormous, so are the risks:

-

High Leverage: With over $2 billion in debt, Strategy is exposed to downside volatility.

-

Shareholder Dilution: Frequent equity offerings to fund BTC purchases dilute shareholder value.

-

Speculative Nature: The company’s fortunes are now almost entirely tied to Bitcoin — not software.

🔮 Final Word: MSTR Stock Outlook

If Bitcoin enters a sustained bull market and reaches $200K or beyond, Strategy could see its stock price multiply. As a leveraged BTC play, MSTR provides asymmetric upside — but carries real downside risk in a crypto bear market.

For bullish crypto investors, MSTR may be one of the most aggressive (and rewarding) ways to ride the next wave.

✅ Bull Case: $6,500+ per share if BTC hits $200K

⚠️ Bear Case: Continued dilution and volatility if BTC stagnates or crashes

💡 Verdict: A high-stakes, high-reward Bitcoin vehicle — not for the faint of heart

About Russ Amy

Hey there! I’m Russ Amy, here at IU I dive into all things money, tech, and occasionally, music, or other interests and how they relate to investments. Way back in 2008, I started exploring the world of investing when the financial scene was pretty rocky. It was a tough time to start, but it taught me loads about how to be smart with money and investments.

I’m into stocks, options, and the exciting world of cryptocurrencies. Plus, I can’t get enough of the latest tech gadgets and trends. I believe that staying updated with technology is key for anyone interested in making wise investment choices today.

Technology is changing our world by the minute, from blockchain revolutionizing how money moves around to artificial intelligence reshaping jobs. I think it’s crucial to keep up with these changes, or risk being left behind.

some even call me the Finpub God?