Will Annaly Finally Get an Upgrade This Year?

Annaly Capital Management (NYSE: NLY) is one of the most requested stocks in the Safety Net column.

That’s not a shock considering its attractive 9.9% dividend yield. But is that nearly double-digit yield safe?

A year and a half ago, I suggested that despite its “F” rating for dividend safety, Annaly could receive an upgrade if its net interest income (NII) increases to the point where the company can afford its dividend.

NII did not rise – and last May, I pointed out that once again, Annaly had an “F” rating.

Have things improved at all for the popular but beleaguered mortgage real estate investment trust (REIT)?

NII is the most important metric for mortgage REITs. These companies borrow money short term and lend it long term. The difference in the amount they pay and earn in interest – minus expenses – is net interest income (NII).

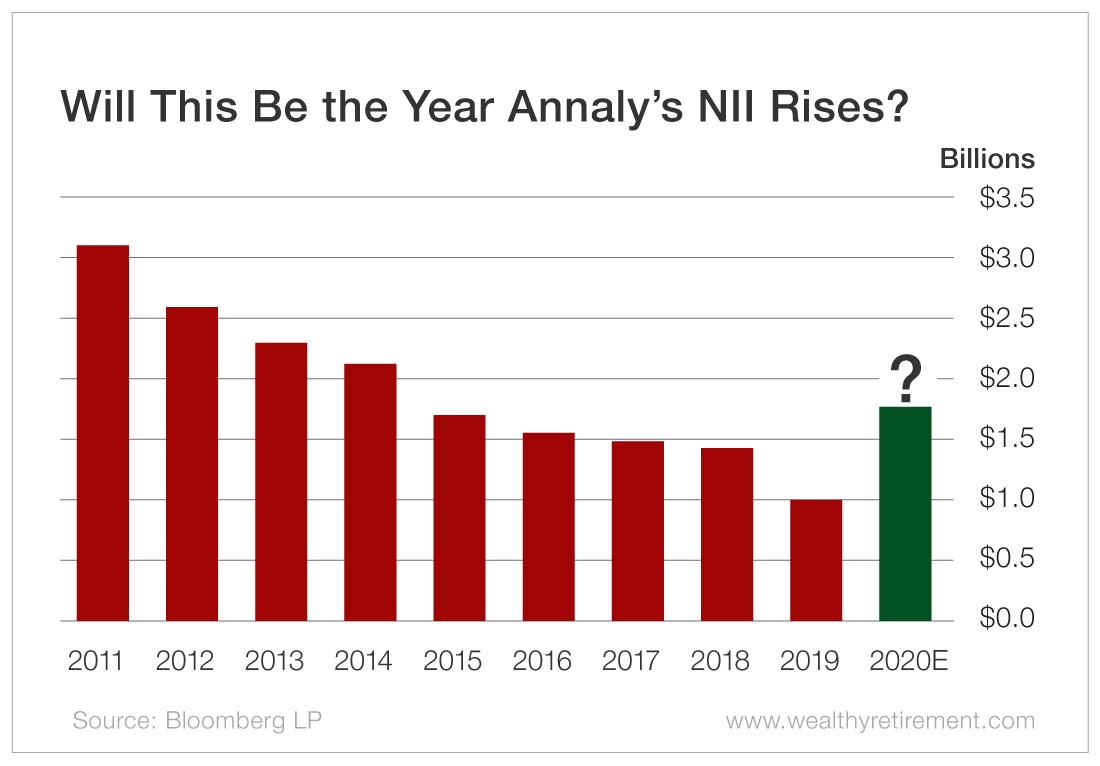

Annaly’s NII has been steadily falling for several years and does not cover the dividend.

But 2020 is supposed to be different…

This year, NII is forecast to rise to $1.77 billion from $1 billion last year. If Annaly hits that target, it will finally cover the expected dividend payout of $1.43 billion.

But NII has been sliding for eight years in a row.

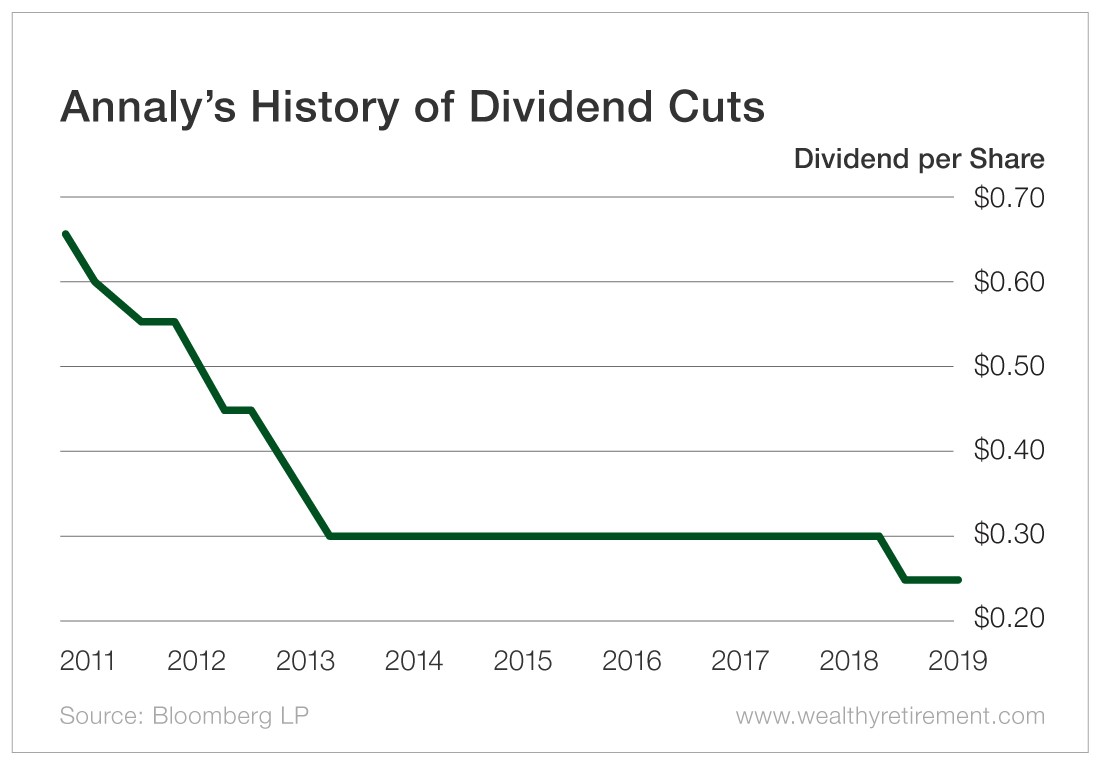

And NII isn’t the only thing that has plummeted since 2011. The dividend has been cut eight times in the past nine years.

The company was a serial dividend cutter until 2013, when the $0.30 per share quarterly payout stabilized…

Or at least until June of last year when it was reduced again, this time to $0.25 per share.

One wouldn’t even have to be able to read to determine Annaly’s dividend safety. All you’d have to be able to do is understand that the first chart is NII and the second chart is the company’s dividend history, and you’d know that the dividend is in jeopardy.

If Annaly can reverse an eight-year losing streak of declining NII, then perhaps the stock will receive a dividend safety upgrade next year.

But until that happens, the destruction of the dividend and NII means Annaly gets a very solid “F” when it comes to the safety of its dividend.

Dividend Safety Rating: F

If you have a stock whose dividend you’d like me to analyze, leave the ticker symbol in the comments section.

About Marc Lichtenfeld

Marc Lichtenfeld is the Chief Income Strategist of Investment U’s publisher, The Oxford Club. He has more than three decades of experience in the market and a dedicated following of more than 500,000 investors.

After getting his start on the trading desk at Carlin Equities, he moved over to Avalon Research Group as a senior analyst. Over the years, Marc’s commentary has appeared in The Wall Street Journal, Barron’s and U.S. News & World Report, among other outlets. Prior to joining The Oxford Club, he was a senior columnist at Jim Cramer’s TheStreet. Today, he is a sought-after media guest who has appeared on CNBC, Fox Business and Yahoo Finance.

Marc shares his financial advice via The Oxford Club’s free daily e-letter called Wealthy Retirement and a monthly, income-focused newsletter called The Oxford Income Letter. He also runs four subscription-based trading services: Technical Pattern Profits, Penny Options Trader, Oxford Bond Advantage and Predictive Profits.

His first book, Get Rich with Dividends: A Proven System for Earning Double-Digit Returns, achieved bestseller status shortly after its release in 2012, and the second edition was named the 2018 Book of the Year by the Institute for Financial Literacy. It has been published in four languages. In early 2018, Marc released his second book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners, which hit No. 1 on Amazon’s bestseller list. It was named the 2019 Book of the Year by the Institute for Financial Literacy.