Dividend Machines: The Top 5 AI Income Stocks to Buy Now

If you’ve glanced at the headlines recently, there’s no doubt you’ve seen dozens of articles breathlessly exclaiming how artificial intelligence (AI) will forever change the world.

It’s not just hype.

Even though you might be tired of hearing about it, AI is going to revolutionize our technology, our economy and our world. In many ways, it already is.

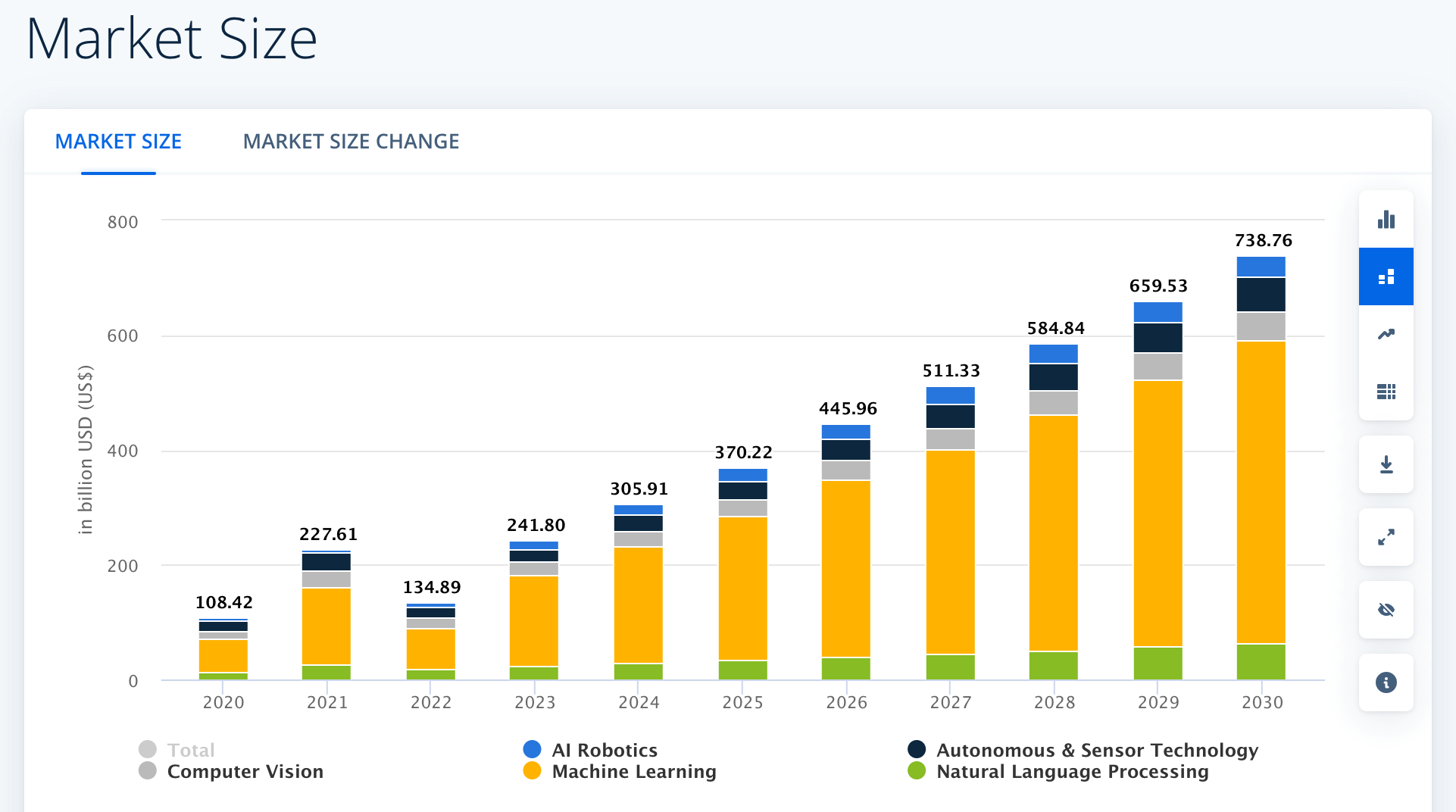

The AI industry is already worth $241 billion. But some analysts predict that the industry could be worth nearly $740 billion by the end of the decade…

AI Market Projected to Explode in Size

Source: Statista

Now, most of the media attention has been on the small tech startups that are pioneering AI technology. But there are several well-established players worth looking at – companies with the resources and expertise to capitalize on AI more effectively than the startups.

Better yet, several of those companies pay dividends.

The companies in this report are some of the best dividend payers that are set to profit from AI. Each one of them is developing either hardware or software (or both) that stands to capture a significant slice of this growing market.

As the AI industry expands, it’s likely that these companies will raise their dividends, their share prices will grow and you’ll build up a solid nest egg from the rise of the machines.

The Original Tech Kingpin

Microsoft (Nasdaq: MSFT) has been the heavyweight in the tech industry for the better part of 20 years. A whopping 74% of all computers worldwide run Windows, Microsoft’s signature operating system (OS). Windows’ biggest competitor, macOS, runs on just 15% of computers worldwide.

Simply put, Microsoft completely dominates the desktop and laptop OS market. And in order to keep its software edge, Microsoft has dived headfirst into AI development.

Its Azure OpenAI Service was one of the first major AI services to be brought to market. Azure is a generative AI platform that can be used to create new content, digitize and catalog data, talk to people via its language model, and even inspect power lines for damage.

Messaging service Swift, which serves much of the financial industry, is using Azure to detect fraud. German energy company E.on uses Azure in drones to photograph and inspect power lines, which makes maintenance and repair safer and more efficient. And CarMax is using Azure to streamline the creation of text summaries for its car research pages.

Azure was a big part of Microsoft’s revenue growth this year. Revenue was up

And as far as dividends are concerned, Microsoft has raised its dividend for 15 years in a row, putting it more than halfway to becoming a Dividend Aristocrat. At current prices, it yields 0.81%.

The original Big Tech stock can easily form the bedrock of a profitable, dividend-paying AI portfolio.

Action to Take: Buy Microsoft (Nasdaq: MSFT) at market. Set a 25% trailing stop to protect your principal and profits.

The iPhone Singularity

We move onward to Microsoft’s biggest competitor, Apple (Nasdaq: AAPL). While Microsoft dominates the computer market, Apple dominates the phone market, with its iconic iPhone owning a nearly 30% market share.

But Apple doesn’t have an equivalent to Microsoft’s Azure program… yet.

That seems odd for a company that has always been an innovator. But all signs point to the company rolling something out soon.

In an interview with Reuters, Apple CEO Tim Cook said the company has invested $22.6 billion into AI research and development. It has even developed its own internal chatbot called “Apple GPT” that might one day be used for customer service interactions. Apple’s Siri, which is already loaded on all Apple devices, also presents the perfect opportunity to deploy a generative chatbot.

We expect big things from Apple in the AI space in the near future.

Like Microsoft, Apple is a long-term dividend raiser. It has upped its dividend every year for the past 13 years and has grown it at an annual rate of

Add Apple to your portfolio to take advantage of the AI innovation that’s soon to be in your back pocket.

Action to Take: Buy Apple (Nasdaq: AAPL) at market. Set a 25% trailing stop to protect your principal and profits.

An Android Dreaming of Electric Sheep

Founded back in 1911, International Business Machines (NYSE: IBM) has been involved in the technology industry for over a century. It was also one of the foundational players in the AI space.

You may remember when Watson, a supercomputer developed by IBM, won a round of Jeopardy! against champions Ken Jennings and Brad Rutter in 2013. And that wasn’t even the first time an IBM machine triumphed over a human competitor… Back in 1997, IBM’s Deep Blue computer defeated chess champion Garry Kasparov.

Now IBM’s consumer-grade version of Watson is bringing all the company’s AI expertise to the fore.

After its Jeopardy! win, Watson was put to work helping doctors treat lung cancer. Today, its descendant, watsonx, can be used to train, validate, tune and deploy new machine-learning models and handle colossal data loads… and soon it will be able to produce reports and other content using the data it processes.

AI was a big part of the 2% revenue growth for IBM in the second quarter of 2024. It’s also sure to drive growth in IBM’s dividend. Unlike Apple and Microsoft, which are aspiring to become Dividend Aristocrats, IBM already is one. The company has raised its dividend every year for the past 29 years, and it currently yields 3.21%.

Buy in now to profit from the grandfather of the technology industry and its foundational computing system, Watson.

Action to Take: Buy International Business Machines (NYSE: IBM) at market. Set a 25% trailing stop to protect your principal and profits.

Consulting the Oracle

Based in Austin Texas, Oracle (Nasdaq: ORCL) is another one of the original tech companies that have since become giants in the industry. It was established in 1977 and its pioneered many innovations that have become standard in the tech industry…

And the company is on the cutting edge of artificial intelligence. It offers a full range of AIproductsfrom generative AI programs to AI-driven apps, prebuilt models, and AI infrastructure.

Oracle has also partnered with many other giants in the AI space. Nvidia, Experian, and Razer are all customers or partners with Oracle.

With over 160,000 employees and operations in 97 countries, Oracle is a true tech giant. And it has the bottom line to prove it…

The company’s fiscal 2024 (ended May 2024) saw revenues climb 6% to $52.9 billion. That same year Oracle saw its net income grow 23.1% to $10.4 billion.

Finally, Oracle’s dividend, which it has a history of raising about every two years since 2010, yields just shy of 1% at current prices. This is one you’ll want to pick up to serve as a cornerstone in your AI dividend portfolio.

Action to Take: Buy Oracle (Nasdaq: ORCL) at market. Set a 25% trailing stop to protect your principal and profits.

Artificial Brains for Artificial Intelligence

It’s very easy to get wrapped up in the incredible software behind AI. But those complex programs require some serious computing horsepower. And Broadcom (Nasdaq: AVGO), a major semiconductor producer based in San Jose, California, is here to provide silicon “brains” to power the AI systems that are coming to the market.

Broadcom’s largest contribution to the AI space is a new chip, the Jericho3-AI, that is capable of wiring together 32,000 GPU chips at once. GPUs, or graphics processing units, are the chips that AI relies on to run its incredibly complex code.

Wiring together that many GPUs without a specialized chip like Jericho significantly reduces their speed and overall efficiency. That’s why Jericho is so useful: It allows bigger, faster computers to run AI tasks more effectively, and it will power the sort of supercomputers we’ll need in order to unlock the full potential of AI.

Action to Take: Buy Broadcom (Nasdaq: AVGO) at market. Set a 25% trailing stop to protect your principal and profits.

AI Profits for Years to Come

The rise of the machines is here. And while AI might not be understood by the general public, it’s here to stay… and it provides investors with excellent profit opportunities.

All six of these companies allow you to cash in on the AI trend… and since they’re established companies, they provide relative safety compared with investing in startups.

But despite their size, each of these companies offers serious growth potential.