The Lipstick Index

What Is the Lipstick Index?

The Lipstick Index is a term coined by Leonard Lauder, former chairman of Estée Lauder, during the early 2000s recession. It describes the phenomenon where consumers, during economic downturns, opt for affordable luxuries like lipstick instead of more expensive items. This behavior suggests that even in tough times, people seek minor indulgences to boost morale.

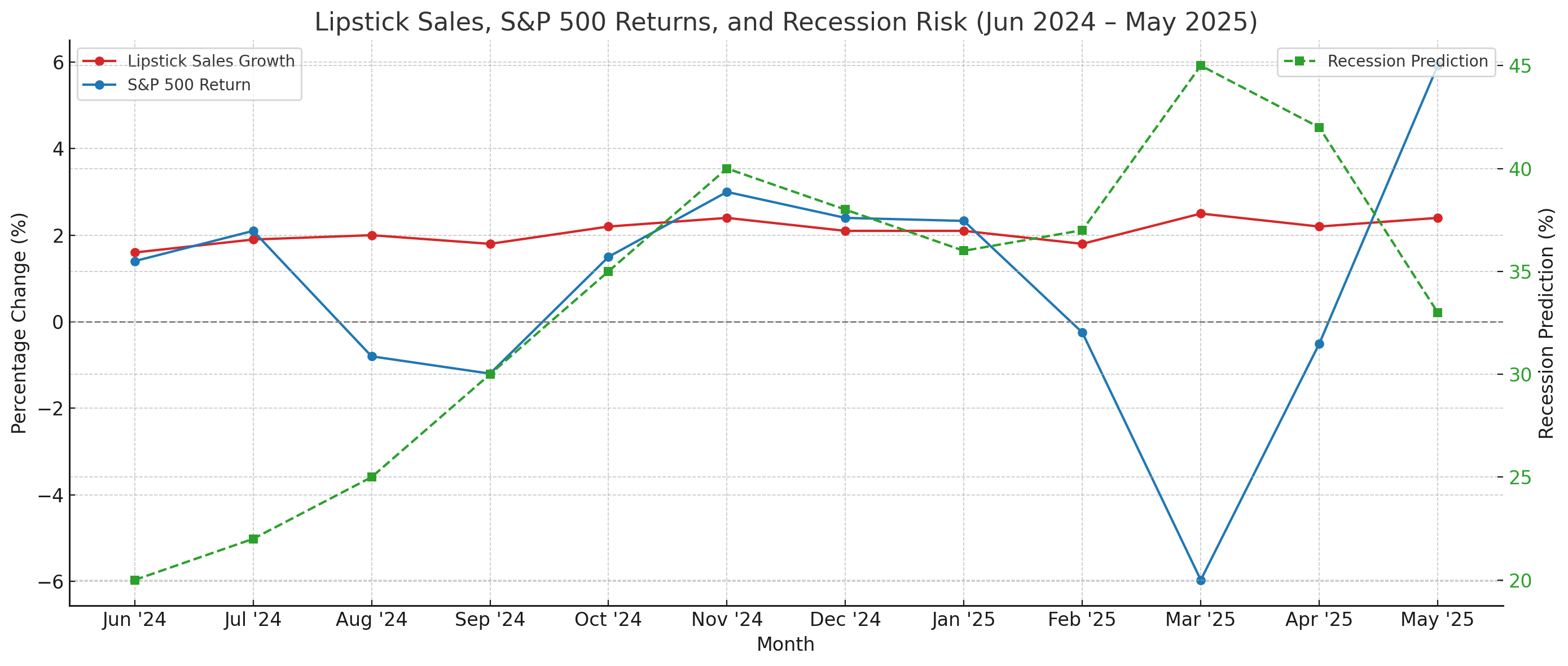

Lipstick Sales vs. Market Performance: June 2024–May 2025

Analyzing the period from June 2024 to May 2025 reveals intriguing trends:

-

Lipstick sales experienced consistent growth, averaging around 2% month-over-month increases.

-

The S&P 500 displayed volatility, with notable declines in March (-5.97%) and April (-0.51%) 2025, before rebounding in May (+5.92%).

-

Recession prediction models peaked in March 2025 at a 45% probability, indicating heightened economic uncertainty.

This divergence suggests that while investor confidence wavered, consumer spending on small luxuries remained resilient.

The Lipstick Index in Action: Visualizing the Data

Key Observations:

-

March 2025: As recession risk peaked and the S&P 500 declined sharply, lipstick sales growth remained positive. Even a very small increase in sales at the bottom of the market

-

April–May 2025: Despite market volatility, lipstick sales continued their upward trend, highlighting consumer inclination towards affordable indulgences during uncertain times.

Michael Burry’s Strategic Shift: Doubling Down on Estée Lauder

In a notable move, Michael Burry, renowned for predicting the 2008 financial crisis, has restructured his investment portfolio:

-

Scion Asset Management, Burry’s firm, doubled its stake in Estée Lauder, acquiring 200,000 shares valued at approximately $13.2 million, according to their latest 13F filing

-

Concurrently, Burry liquidated most of his other holdings, including significant positions in Chinese tech companies, and initiated bearish bets against firms like Nvidia .

This concentrated investment suggests Burry’s confidence in Estée Lauder’s potential resilience amid economic downturns.

Interpreting Burry’s Move: A Bet on the Lipstick Index?

Burry’s focus on Estée Lauder aligns with the principles of the Lipstick Index:

-

Consumer Behavior: Even during economic hardships, consumers tend to indulge in small luxuries, such as cosmetics.

-

Market Resilience: The beauty industry, particularly companies like Estée Lauder, often demonstrates stability during market downturns.

By investing heavily in Estée Lauder, Burry appears to be banking on the enduring demand for affordable luxuries, even as broader markets face volatility.

Investment & Marketing Implications

For Investors:

-

Estée Lauder (EL) and similar beauty companies may offer defensive investment opportunities during economic downturns.

-

Monitoring consumer behavior trends can provide insights into resilient sectors.

Limitations of the Lipstick Index

While the Lipstick Index offers valuable insights, it’s essential to consider its limitations:

-

Evolving Consumer Preferences: Shifts towards skincare and wellness products may influence traditional lipstick sales. So while it may not be just Lipstick going up, but other “value” or affordable and feel good items. Instead of the $200 perfume, it’s the $20 eye shadow.

-

Global Market Dynamics: Factors like supply chain disruptions and geopolitical tensions can impact the beauty industry.

Final Thoughts

The convergence of consistent lipstick sales growth, market volatility, and Michael Burry’s strategic investment in Estée Lauder underscores the relevance of the Lipstick Index in 2025. As consumers continue to seek comfort in small luxuries, and investors adjust their portfolios accordingly, the beauty industry remains a focal point in understanding economic and consumer behavior trends.

Read Next: Why is the US Dollar Losing Value?

About Russ Amy

Hey there! I’m Russ Amy, here at IU I dive into all things money, tech, and occasionally, music, or other interests and how they relate to investments. Way back in 2008, I started exploring the world of investing when the financial scene was pretty rocky. It was a tough time to start, but it taught me loads about how to be smart with money and investments.

I’m into stocks, options, and the exciting world of cryptocurrencies. Plus, I can’t get enough of the latest tech gadgets and trends. I believe that staying updated with technology is key for anyone interested in making wise investment choices today.

Technology is changing our world by the minute, from blockchain revolutionizing how money moves around to artificial intelligence reshaping jobs. I think it’s crucial to keep up with these changes, or risk being left behind.

some even call me the Finpub God?