Can This Serial Dividend Cutter Hold Its 11.6% Yield?

An investor looking at Western Asset Mortgage Capital Corp. (NYSE: WMC) might see a juicy 11.6% yield and a dividend that’s been stable for four years and believe the payout is safe.

Let’s find out if it really is.

The mortgage real estate investment trust (REIT) has invested in mortgage securities for 46 years. Its financials are in decent shape.

This year, net interest income (NII) is expected to be the highest it’s been since 2016.

(NII is the measure of cash flow used for mortgage REITs. It’s the money the company makes by borrowing money short term and lending it out at higher rates longer term.)

In 2018, NII was $71.1 million. Wall Street forecasts that when the final 2019 numbers are tallied, Western Asset Mortgage Capital will report $73.2 million. This year, the analysts’ consensus estimate is $88.1 million.

If 2019’s projection is correct, the company will have paid out about 90% of NII in dividends. This year, it will likely pay out around 74%. So short term, the dividend looks safe.

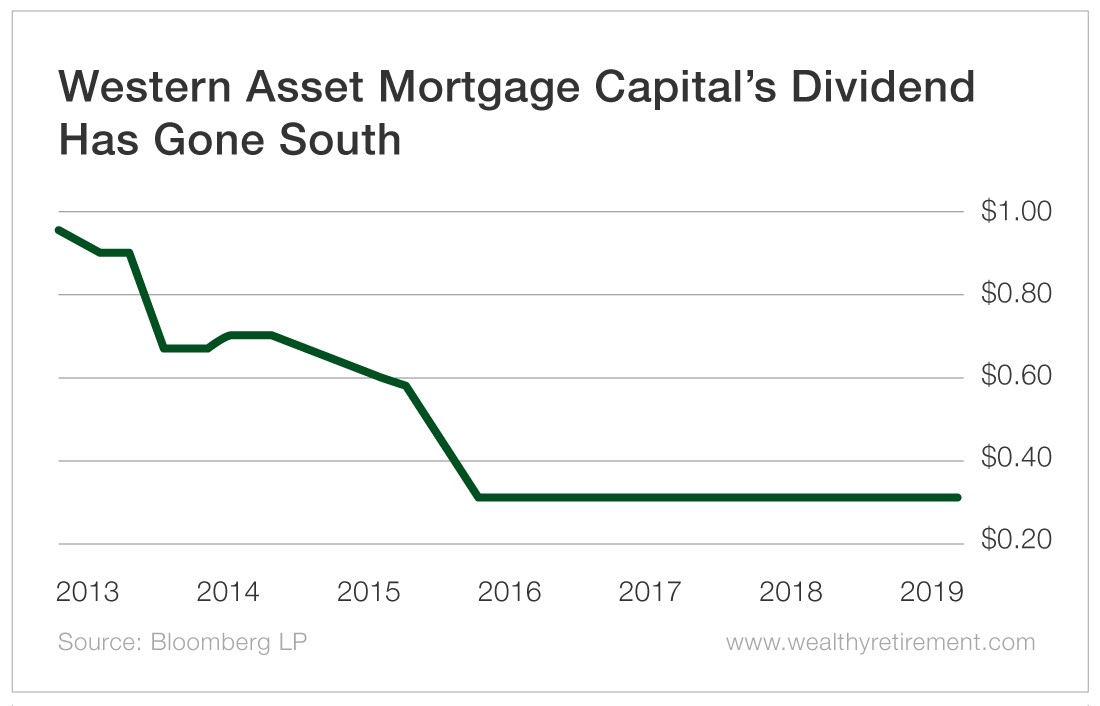

But here’s the problem – Western Asset Mortgage Capital lowered the dividend eight times between 2013 and 2016. And since then, the dividend has been flat.

Right now, the company can afford its dividend. But what happens if the company hits a speed bump and NII turns lower?

There’s an expression – when someone shows you who they are, believe them.

The same can be said for companies…

Western Asset Mortgage Capital has shown it will cut the dividend when it believes it is necessary. It will be a number of years before the company can shake off its dividend-slashing history.

Until then, don’t expect the payout to be safe. Management has shown over and over that the dividend is not sacrosanct. It will lower the dividend whenever necessary.

Dividend Safety Rating: F

If you have a stock whose dividend safety you’d like me to analyze, leave the ticker symbol in the comments section.

About Marc Lichtenfeld

Marc Lichtenfeld is the Chief Income Strategist of Investment U’s publisher, The Oxford Club. He has more than three decades of experience in the market and a dedicated following of more than 500,000 investors.

After getting his start on the trading desk at Carlin Equities, he moved over to Avalon Research Group as a senior analyst. Over the years, Marc’s commentary has appeared in The Wall Street Journal, Barron’s and U.S. News & World Report, among other outlets. Prior to joining The Oxford Club, he was a senior columnist at Jim Cramer’s TheStreet. Today, he is a sought-after media guest who has appeared on CNBC, Fox Business and Yahoo Finance.

Marc shares his financial advice via The Oxford Club’s free daily e-letter called Wealthy Retirement and a monthly, income-focused newsletter called The Oxford Income Letter. He also runs four subscription-based trading services: Technical Pattern Profits, Penny Options Trader, Oxford Bond Advantage and Predictive Profits.

His first book, Get Rich with Dividends: A Proven System for Earning Double-Digit Returns, achieved bestseller status shortly after its release in 2012, and the second edition was named the 2018 Book of the Year by the Institute for Financial Literacy. It has been published in four languages. In early 2018, Marc released his second book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners, which hit No. 1 on Amazon’s bestseller list. It was named the 2019 Book of the Year by the Institute for Financial Literacy.