What Is Internal Rate of Return (IRR)?

Investors are often faced with decisions – especially when comparing two prospective investments. Knowing where to put your money comes down to understanding the opportunity of investments in comparison with one another. Often, this means looking at the IRR. What is internal rate of return (IRR)? It’s a tool that’ll help you make smarter decisions when the time comes to pick between investments.

New investors likely aren’t familiar with IRR as a metric for evaluating investments. But the earlier you learn about this tool, the more powerful it will become in your broader investment journey. Here’s a look at IRR, how it’s calculated and what you need to know about using it to further your return on investment (ROI).

The Definition of Internal Rate of Return

Internal rate of return is a method of calculating the future profitability of a potential investment. It’s closely affiliated with net present value (NPV): the difference between cash inflows and outflows over a specific time period (more on this below). IRR looks at the annual expected rate of growth of an investment over that time period.

The real purpose of IRR is to determine the “discount rate,” which is similar to the compound annual growth rate (CAGR) of an investment. Where CAGR acts as a mean rate of return for an investment that’s likely to fluctuate over time, it’s calculated when you know the end total. With IRR, you’re working to determine the discount rate that makes an investment worth the cost of the principal. The higher the IRR, the more lucrative the investment is.

What Is IRR Used For?

IRR is primarily used to compare potential investments. If Investment A has an IRR of 12.5% over five years and Investment B has an IRR of 8.2%, Investment A is clearly the more appealing option for an investor.

While a great tool for investors, IRR has roots in corporate finance. It’s used to justify the expenditure of company funds on capital projects. Companies use IRR to determine whether a project will return sufficient value to the company (or shareholders). If the IRR is high, it signals a good project. Lower IRR tends to hint that a project may need reevaluation.

The Formula for Internal Rate of Return

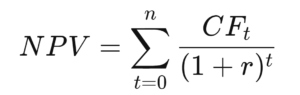

As is the case with most investments involving an interest rate, there’s a formula behind IRR that allows investors to assess the rate of return. That formula is as follows…

- NPV = net present value

- CFt = net after-tax cash inflow-outflows during a single period (t)

- r = internal rate of return that could be earned in alternative investments

- t = time period cash flow is received

- n = number of individual cash flows

Curious about net present value (NPV)? Don’t worry – it’s just a different measure of IRR. Whereas IRR measures the percentage of profitability of investments over time, NPV shows the dollar value.

If you’re looking at this formula with confusion, don’t worry. There are plenty of Excel formulations and online calculators capable of showing you IRR, which means sparing yourself the napkin math required to figure it out.

It’s important to also note that a compound interest calculator isn’t the same as an IRR calculator. To see an example of compound interest at work (compound annual growth rate), check out our investment calculator and play with the variables.

IRR vs. NPV: What’s the Difference?

As mentioned above, IRR and NPV tend to go hand in hand. They both revolve around looking forward at the validity of a potential investment. When used as investment valuation tools, they often point to the same result. Yet it’s important to know the difference.

- IRR is a better tool for forward-looking evaluation when there’s a relatively equal chance of stability across every year of the investment. IRR uses the same discount rate and assumes the same level of risk. It is also better over a short-to-medium time horizon, generally three to five years. The higher the IRR is above the discount rate, the better the investment.

- NPV is a better tool for looking further into the future – especially when investments might be subject to volatility. NPV is also better for evaluating fund and index investments where there are more contributors to an aggregate value. Likewise, if you don’t have any idea of what the discount rate of an investment might be, NPV can help you figure it out.

IRR and NPV are often two means to the same end. It’s all a matter of the type of investment you’re evaluating and the variables known to you.

Get Familiar With IRR When Looking Ahead

Looking long term means planning ahead to understand what you’re getting out of investments. What is internal rate of return? It’s a measure of the worthiness of an investment versus another. Not only can it tell you whether an investment is good or bad (profitably), but it can also help you put your money in better positions to succeed. If you’re up against a choice of investments, IRR will guide you toward the path of best ROI by giving you a glimpse into the future of that investment.

And your investments can help you build wealth in your life. Sign up for the Liberty Through Wealth e-letter below to learn more about financial freedom and investing!

Keep in mind that IRR is only one tool in the subjective analysis of a future investment’s worthiness. It can give you clear information about whether an investment is worth consideration, as well as what the return needs to be to make it worthwhile. Ultimately, it’s up to investors to be diligent in comparing and contrasting investments when faced with the decision about where to put their money.