Don’t Sit on This!

Today in The War Room, we got our feet wet by entering a stay-at-home play.

While everyone else is focusing on companies like Zoom and Microsoft as great software trades… we decided to go with a pick-and-shovel play that’s a little more tangible.

The work-from-home trend isn’t going away.

In fact, it’s only going to get bigger and bigger as companies realize how much they can save by not providing expensive facilities in expensive cities.

Now, not everyone can work from home, but millions who don’t work in manufacturing or service businesses can.

To put it bluntly, every office space in every office building is now fair game.

By hiring remote workers in less-expensive regions, companies can still offer competitive wages and save costs. Why hire a remote worker for $150K in San Francisco when you can get the same guy in San Diego for 30% less?

Who cares where people live as long as they do the work!

Microsoft and Facebook are allowing thousands to work from home until the end of the year or longer.

And just today, Google announced that it would offer $1,000 to workers who are working from home to buy “stuff” that will help their productivity.

One way to play this fast-developing trend is with the office furniture sector, specifically with a higher-end company like Herman Miller (Nasdaq: MLHR), the Michigan-based maker of high-quality office furniture.

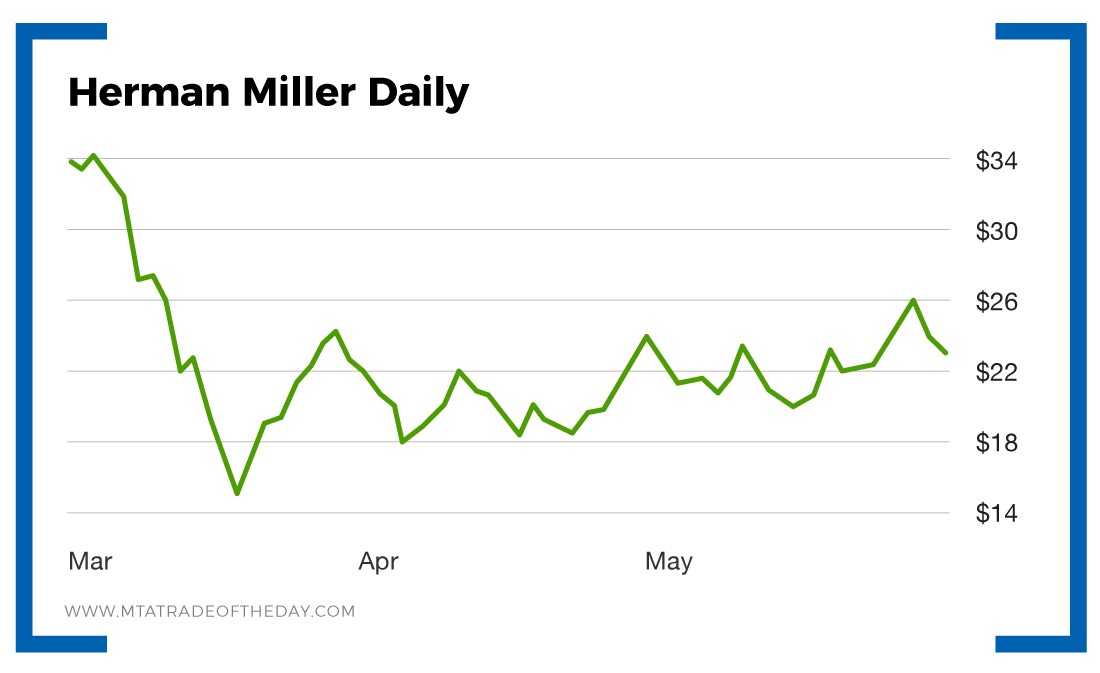

This multibillion-dollar company was hit hard by the market crash in March and is now slowly making its way back up.

Earlier this month, a director of the company paid almost $22 for 25,000 shares.

Today, War Room members paid less than that director did… even though the shares are at a higher price. How?

We entered a covered call trade.

When you make a covered call trade, you buy the shares and you sell options against the shares you bought.

This serves two purposes:

- It allows you to collect income from selling the calls.

- It reduces the cost of your purchase.

With this setup, we are poised to win in almost every scenario…

- If the shares move higher, you win.

- If the shares stay at the same price, you win.

- If the shares move lower, but not lower than your cost, you win.

The only way you lose is if the shares move below your cost.

We sold options below the current price, taking advantage of high options premiums. We did this to provide us a downside cushion in this volatile market. So if the shares fall, we will probably hang on to them and sell more call options to reduce our cost further. The key is to do this on high-quality companies.

Action Plan: Since Herman Miller traded in the teens during the height of the crash, we must keep an eye to the downside as well. A trade like this gives us a cost basis well below the current price, and it also gives us upside potential.

If you want to know the exact details of the trade and how you can make money from this new trend, join us in The War Room now!

About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?