This Gold Penny Stock Could Score You a 50% to 100% Win

If you don’t have any exposure to gold, then the current pullback in gold prices may be your chance to jump in and get some!

Not all gold stocks are alike. Some are strong, established miners like Newmont or Barrick. And here’s a list of some of the top gold stocks in 2020.

Others are, well, a little sketchier…

When gold is cheap, these fringe players don’t make money because their cost per ounce mined is very high. But they can pop more than the big guys when the price of gold moves higher.

These companies can produce outsized returns because they are so cheap to begin with. It’s a gamble, though, with the companies trying to stay in business until gold prices move higher.

Gold Penny Stock to Watch

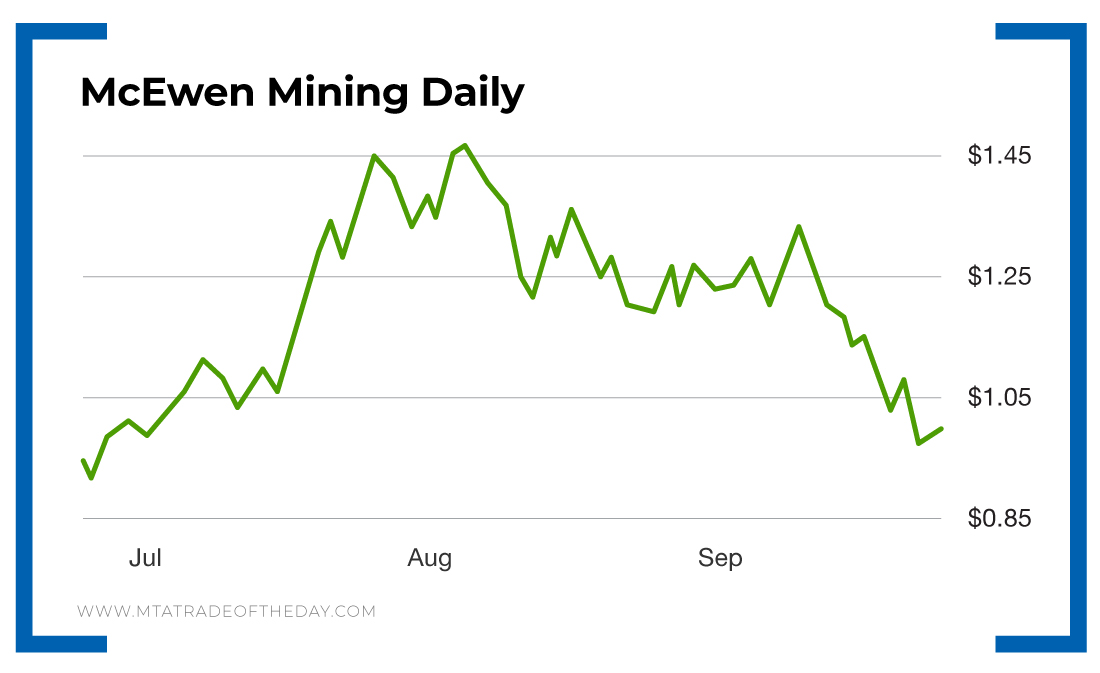

One such speculation is McEwen Mining (NYSE: MUX).

McEwen Mining should be a very successful mining company. It isn’t… yet. But there is still hope.

It’s a microcap with a market cap of just over $400 million that has been profitable in the past. Chairman and CEO Rob McEwen is the largest shareholder. He was the founder of Goldcorp, which he took to a multibillion-dollar valuation before it was taken over by Newmont Mining.

McEwen has had a more difficult time with McEwen Mining, but the tide could be turning. And if it does, we could score a 50% to 100% winner with this one.

It’s speculative, for sure – the low is in the $0.60 range. That is where we would look to exit if the stock revisited those levels.

I will decide at that time based on the reason or lack of reason as to why it traded down to that level. The company is not shy about issuing stock to fund operations – that is a risk. Here is the statement from the most recent earnings call in August…

I very much wish I could say that all our difficulties that started last year are now behind, but they are not, yet. The second quarter was challenging from an operational and health and safety standpoint. Our significantly lower production not only reduced our revenue, but also dramatically increased our costs per ounce. In addition, a change in how we account for development expenditures added significantly to our cash cost per ounce at Black Fox. However, our path to future growth and improved operational performance has become clearer. We are in a transition period setting up for future growth. We have a large resource base, four operating mines and can see an exciting organic growth pipeline of projects ahead that could potentially push our production to 300,000 ounces per year. I recently purchased 2 million shares, increasing my ownership to 82 million shares, and underlining my confidence in our future.

So there you have it – a penny stock mining speculation that could hit it big… and the chief owner is backing it up with a multimillion-dollar share purchase.

To join us, you can sign up for our free Trade of the Day e-letter below. You can then participate in more trades like gold penny stock McEwen Mining in real time!

About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?