A Microcap Stock Play With MoneyGram

One of our favorite stocks came into range last week…

War Room members have played MoneyGram (Nasdaq: MGI) before and made money doing it.

This time I recommended a special strategy that has the potential to bring members even more profits in the days and weeks ahead.

Most of our recommendations in The War Room are options trades. But in this case, I recommended a stock play because the options prices were just too expensive.

A note to the wise…

When you are dealing with penny stocks, it’s usually best to buy the shares since they don’t expire!

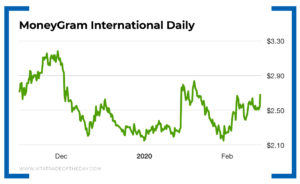

The first time MoneyGram came to my attention was when Alibaba offered to buy the company for more than $1 billion. However, the U.S. government nixed that deal – and MoneyGram shares plunged on the news and have stayed in a very narrow range between $2 and $4.

The shares came to my attention again after it was announced crypto giant Ripple Labs invested $50 million into MoneyGram by buying shares at $4.10.

MoneyGram is a leader in cross-border payments, and Ripple is trying to be the leader in payments processing technology using its own platform.

Then, the other day, MoneyGram popped back on my screen after Brink’s invested $9 million in the company. That news was tucked away in a filing that few people would have seen.

MoneyGram also announced that it joined the “cash by text” crowd for cross-border payments, which puts the company right up there with some of its technology partners like Visa.

So the question you must ask yourself is this…

Why are so many companies not only partnering with MoneyGram but also investing real money by buying stock in it as well?

Action Plan: MoneyGram has already been to the altar once with Alibaba when it was trading 10 times higher. Could another trip to the altar with a different company be far behind?

We may not stick around to find out, but with a special three-pronged strategy found only in The War Room, we’ll look to have members take in some nice gains from MoneyGram when all is said and done.

Microcap stocks are volatile for sure. And if you can’t stomach 5% or 10% moves in a day or even a week, it may be best to sit the trade out.

But in The War Room, we always have your back. Isn’t it time you hopped aboard the MoneyGram train and joined me?

About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?