All Clear? Not Just Yet!

Markets closed up today…

But don’t be fooled into thinking this is the all-clear moment when the market will return to form. While yesterday’s actions brought us closer to the bottom than the day before, one headline could change everything. Because of that, the betting is still pointed toward the downside in the days and weeks ahead.

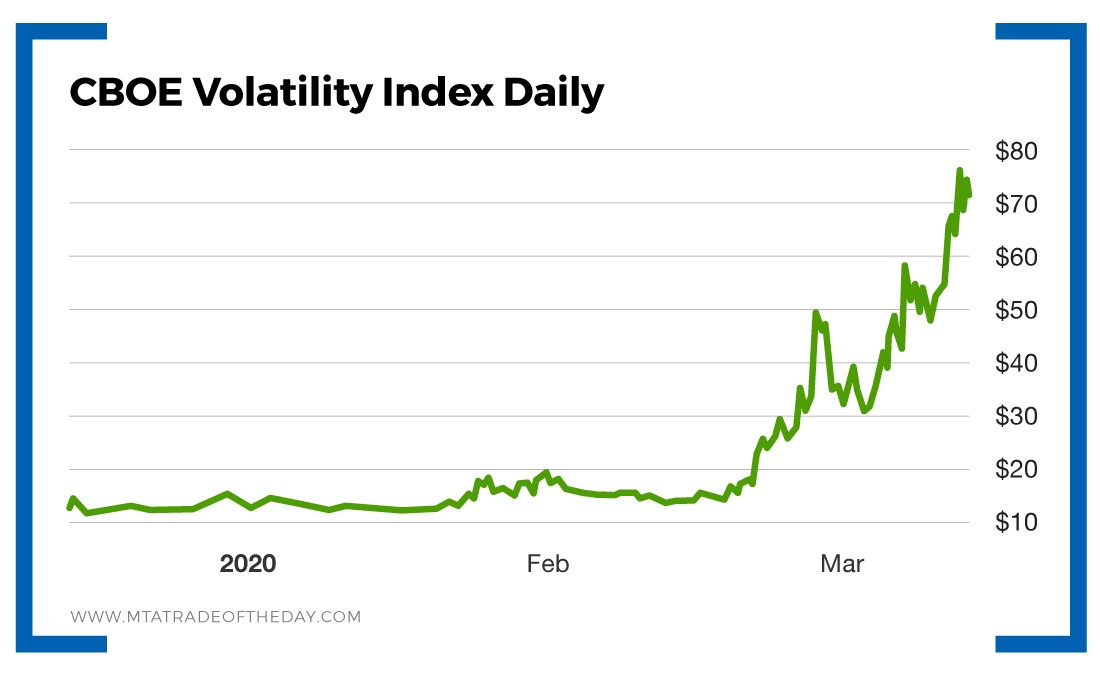

However, with the CBOE Volatility Index (VIX) going absolutely parabolic this week, we may see a little letup in the velocity of the downside moves, meaning the daily massive moves down will start to slow down. So expect more big down days, but not necessarily four or five big days in a row.

That’s about as certain as I can be right now…

During this market crash panic, I will continue recommending the “dipping our toes in” strategy for longer-term positions, while I’m sure Bryan will continue his streak of quick-hit winners.

Yesterday I was buying stock in companies like Pfizer, Merck and even Disney. I was also dabbling in some small caps like Tivity and shares of SmileDirectClub, but I didn’t stop there. I picked up gold plays like Sibanye-Stillwater and added to some positions in the financial sector and preferred stocks.

I am a strong believer that panics – and a 30% down move – create opportunities. If we go down from here, I’ve planned for another move lower that takes us to the levels present at the beginning of the current administration. I doubt that will happen, but I am ready with dry powder.

Finally, we are seeing theme park closures and event cancellations – smart moves that should have been implemented sooner. The market wants to see this pandemic controlled, not the pathetic government inaction that we have seen to date. The market wants to know that precautions are being taken to slow the spread of COVID-19 while allowing time for it to be eradicated.

Unfortunately, the number of new cases will continue to soar since we are only NOW beginning to test people in earnest. Part of that is already priced into the market.

Action Plan: Up days in the market should provide some relief, but it’s not time to be complacent. Keep your powder dry, and always remember to position size!

Dip your toes into bargain stocks that you plan to hold for a long time, but be ready to act on some short-term opportunities as well!

If you’d like guidance on the bargain stocks you should be buying, join me in The War Room to see firsthand how you can profit whether it’s an up day or a down day!

“I want to thank you for providing me with such an opportunity to take advantage of your experience and wisdom as we navigate these shark-infested trading waters. I have learned a lot from you and those lessons have helped me profit when all I’m hearing from others is how bad the market is.” – Wilfred S.

“Hey we couldn’t have done this without being here with everyone working together. Thank you and all that bring it together. My account has doubled in the last 2 weeks. This really is an incredible place to be.” – Maclean

About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?