Your Market Crash ETF Toolkit

- When the market drops and fears run rampant, it’s tempting to abandon ship.

- But Nicholas Vardy recommends stocking your ETF portfolio with this toolkit, so you could actually profit from a bear market.

“You make most of your money in a bear market. You just don’t realize it at the time.”

– Shelby Cullom Davis, Investment Manager

This past weekend was a watershed moment.

I awoke on Monday morning to texts and emails from increasingly worried friends.

The greed of 2019 had morphed into the fear of 2020.

Signs were everywhere…

The CNN Fear and Greed Index – my favorite measure of market sentiment – tumbled into single digits. The VIX – or fear index – had soared above 50. The oil price crashed more than 30%.

All this has many of my friends wanting to run for the exits.

Sure enough, the U.S. stock market suffered its worst loss since December 2008.

Today I want to remind you of three important things.

First, there has never been a correction that didn’t end.

Second, remember the mental model of “Mr. Market’s mood swings.” The more depressed Mr. Market gets, the more euphoric he will be on the rebound.

Third, it’s not what happens in the market but how you react to it that matters.

All Corrections End

I spent much of this weekend reviewing the opinions of some of the world’s leading macro strategists. They were almost uniformly bearish.

That’s not surprising.

The unwritten rule of market punditry is that pessimists always sound smart. Optimists always sound naive.

The relentless onslaught of doomsday scenarios is overwhelming compared with a Panglossian conclusion of “everything is basically okay.”

Whenever markets sell off sharply, it always feels like “this time is somehow different.”

But is it really?

In 1998, then-Assistant Treasury Secretary Larry Summers said the collapse of mega hedge fund Long-Term Capital Management threatened “the worst financial crisis since the end of World War II.”

The bursting of the dot-com bubble two years later crushed the dreams and the million-dollar paper fortunes of my generation of bright young things.

The global financial crisis of 2008 made the career – if not the fortunes – of doom-and-gloomers.

These market collapses had but one thing in common: They all ended.

The Bigger the Crisis, the Bigger the Bounce

Modern financial theory teaches that all investors are like homo economicus – the perfectly rational man.

What a bunch of bunk. Financial markets are ruled by fear and greed. Little else matters.

Fear and greed also mean that market moves – both up and down – are characterized by extremes.

On the upside, consider the absurd rise of Tesla (Nasdaq: TSLA) from $180 in May to more than $900 in February. Its parabolic rise even beat that of an equally speculative asset, bitcoin.

On the downside, the S&P 500’s moves have been historic. The market has dropped by more than three standard deviations for four days out of the last 10. Calculate the probabilities of this happening, and you’ll find it’s once every several hundred years.

Let me venture a prediction. At one point, there will be a March 9, 2009, moment when the market bottoms.

After that, look for a monster year.

It’s How You React to the Markets

“Never confuse brains with a bull market,” says the Wall Street adage.

Everybody is a genius when stocks are going up.

My approach with my ETF trading service, Oxford Wealth Accelerator, has always been different. My goal has always been to recommend a diversified portfolio – a collection of bets where some recommendations zig while others zag.

And those include bets that perform well during a market crash.

We stopped out of our long-term stock market positions more than a week ago. While that was painful at the time, it was the right thing to do.

But the Oxford Wealth Accelerator portfolios are well-positioned to generate big gains from the recent sell-off. Here’s why…

No. 1: Bet Big on Bonds

Investors flee to bonds during times of panic. The current pullback is no different.

The single best way to profit is to bet on long-duration zero-coupon bonds.

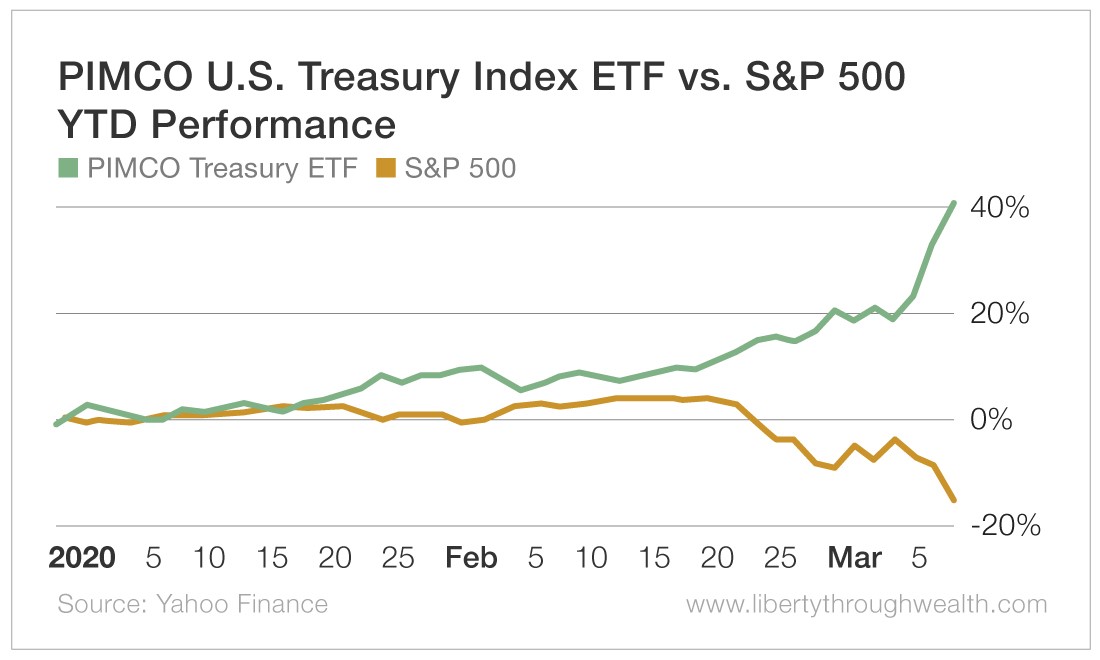

I did just that when I recommended the Pimco 25+ Year Zero Coupon U.S. Treasury Index ETF (NYSE: ZROZ) back in August.

Not surprisingly, this position shot up 42.5% year to date.

Just compare its performance with the S&P 500’s.

I recommended a similar ETF to my subscribers last week. That position soared 13.5% in the past four trading days alone.

No. 2: Bet Against the Stock Market

Here’s another way you can profit from the market sell-off: inverse ETFs.

Inverse ETFs are bets against the market. That means they go up when the market goes down.

Say you believe that the U.S. market will continue to crash.

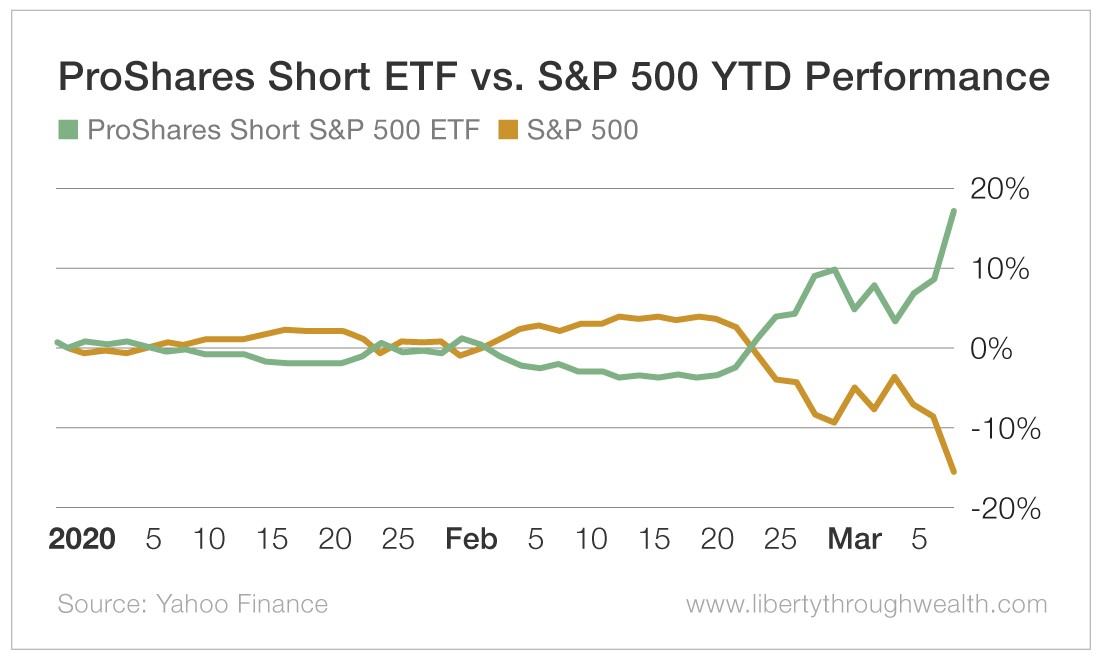

You can bet against the S&P 500 by buying the ProShares Short S&P 500 ETF (NYSE: SH). This ETF moves inversely with the price of the S&P 500 each day.

If the index drops 10%, this ETF rises by the same amount. The ProShares Short ETF is up 16.9% year to date.

There are even leveraged versions of this short bet.

Get your timing right, and you can make more money more quickly than you ever could in a bull market.

The bottom line?

ETFs offer you many ways to profit from the current market sell-off.

I have a “toolkit” of ETFs that includes bets against commodities and currencies – and even bets that benefit from “black swan” events.

And I’ll be recommending more of these in Oxford Wealth Accelerator in the weeks ahead.

Smart traders with the right tools can make money in the markets… as long as they “keep calm and carry on.”

Make sure you are one of them.

About Nicholas Vardy

An accomplished investment advisor and widely recognized expert on quantitative investing, global investing and exchange-traded funds, Nicholas has been a regular commentator on CNN International and Fox Business Network. He has also been cited in The Wall Street Journal, Financial Times, Newsweek, Fox Business News, CBS, MarketWatch, Yahoo Finance and MSN Money Central. Nicholas holds a bachelor’s and a master’s from Stanford University and a J.D. from Harvard Law School. It’s no wonder his groundbreaking content is published regularly in the free daily e-letter Liberty Through Wealth.