How to Trade Cleveland-Cliffs Options for Free

There is no better trade on Wall Street than a free ride. A free ride refers to a trade that goes your way to the point that you can take your initial investment off the table and still have exposure to the upside.

In this case, not only did War Room members take their initial investment off the table…

They took some profits too, enough that they’re being paid to be in the trade.

Let me explain…

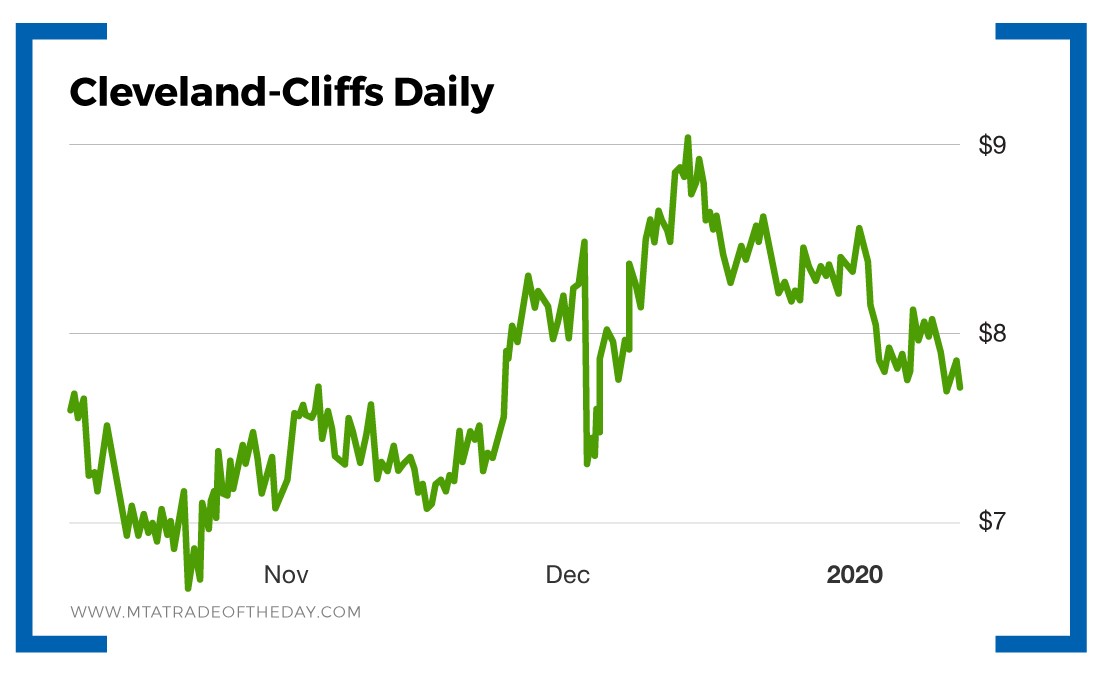

Last week War Room members took a position in Cleveland-Cliffs (NYSE: CLF). This is the second time in less than a month members traded this stock and won both times!

Members bought Cleveland-Cliffs stock, and a couple of days later it moved up enough for members to take their money and profits off the table.

But they didn’t stop there…

Members took part of the profits and put them back into a Cleveland-Cliffs call option that expires on February 7, a week before the company is estimated to report earnings. The profits from the first Cleveland-Cliffs trade were enough to buy the new options outright.

Normally, we would advise members to just take the profits and run. But in this case, something interesting popped up that prompted me to recommend a second trade.

One of my wire services showed this message:

Cleveland-Cliffs call volume above normal and directionally bullish. Bullish option flow detected in Cleveland-Cliffs with 42,669 calls trading, 7x expected, and implied volume increasing almost seven points to 57.51%. February 7 weekly “▮▮” calls and February 20 “▮▮” calls are the most active options, with total volume in those strikes near 30,500 contracts. The put-call ratio is 0.12. Earnings are expected on February 7.

Sorry, but I had to black out the strike dates so War Room members don’t get mad at me for sharing the same picks they’re paying for.

Someone is betting big on Cleveland-Cliffs moving in the weeks ahead…

Now, this isn’t foolproof…

The trades could have been part of a strategy like covered or naked calls. One never knows for sure.

But it really doesn’t matter much for War Room members. They’re in the trade for free.

If it moves lower, there’s no skin off their back.

Action Plan: The free ride is a very rare occurrence on Wall Street.

But this trade on Cleveland-Cliffs was open to everyone in The War Room. There is no upside cap like there is in a spread, and that makes the potential for humungous profits even sweeter.

About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?