Removing the Mystery From the VXX

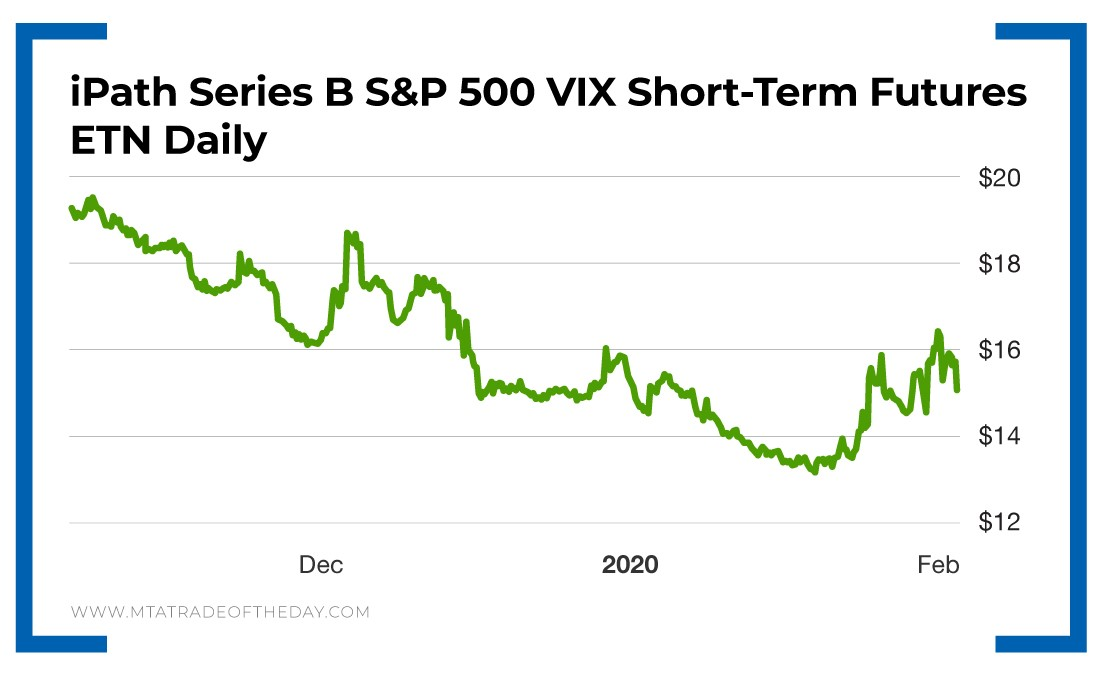

On Monday, Bryan and I recommended a volatility straddle using the iPath Series B S&P 500 VIX Short-Term Futures ETN (NYSE: VXX).

A straddle is when you buy a put and a call option with the same strike price.

Volatility, as measured by the CBOE Volatility Index (VIX), takes into account the number of puts and calls being bought and sold on S&P 500 stocks. When the market is crashing, the VIX moves higher; when the market is soaring, the VIX moves lower.

In this case, War Room members bought a straddle. The goal was to see enough of a move in the VXX to lead members to profit in one of two ways – by either having the straddle price go higher than what they paid or having one side of the trade go high enough to cover the cost of the entire straddle, resulting in a free trade.

To understand the VXX and the VIX, you must first understand the relationship between the two…

The VXX is an exchange-traded note (ETN), and the VIX is an index. It’s very important not to confuse the two. The VXX uses futures options on the VIX to try and mimic the move of the VIX. Most often, it fails miserably at doing so. In fact, based on my calculations, it mimics about 40% of the move at best.

So what gives?

Why even play the VXX to begin with if you’re getting only 40% of the move?

You would want to play the VXX because it moves when there is increased intraday velocity in the moves of the market.

This is important.

The VXX will deliver large gains only when there is a lot of up and down movement in a short period of time. If that movement is not violent, the VXX will see deterioration regardless of how big the up or down move is (if that move is over a longer period of time).

This is because of the futures component. The ETN managers buy and sell futures contracts to mitigate their risk. If they see a gradual move, they know that futures are cheap because volatility is low – so they can offset risk cheaply.

By creating offsets and reducing risk, ETN managers can manage the nearer-term contract prices, as they know they have coverage in case of a big move. They know big moves don’t last, which is why they have security knowing they can eventually cover at a lower price.

Still with me? Let’s get back to the VXX straddle War Room members did…

The goal was to hold for a while as the volatility from Thursday and Friday of last week were setting the stage for increased volatility.

But around midday, we noticed that a major bear flag on the Nasdaq did not enjoy any follow-through. That was a signal that the VIX was entering into a period of lower volatility for the day and that the VXX options would begin to lose premium – which is why I issued a sell recommendation, and members were able to escape with a profit.

Action Plan: Knowing how to trade the VXX is just as important as understanding how the VXX actually works.

And in The War Room, we’ll give you the trades and the mechanics, so join me today!

About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?