Sell These Stocks If Biden Loses the Election

Will we know who the next president will be? Perhaps…

The markets could be going nuts like Black Friday at Walmart or staying as calm as a Wisconsin lake in mid-August. We just don’t know, and that is why we’ll be live, analyzing the markets in real time, assessing where to deploy capital and where to pull back from.

If Joe Biden loses, the sector that may suffer the biggest short-term losses could be alternative energy. Companies in the electric vehicle, charging station, and wind and solar energy spaces could all be at risk. Some names include First Solar, Blink Charging and just about any other name with solar in it.

I think the sell-off will be a knee-jerk reaction, however, as the future growth sectors are the very same in which companies like Tesla, General Motors and Ford are investing billions of dollars. So, while they should get hammered, the opportunity to buy may also be the best since March.

Sell the VIX

The market loves certainty and money-printing stimulus, as it forces investors to move into the stock market. That means people will buy stocks and create what we call “stockflation.” Donald Trump measures his success by the level of the stock market, and he will do whatever it takes to make that number look great.

Selling volatility is a weird trade. While you are “selling” volatility, you are actually “buying” stocks or indexes.

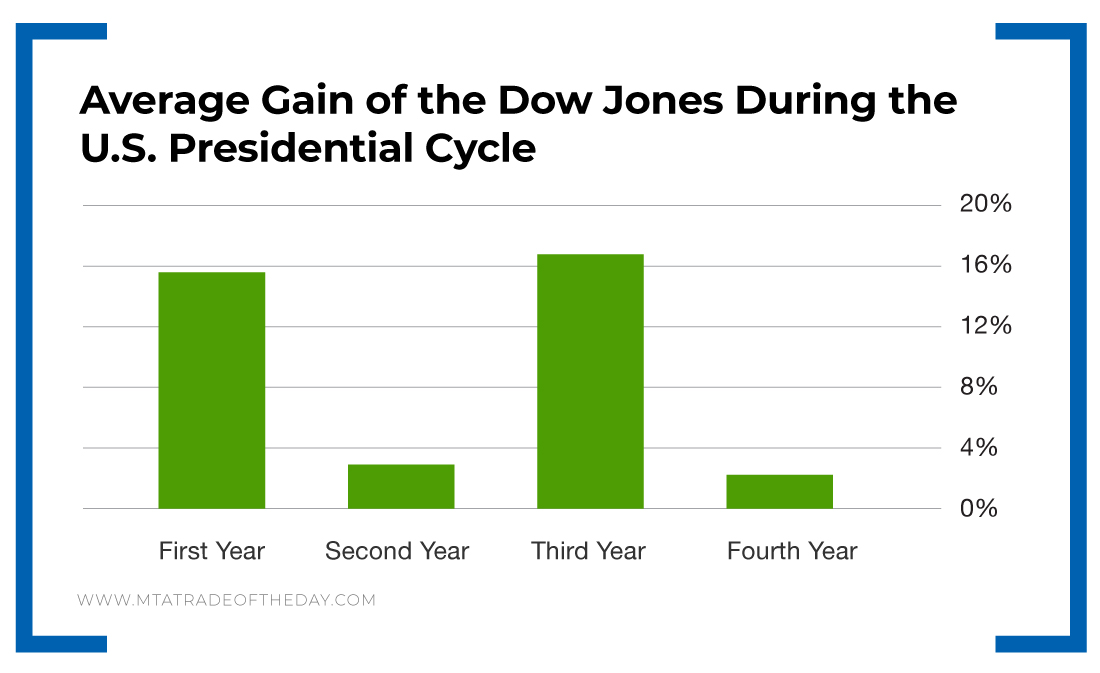

So you want to be ready for a massive surge in share prices over the next year. In fact, as you can see from this chart below, the first year of a new presidency is historically the second-strongest for markets.

And when you have a commander in chief who is focused on making the market go higher, it could be a banner year.

About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?