The 11 Stock Market Sectors and Their Performance

The stock market can be an overwhelming place, especially if you’re new to the scene. With so many stocks to choose from, you might not know where to begin. That’s why knowing the stock market sectors can help.

Sectors break up the stock market into smaller pieces. By understanding them, you can better know where you want to invest your money.

What Are the Stock Market Sectors?

Stock market sectors are groups of stocks based on similar characteristics. This can include related products, services or shared operations. MSCI (Morgan Stanley Capital International) alongside S&P Dow Jones Indices built this classification system. There are 11 sectors, each divided further into industry groups, industries and sub-industries.

- Communication Services

- Consumer Discretionary

- Consumer Staples

- Energy

- Financials

- Healthcare

- Industrials

- Information Technology

- Materials

- Real Estate

- Utilities

Below is a brief description of each sector. I’ve also included a snapshot of each sector’s performance in 2019 and the start of 2020.

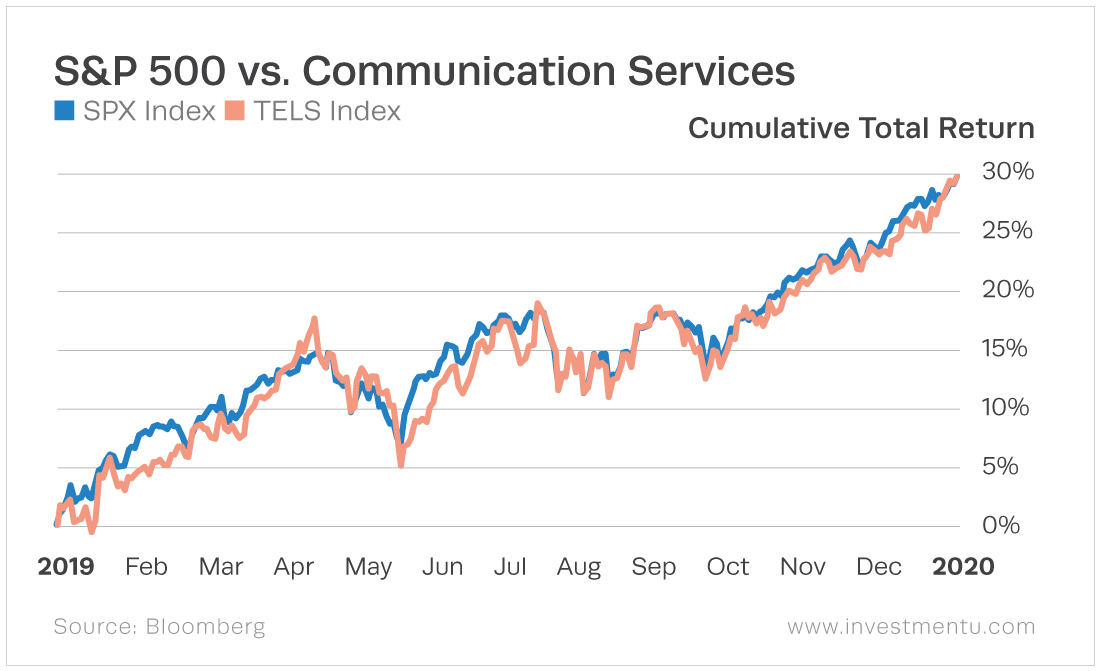

Communication Services

Before fall of 2018, this sector was known as the telecom center. However, years of changes, such as mergers and new market demand, led to the decision to redefine the sector. Once formed by telecommunication companies (e.g., Sprint, Verizon), the sector now also consists of media and entertainment companies, such as Facebook and Netflix. With these companies, communication is possible across the globe.

The communication services sector tends to follow the general market. Generally, there are strong gains during a bull market, but a bear market can lead to severe losses. Also, some companies in this sector may struggle as technology advances and they’re forced to adapt.

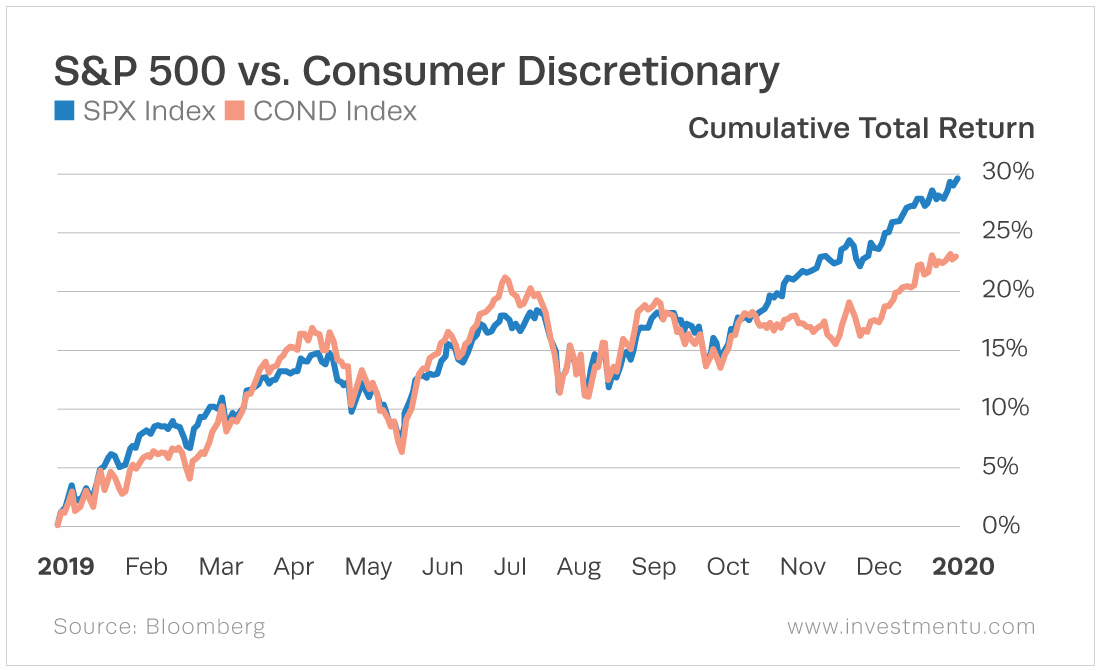

Consumer Discretionary

A good way to describe the consumer discretionary sector is luxury. It includes industries like automobiles, hotels and restaurants. Companies market their products to consumers, and consumers buy those products. But that’s if they have extra money after paying bills.

These industries rely on a strong economy where people can spend on more luxurious items, such as buying a new car or traveling on vacation. That’s why this sector is sometimes referred to as “consumer cyclical.” It can be a great investment in a growing economy and a good investment in a stable one. But if a recession is near or happening, it’s best to avoid it.

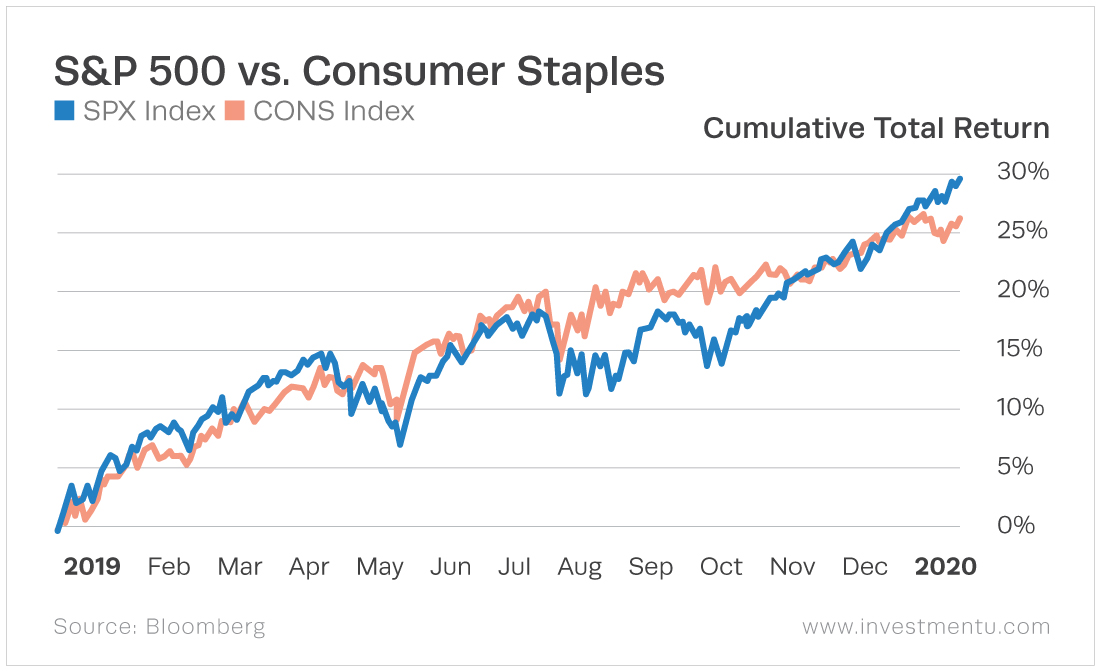

Consumer Staples

Humans have basic needs. No matter what the economy looks like, people always need food, household goods and personal products. All of this is in the consumer staples sector. It includes grocery stores and retailers like Walmart and Target.

The opposite of the consumer discretionary sector, this sector tends to outperform in recessions when people are focused less on luxury and more on necessity. That’s why consumer staples are some of the most defensive stocks.

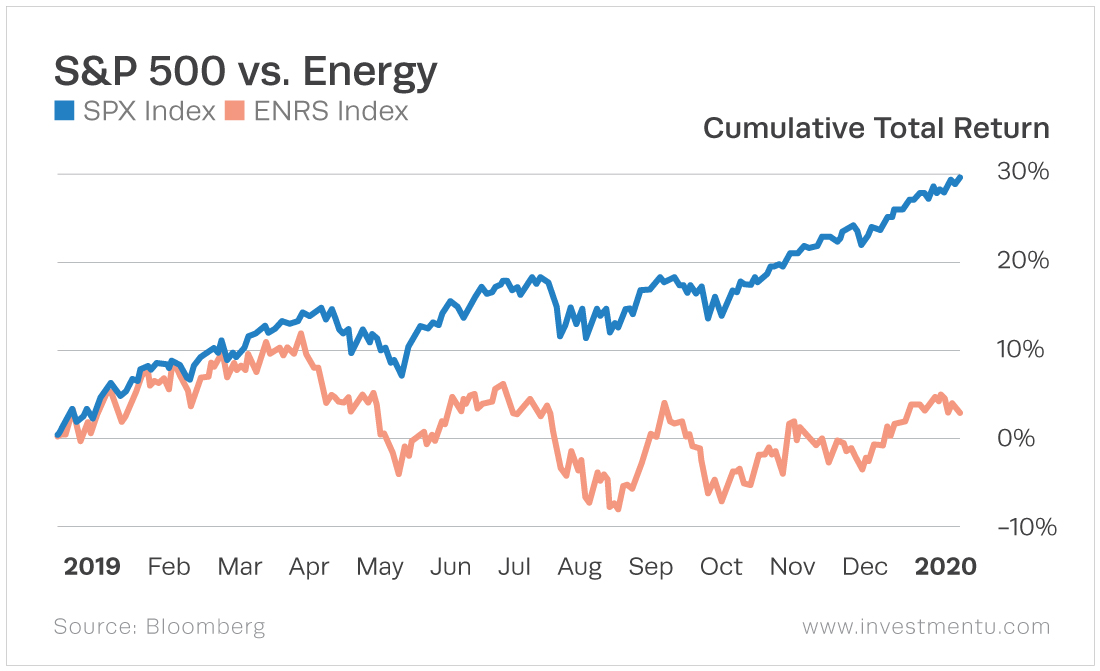

Energy

Oil, gas, coal… All of these are in the energy sector. These companies extract from the earth to produce energy, including alternative sources, such as solar and wind. It also includes companies that build energy equipment, provide energy services and are involved with any step of the production process. This could be oil field exploration, refining fossil fuels or marketing.

During times of growth, the economy needs more energy. And since some of the world’s raw energy is in unstable areas, it’s not uncommon to see a reduction in international supply. The industry can also take a hit when energy prices are falling from a weak economy or a surplus of product.

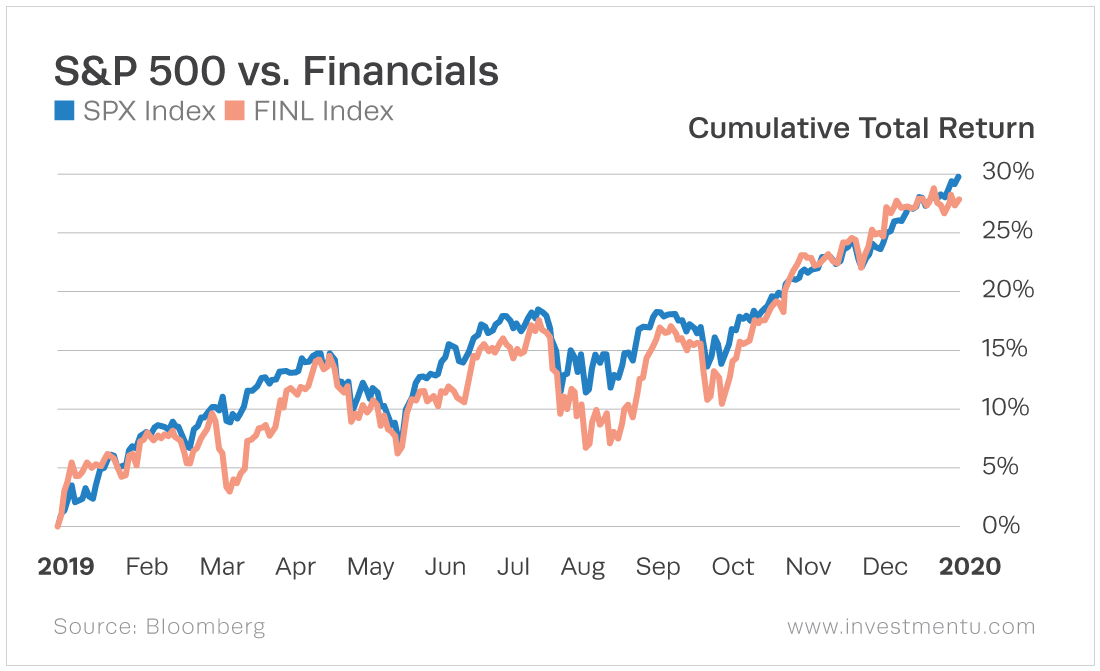

Financials

When you think of finances, what comes to mind? If it’s banks, you’re not wrong. But the financials sector also includes insurance companies, investment brokerages and even some real estate firms.

Here, revenue is usually generated from mortgages and loans that increase in value as interest rates rise. The sector trends with the economy. When the economy climbs, there will be more demand for financial services. But in a downturn, lower loan performance hurts lenders. Even insurance companies and investment brokers aren’t safe from the effects.

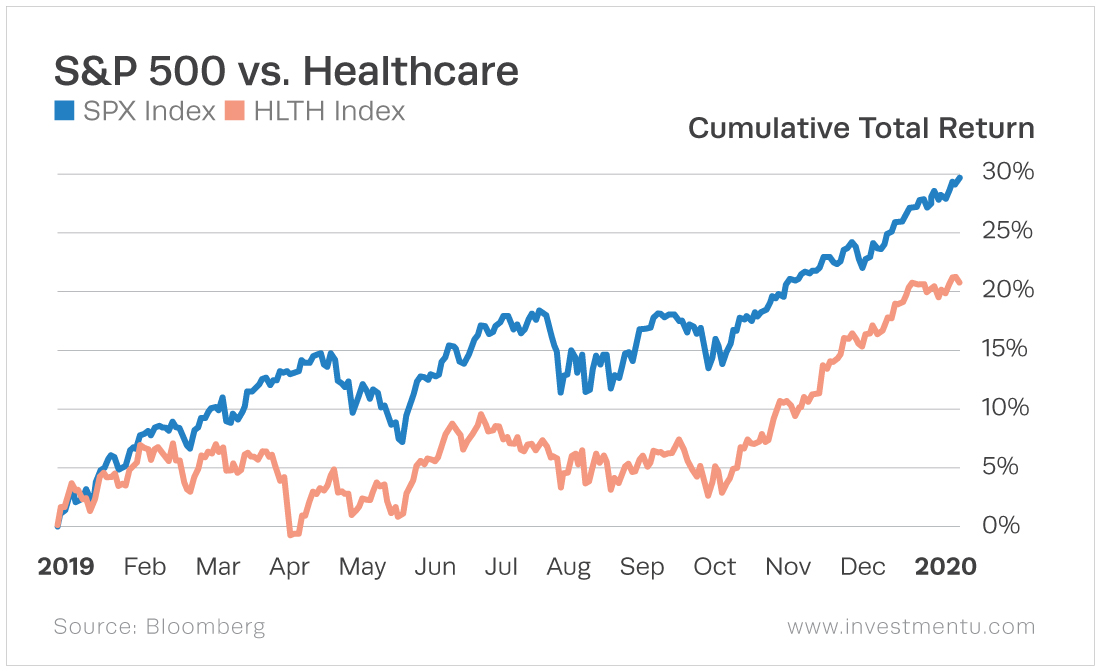

Healthcare

Healthcare is a popular stock market sector. It combines helping others with cutting-edge research and technology. There are two big hubs in the healthcare sector: pharmaceuticals and healthcare equipment and services. Pharmaceuticals involves drug and biotech companies. Equipment and services range from building the equipment to doctors helping patients.

This sector can be home to great success and sometimes failure. People will always need doctors and medicine. And the healthcare market continues to grow with the aging population.

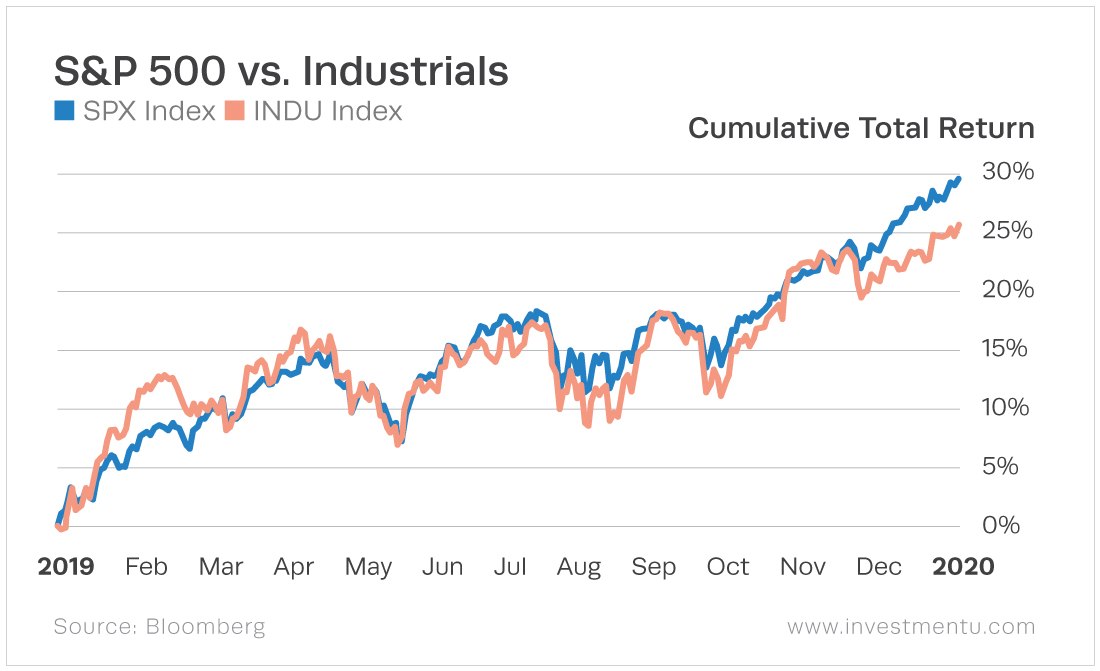

Industrials

Many companies in the industrials sector produce capital goods, including defense, aerospace, construction, transportation and manufacturing. You might be familiar with companies like Delta, Deere or UPS.

Industrials is a cyclical sector. In a failing market, demand is low. But when the market rises, the sector sees a boost. Many industrials are large cap and have stable dividends.

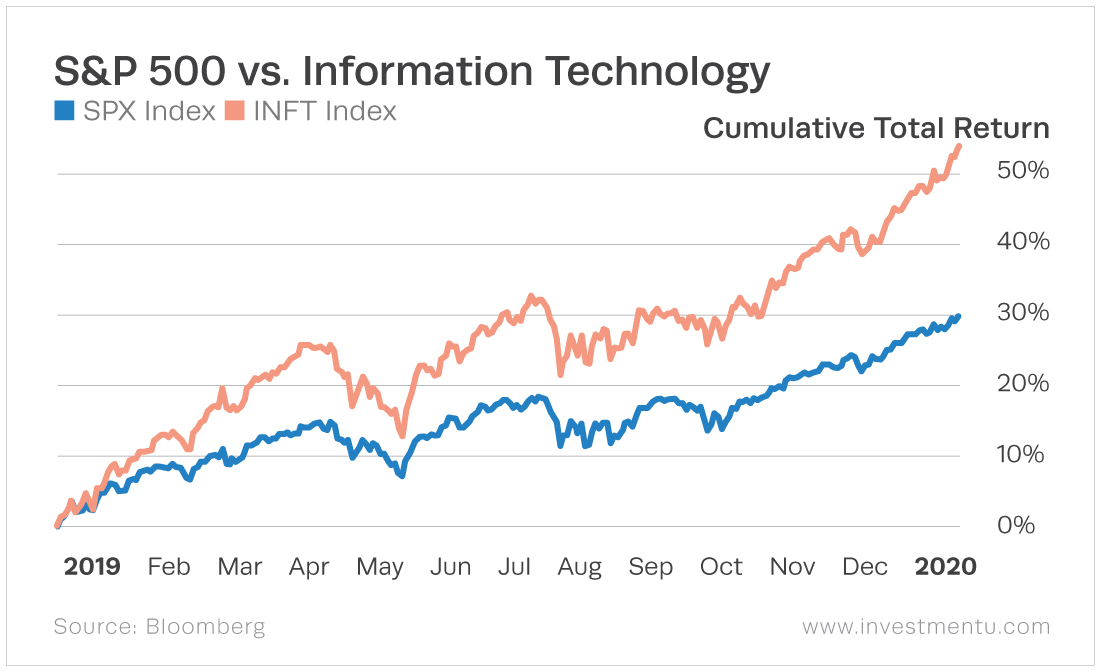

Information Technology

The information technology sector is made up of companies that make our internet-driven world work. This includes internet, software and semiconductor companies. To learn more about these companies and the sector, check out our Tech Stocks research.

With the rise of technology, it’s no surprise the tech sector is one of the leading performers. And it may continue to outperform if the bull market keeps running.

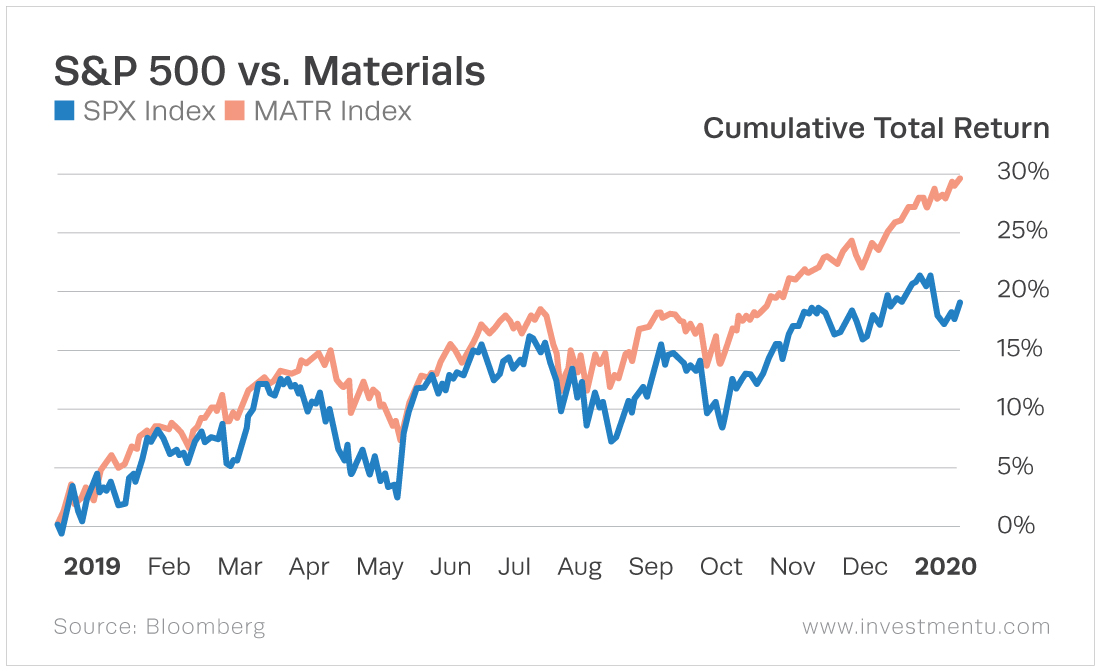

Materials

Materials companies work on finding, developing and processing raw materials or natural resources. This could be mining, logging or metal businesses. Some oil and natural gas stocks are also placed in the materials sector. These companies are usually business-to-business and part of a supply chain.

Sometimes the sector can benefit from inflation. When prices rise, the cost of extracting material stays the same. But that doesn’t mean the sector has no weaknesses. A rising problem in today’s world is shortage of natural resources. This can lead to struggling companies.

Real Estate

As the name suggests, this stock market sector includes companies that own, develop, lease, and manage land and property. They run malls, apartments, senior living and more. Their revenue comes from rent and increasing property values.

Real estate performs poorly in a declining market. When people struggle financially, they’re less likely to go out and buy a new home. But when the economy is growing, the real estate sector tends to do well. Stocks in the real estate sector can be a great long-term investment. And another popular way to invest is a real estate investment trust (REIT).

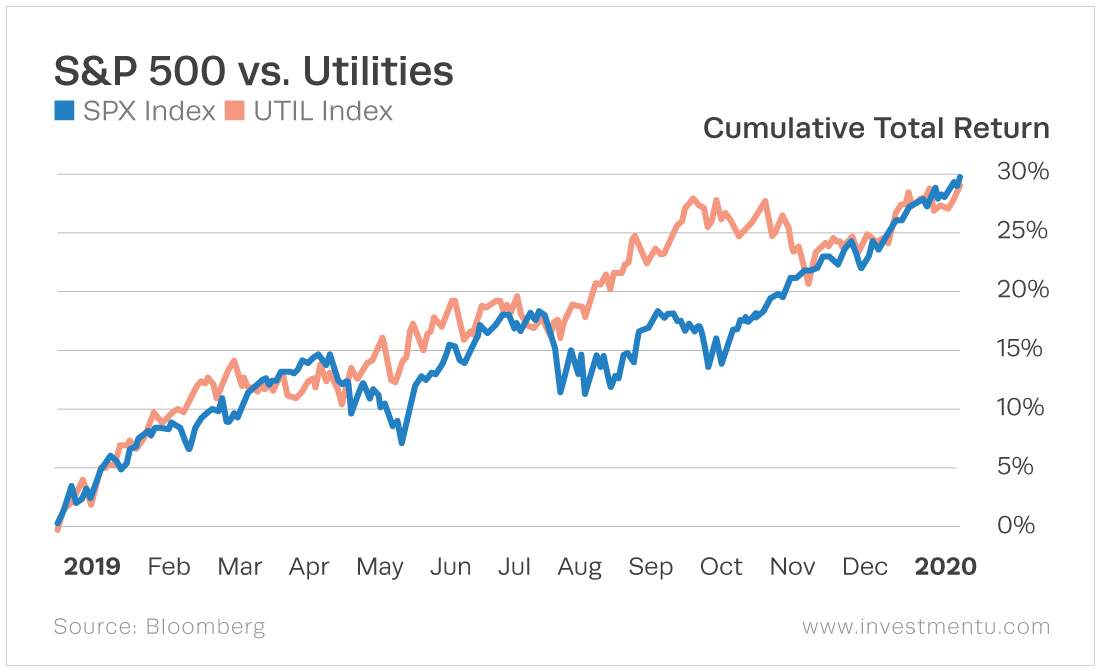

Utilities

This sector contains electric, gas and water utilities. Typically, these companies dominate regionally and fall under heavy regulation.

Utility companies are usually well-established, keeping stable revenue even in recession. This makes utility companies another good defensive investment. But be sure to keep an eye on interest rates. If they rise, utility stock prices will likely decline.

With a better understanding of stock market sectors and their performance, you can make better investing decisions. To learn how you can invest, check out our 5 Step Stock Investing Guide. And you can also sign up for our free e-letter. You’ll receive awesome investing tips – and did I mention it’s free? Sign up below!

About Amber Deter

Amber Deter has researched and written about initial public offerings (IPOs) over the last few years. After starting her college career studying accounting and business, Amber decided to focus on her love of writing. Now she’s able to bring that experience to Investment U readers by providing in-depth research on IPO and investing opportunities.