What Is Swing Trading in the Stock Market

We’ve all heard of day trading. And the opposite of that is long-term investing. Nestled comfortably between these opposite investment strategies is swing trading. So what is swing trading? Well, it depends on who you ask… But one of the prime characteristics of swing trading is its holding time.

You see, day traders tend to close out their positions before the markets close. They can be in and out of a trade in mere minutes. This involves a lot of research. A good chunk of capital. An iron constitution. And a whole lot of time.

In long-term investing, a lot of research is still necessary to be successful. But once an investment is made, it’s held on to for years. This is like a Ron Popeil approach to trading. You set and forget it. There’s no need to worry about intraday volatility or routinely check what the markets are doing. Long-term investors are in it for the long haul. What’s going on in the markets on any given day really isn’t a concern for them.

Then there are the swing traders. These are a special breed. The benefit to this style of investing is you don’t have to be glued to a screen all day, monitoring every up and down in the markets. But you do need to pay attention. While day trading is a full-time job, swing trading is akin to an intense part-time job.

Entries and exits from a position can happen at any time. This necessitates a lot of technical or fundamental analysis or the use of quantitative tools used to trigger trades. And holding times can be anywhere from a couple of days to a few weeks… It just depends what and where the markets are moving.

It’s More Than Just Holding Periods

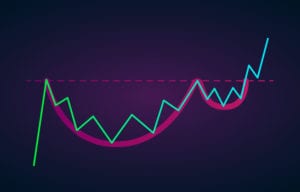

What is swing trading for the part-time trader? It usually involves a firm plan and looking at a lot of chart patterns. Most swing traders tend to look to multiday chart patterns. When done right, a swing trader can seize short- or medium-term gains by following a stock’s (or any financial instrument’s) up and down routine. In other words, by playing off swings in price that follow a pattern of some sort.

Different swing traders home in on different things. But they’re all fairly technical. For instance, one swing trader may use historical data to chart out fluctuations in price. Another swing trader might analyze moving averages or look for cup-and-handle patterns in trading volume.

Once a swing trader finds a pattern (or three) they like, it can get complicated fast, because there is no shortage of useful chart patterns out there.

When done well, swing traders can predict the likely short-term direction a stock’s price is heading and capitalize on it. And that goes for whichever direction it looks like it’s going.

If the patterns analyzed indicate a bullish direction, the swing trader will take a “long” position. This can be as simple as buying shares of a common stock, picking up some call options or buying futures contracts.

On the other hand, if a swing trader sees a bullish pattern, they can take a “short” position. This can amount to shorting a stock, short futures contracts or buying put options. If the price continues its downward trajectory, any of these can turn a healthy, short-term profit.

All of this might sound a lot like day trading with a slightly longer holding time. But if you’re still scratching your head and trying to figure out what swing trading is, there are some key differences to take note of.

Swing Trading vs. Day Trading

Day traders take a lot of pride in their speed. But it can be costly to get started. Most active day traders require a minimum account balance of at least $25,000. And it doesn’t take much to qualify as a day trader. Anyone who trades four or more times in five business days and is moving around at least 6% of their capital is considered a day trader.

On the other hand, swing traders – by design – won’t hit that threshold. That means investors can try their hand at swing trading with just a couple bucks in their account. But the amount a swing trader invests will have a direct impact on the size of any potential returns.

While day trading requires a whole lot of time to do it right, swing trading is much less demanding on the day-to-day schedule. And as someone’s investment account grows, it can become unwieldly to keep track of everything. This is why many day traders move into swing trading. It can be just as rewarding… and it doesn’t involve the same level of dedication.

The Bottom Line on Swing Trading

If you’ve got an eye for a good chart pattern or spotting trends in the markets, swing trading could be a great tool to add to your investment kit. It’s cheaper than day trading and doesn’t have the lengthy time horizon of long-term investing. It’s a great way to stay active and interested in the markets… without incurring the expensive day trading price tag.

The truth is, swing trading is just one of many ways to give a boost to your portfolio. But if you’d like to learn more about it, keep an eye out for Investment U contributor Nicholas Vardy’s explainers and examples. He’s a seasoned quantitative strategist with decades of experience swing trading.

Read Next: What is Margin Trading for Investors?

About Matthew Makowski

Matthew Makowski is a senior research analyst and writer at Investment U. He has been studying and writing about the markets for 20 years. Equally comfortable identifying value stocks as he is discounts in the crypto markets, Matthew began mining Bitcoin in 2011 and has since honed his focus on the cryptocurrency markets as a whole. He is a graduate of Rutgers University and lives in Colorado with his dogs Dorito and Pretzel.