This Penny Gold Stock Could Rocket Higher

Gold stocks are performing really well across the board…

However, there is an outlier…

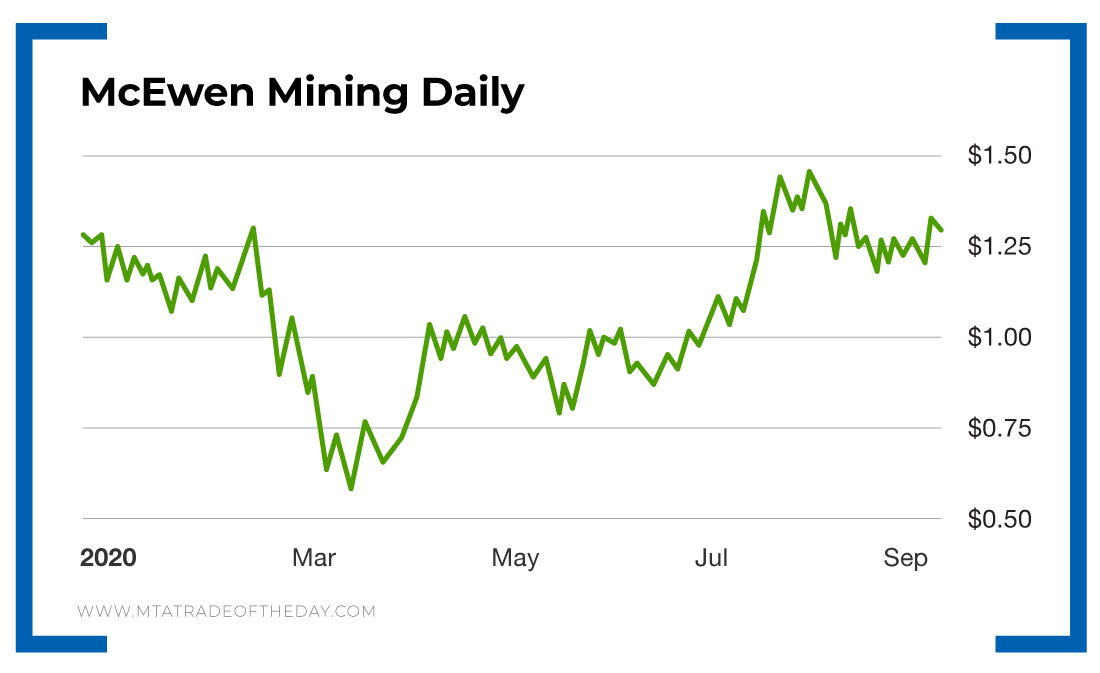

In fact, this gold producer is currently trading at the same levels that it was trading in the beginning of the year. Other gold stocks have doubled or even tripled since then.

What makes this story even more surprising is that CEO Rob McEwen was the founder of Goldcorp, one of the biggest gold mining companies on the planet. After its recent merger with Newmont Mining, it was valued in the billions.

McEwen Mining (NYSE: MUX) is currently worth around $500 million, and Rob McEwen is the largest shareholder, owning close to 82 million shares (more than 20% of the company), and he keeps buying shares. Either he’s nuts, or he sees opportunity.

Now, McEwen Mining is trading at lower levels for a reason. The company’s recent net loss is largely due to overspending on advanced projects and exploration.

Here’s what McEwen said in the last earnings call on the subject:

I very much wish I could say that all our difficulties that started last year are now behind, but they are not, yet. The second quarter was challenging from an operational and health and safety standpoint. Our significantly lower production not only reduced our revenue but also dramatically increased our costs per ounce. In addition, a change in how we account for development expenditures added significantly to our cash cost per ounce at Black Fox. However, our path to future growth and improved operational performance has become clearer.

We are in a transition period setting up for future growth. We have a large resource base, four operating mines and can see an exciting organic growth pipeline of projects ahead that could potentially push our production to 300,000 ounces per year. I recently purchased 2 million shares, increasing my ownership to 82 million shares, and underlining my confidence in our future.

P.S. Notice to all Trade of the Day members: Join us on Instagram! Super-awesome news here. Our social media team just launched an Instagram page, and all Trade of the Day members are invited to join. It’s totally free! Just click HERE– then click “Follow.” Bryan and I plan to post charts, videos, and even some funny and entertaining memes every once in a while. It’ll be a great experience and keep us all plugged in together – even while on the go. So please take a moment and follow us now!

About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?