Three Stocks Billionaires Are Investing in Right Now

They spot trends ahead of the crowd, have many, many ears to the ground, see inefficiencies in the market and use their talents to spot undervalued opportunities…

Billionaires are movers and shakers who can make things happen in the market and the world.

Their moves should not be taken lightly.

Sure, they have the money to make a bunch of bad moves and still come out ahead. But you don’t become mega-wealthy by doing that over and over. That’s usually reserved for those who inherit their wealth, not earn it.

So when these big guns make big moves, I pay attention, and so should you.

Three billionaires are buying three stocks right now, and you should join them…

Billionaire No. 1: Warren Buffett

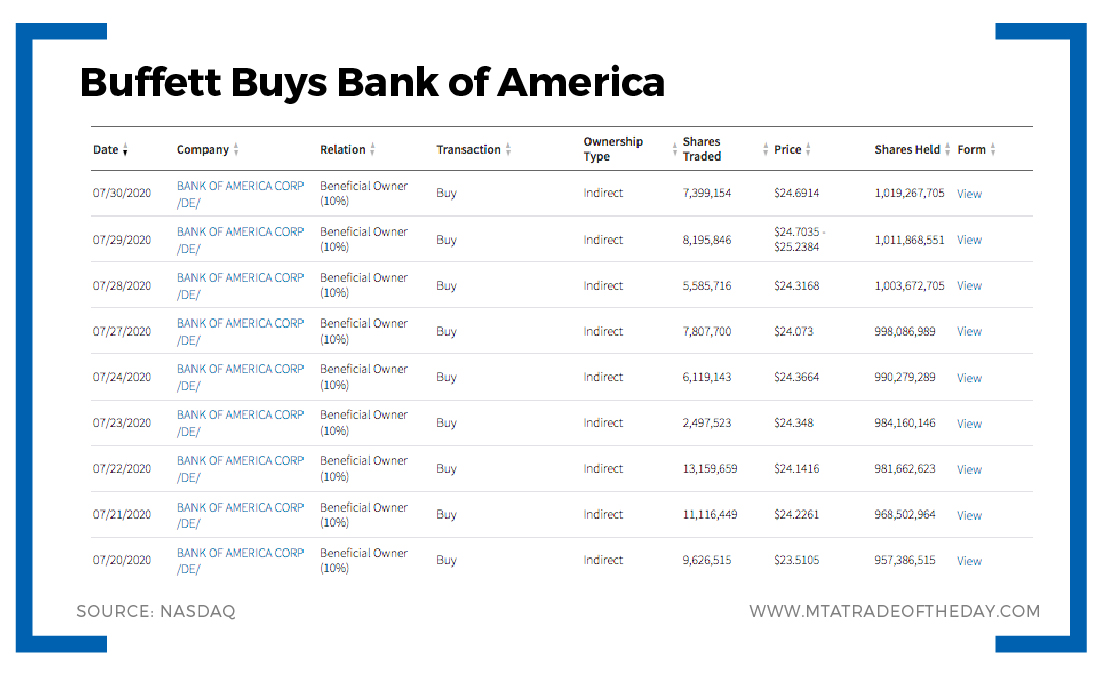

You don’t get much bigger than Buffett, and he is adding a monstrous quantity of Bank of America (NYSE: BAC) to his holdings at Berkshire Hathaway.

How much?

Well, Bank of America is now his biggest bank holding, and he just added another 69 million shares. That’s more than $1.2 BILLION worth of shares that he’s bought on the open market in just the past two weeks.

Buffett knows the bank is trading at a discount to book value, and that is when he buys big. Book value refers to the actual value of the company after it liquidates its assets and pays back its liabilities.

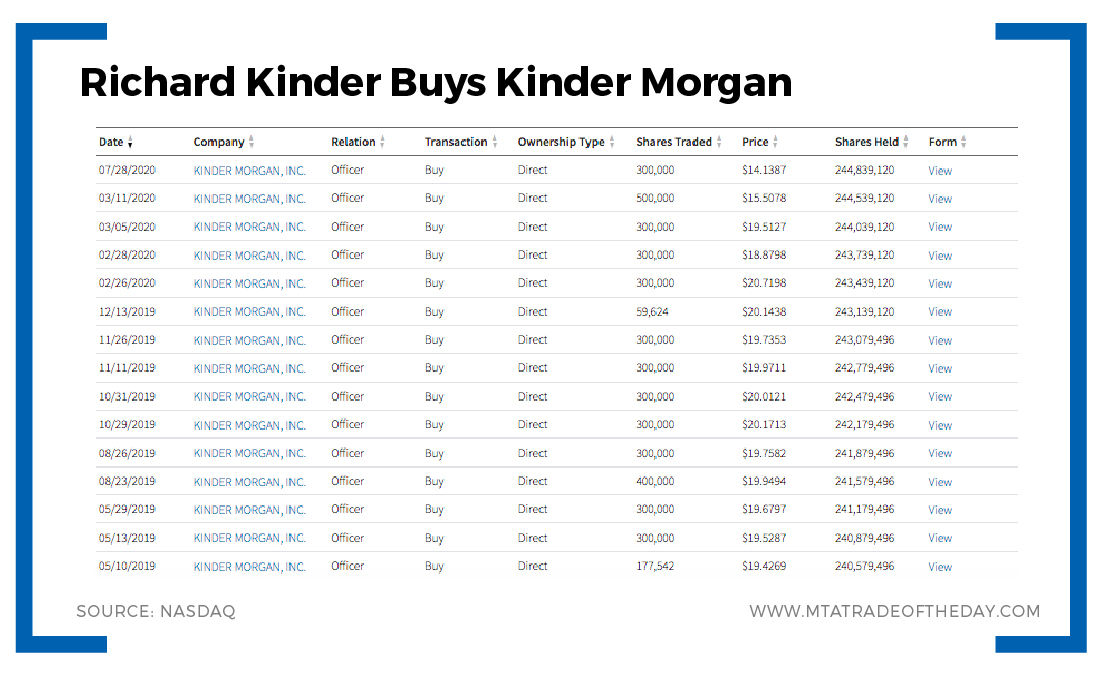

Billionaire No. 2: Richard Kinder

The namesake executive chairman of Kinder Morgan (NYSE: KMI), the mega pipeline operator, is buying back his own stock like it’s going out of style. Look at this table and you’ll see that Kinder has bought more than 4.4 million shares in 2019 and 2020.

He likes the pipeline business. It’s a toll business, and he gets paid regardless of the price of oil or gas.

Of course, if less is transported, he gets less. But he’s obviously looking past the downturn and toward a recovery, and he’s happy to collect a fat 7% dividend while he waits.

Billionaire No. 3: Stephen Luczo

And finally, there’s Stephen Luczo, chairman of the board of Seagate.

He’s buying shares of telecom giant AT&T (NYSE: T), where he sits on the board of directors.

He’s also collecting a hefty dividend of 7% while watching this giant take strides forward in telecom and entertainment. Meanwhile, AT&T is steadily paying down its debt thanks to the massive cash flow it generates each year.

About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?