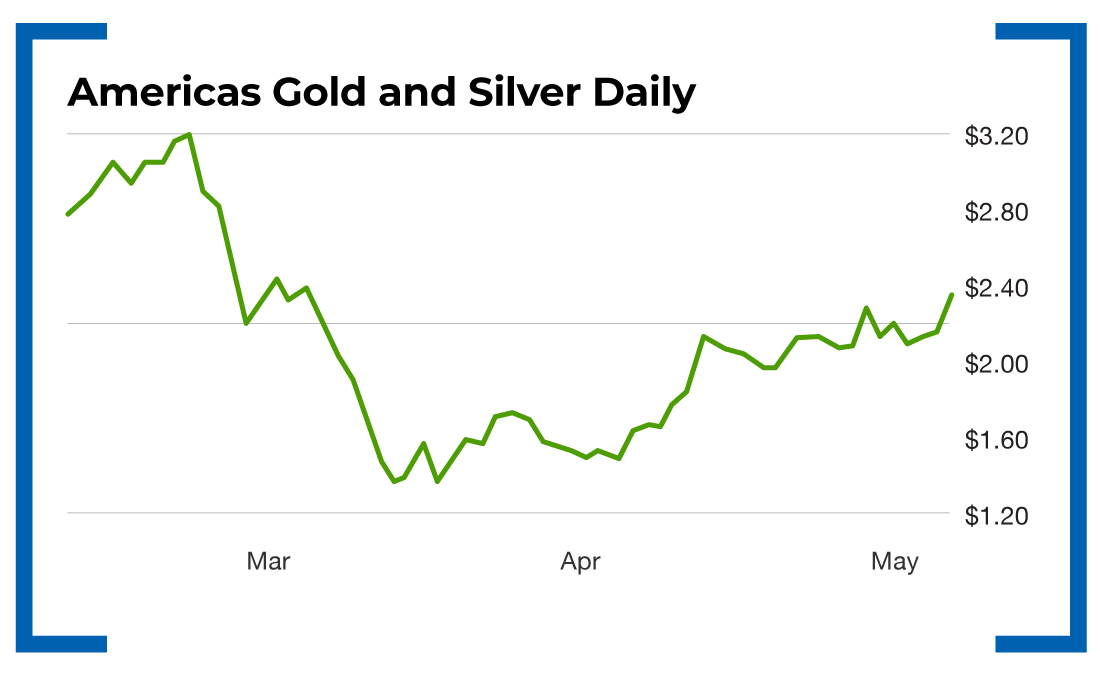

Two Gold Tycoons Are Loading Up on This $2.30 Stock

Oftentimes, when a company issues stock, its share price plunges…

This is usually a sign of weakness – a company that needs capital to continue operations. And that money does not come cheap.

In fact, for small caps and microcaps, that money might come at a 15% to 40% discount to the market price. And the shares should soon follow lower. After all, if the company is willing to take a haircut, why should you as a shareholder be willing to hang on at higher prices?

If you’re in the right situation – in the right company – a capital raise might be your opportunity to load up.

Let’s take Americas Gold and Silver (NYSE: USAS) as an example…

War Room members are in the shares well under $2, and they plan on making a bundle on the position.

Take a look at this press release from the company earlier this week…

TORONTO, May 5, 2020 – Americas Gold and Silver Corporation (“the “Company”) (TSX:USA; NYSE American: USAS) has today entered into an agreement with a syndicate of underwriters pursuant to which the Underwriters have agreed to purchase on a bought deal basis 8,930,000 common shares of the Company (the “Common Shares”) at a price of C$2.80 per Common Share (the “Offering Price”), for aggregate gross proceeds of approximately C$25,000,000 (the “Offering”). Strategic investors led by Pierre Lassonde and Eric Sprott have indicated that they intend to subscribe for such number of common shares from the offering totaling C$8.75 million.

Ordinarily this would be worrisome. However, in this case, it’s not.

Here’s what I told War Room members…

The deal is a bought deal. That means they already placed the shares and did not have to “look” for buyers. It’s good for the company, as it is selling shares AT THE MARKET – with no discount. When a company needs to raise money, it’s usually at a discount to market, and that discount for a microcap can be anywhere from 15% to 40%. These two giants of the industry are buying EVEN more shares – they already are the two largest shareholders. Lassonde, if you are not familiar, is a billionaire who co-founded Franco-Nevada. And Sprott is a billionaire who founded Sprott Inc.

Americas Gold and Silver shares fell to almost $2 on the news but stayed there only for a couple of hours. Today, the stock traded as high as $2.40, up almost 20% just two days later.

Action Plan: Companies like Americas Gold and Silver don’t need the money.

This capital raise was an opportunity for majority shareholders to be rewarded with a big chunk of cheap stock at low prices, without moving the market.

They’re not the only ones to benefit… War Room members got in this play at much lower prices.

About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?