Wall Street’s “Suck Maneuver” Brings Us Quick Gains

If you see an angry bull coming your way and you’re smart, you’ll get out of the way. The best bullfighters know this and so do the best market makers on Wall Street.

They see what’s coming down the line before you do. But if you know how to recognize the signs in the market, you can flip the market makers’ “suck maneuver” in your favor. That’s a term market makers use to describe a certain strategy that I’ll reveal to you shortly…

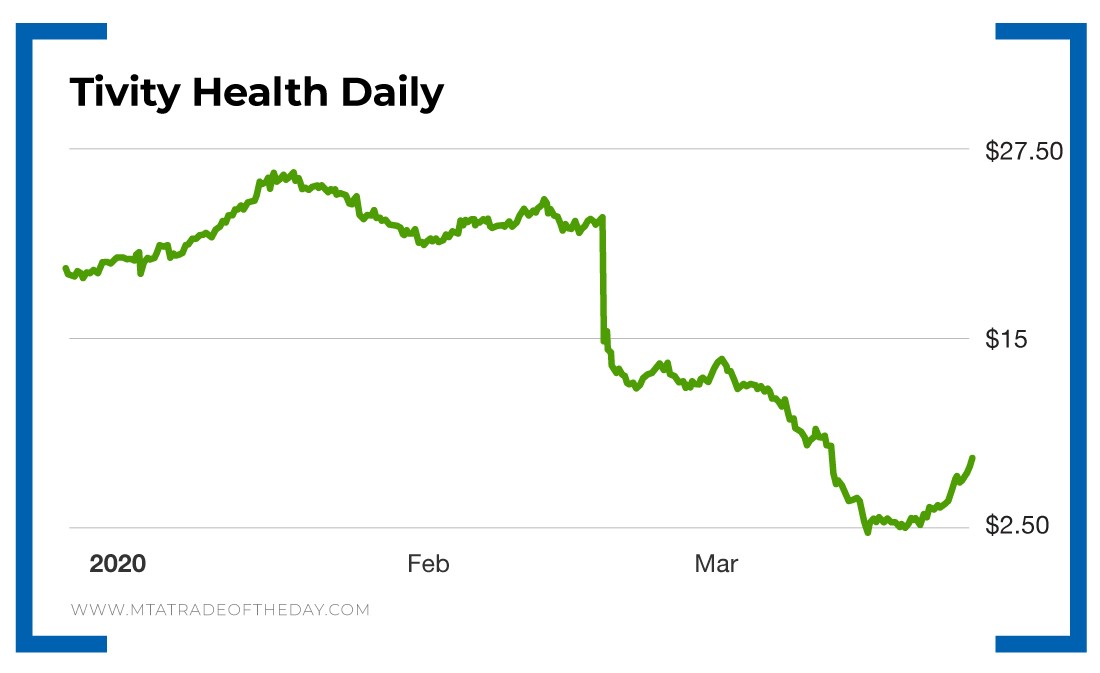

Last week I noticed one of The War Room’s prior holdings, Tivity Health (Nasdaq: TVTY), had a rapid increase in insider buying. This was not strange to see – what was strange was that the shares were tanking while insiders were buying.

Here’s some quick information on Tivity Health…

Tivity Health acquired the SilverSneakers program in 2006, which encourages older adults to lead healthier lifestyles through exercise, social interaction and nutrition. Many health insurance programs support SilverSneakers.

During this coronavirus pandemic, one would think the SilverSneakers program would be in danger.

And one would be right.

But once this pandemic ends, those SilverSneakers seniors will be ready for their social gatherings!

Tivity Health also acquired the diet and nutrition company Nutrisystem in March 2019.

Nutrisystem is a food delivery company in disguise, and people are looking for ways to get food delivered to their homes without ever having to interact with another human being.

Even with these acquisitions, Tivity Health was certainly not at the top of my list of stocks to recommend. However, I keep all sorts of stocks on my screen, and when that insider buying hit, I looked closer.

While Tivity Health insiders were buying, its stock ticker on my screen was screaming red. The shares were trading at $6. An hour later they were at $5. That’s where they closed. The next day they were trading at $4, then $3, and then in an hour they dropped to $2.

The shares were falling much faster than the market.

When I saw the shares gapping down with heavy volume and no news to cause it, it was obvious what was going on. There was a huge seller who had to get out at all costs.

The market makers could see this, they kept lowering the bid and the shares kept coming in. At $2, the market makers signaled that they would take all the shares, and the suck maneuver was complete.

Within a few minutes, the shares began to reverse higher, closing at $3 for the day, up 50% from the low set an hour before the close.

Action Plan: In The War Room, you’ll get all types of trades, including timely stock trades like Tivity Health.

And you’ll get them in real time, well before the crowd figures out what’s going on – so join me today and get in on the next play!

About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?