Wedge Pattern Trading: Learn the Basics

Wedge pattern trading is another basic concept that most beginner day traders need to familiarize themselves with. It takes cues from ABCD and flag patterns. And it’s a more nuanced indicator for market behavior – especially in the context of consolidation. The primary function of this pattern is to help day traders recognize the opportunity for a price reversal and act before it comes to fruition.

Like flag pattern trading, wedge pattern trading is based on the idea of an impending price break, signaled by trending fluctuations in the price. Where it differs is in the convergence of those fluctuations into a correction point.

Recognize Rising and Falling Wedges

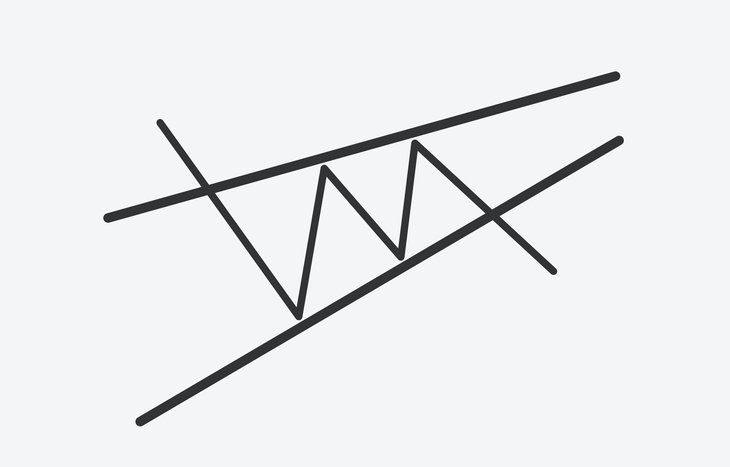

Like flags, wedges are marked by price fluctuations, with peaks and valleys that can be connected by a straight line. However, instead of remaining parallel, as is the case with flags, wedges see a convergence of these peaks and valleys. A price break occurs at or near the point of convergence, pushing the price in the opposite direction from the trend lines. For example, this is evident in both rising and falling wedges.

- Rising wedges occur when the peaks of a stock trend upward, with steeper valleys.

- Falling wedges see the peaks of a stock trend downward, but they are steeper than the valleys.

Typically, a wedge occurs over 10 to 50 trading periods – enough time for the trajectories of a stock’s peaks and valleys to form convergent trends. During this time, rising and falling wedges both include three characteristics:

- A trend of convergence

- Declining volume as the trend progresses

- A breakout from the trend near the point of convergence.

The price correction that follows the culmination of a wedge pattern generally occurs in opposition to the trend: Rising wedges tend to break downward, while falling wedges tick upward after the break. Knowing this and recognizing wedges gives day traders insight into anticipated stock behavior.

Why Is the Wedge Pattern Important?

Wedges are useful for interpreting impending price breaks. As is the case with flags, wedges indicate instability and problems achieving a consistent support level. The convergence of the wedge, backed by declining volume, clues traders in to the potential for a breaking reversal in price action. As the trend converges, buyers become more aggressive and sellers become more cautious. This can help inform a trader’s action depending on their position.

The efficacy of wedge patterns is what makes them useful. Studies suggest that they’re reliable predictors of a price reversal more than two-thirds of the time. Typically, falling wedges are more indicative of a price break than rising wedges. The ability to recognize both rising and falling wedges gives traders a basis for accurately setting stop-losses and anticipating price corrections.

Common Mistakes in Wedge Pattern Trading

Like most pattern trading strategies, wedge pattern trading works best when observing the fundamentals. Trying to time peaks and valleys can result in preempting the pattern. This will leave traders on the outside looking in as a stock continues near the break. Traders should take profits when the price breaks above the starting point of a falling wedge, for example.

Another common mistake in wedge pattern trading is incorrect wedge identification. For a wedge pattern to be valid, it needs at least three touches on both sides of the wedge. Any fewer and it’s a trend, not a pattern. The market needs to test the support and resistance levels of the trend three times before it can break in one direction or the other. This is also important for establishing proper stop-losses. Without a clear trend line, it’s difficult to set appropriate levels.

The Final Word on Wedge Pattern Trading

There are a wide range of patterns that investors are looking for. And these indicators help traders build wealth on a path to financial freedom. To find your path, sign up for the Liberty Through Wealth e-letter below. This daily newsletter provides expert stock analysis and tips for building wealth in your life.

Wedge pattern trading can be one of the most lucrative pattern-based trading strategies for day traders because of the potential to capitalize on a significant price reversal. Establishing a wedge and setting appropriate stop-losses can lead to smart profits when the fundamentals of the pattern play out.