What Investors Like You Cannot Control… and What You Can

In a column last week, I noted that you should have three primary goals as an investor:

- Understand the true state of the world.

- Recognize what you can and cannot control.

- Capitalize on profitable trends.

Appreciating the true state of the world?

Most investors go off the rails right here, unfortunately, by falling prey – usually unwittingly – to the relentless negativity of the mainstream media.

Click here to watch Alex’s latest video update.

Most people believe the world is far less free, less peaceful, less safe, less equal and less affluent than it really is. (See my previous column for details.)

If you want to be a successful investor, follow the trend lines… not the headlines.

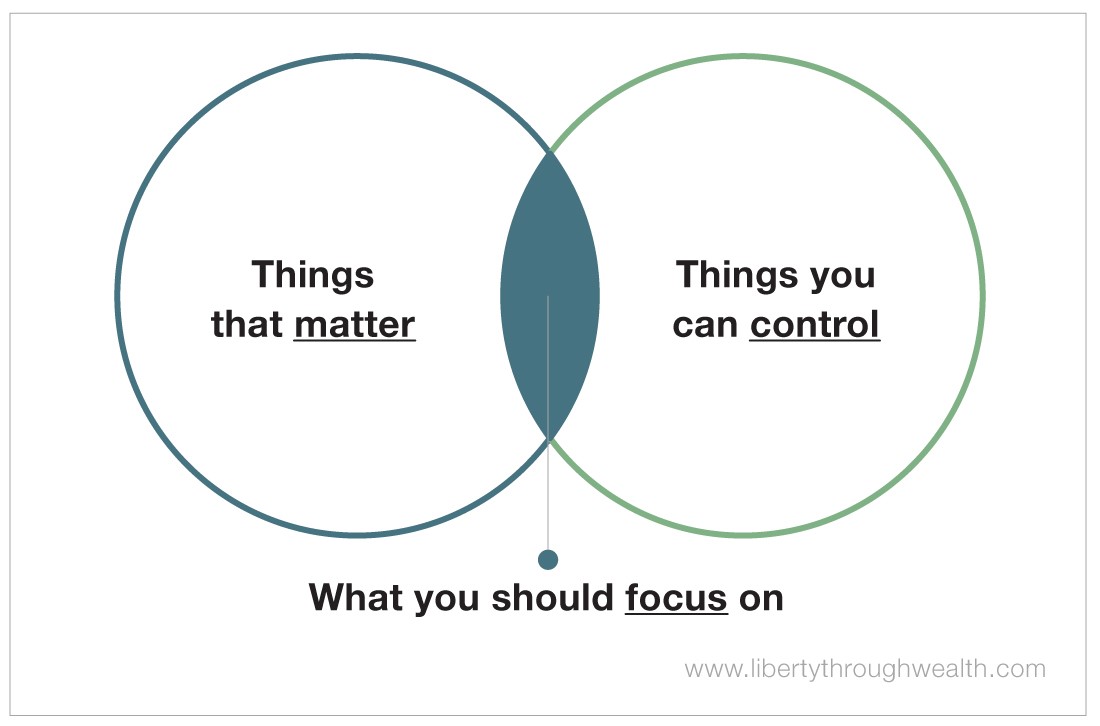

After adopting an accurate, fact-based view of the world, your next step is to discern what you can control. This chart is helpful.

There are a lot of things that matter to investors. Just a few of them include…

- Economic growth

- The business cycle

- Inflation

- Interest rates

- Commodity prices

- Technological innovation

- Corporate earnings

- Geopolitical events

- Elections

- Fed policy

- New legislation.

Take a good long look at that list. All of these factors will affect your portfolio in one way or another.

Which of them can you control? Precisely none.

Which can you accurately and consistently predict? Again, none.

So why waste your precious time obsessing over them?

At this point, some will say, “Well, no one knows these things for certain, but you have to guess.”

No. You don’t have to guess. That’s what being an intelligent investor is all about, limiting the guesswork.

Instead you should focus on “The Seven Factors That Determine the Future Value of Your Portfolio.”

Those are…

- How much you invest

- How long you let it compound

- Your asset allocation

- Your security selection

- Your sell discipline

- Your investment costs

- Your taxes on interest, dividends and capital gains.

Which of these factors are within your control? All of them.

So let’s return to the original question: What should you be doing as an investor?

You should invest as much as you reasonably can, as soon as you can and leave it alone to compound as long as you can.

You should have an asset allocation that reflects your age, experience, risk tolerance and time horizon.

If you are young and aggressive, for example, your portfolio should lean heavily on the best-performing asset class of all time: common stocks.

And you should diversify among large and small cap stocks, foreign and domestic equities, and growth and value stocks.

If you are older and more conservative, you should still own stocks to generate returns that comfortably exceed inflation. But you should also own bonds – including high-grade, high-yield and inflation-protected – to provide ballast and reduce volatility.

You should implement your asset allocation with a selection of securities – individual stocks, ETFs and no-load mutual funds – that are low-cost and tax-efficient.

You should use a sell discipline – annual rebalancing and/or trailing stops – to protect your profits and limit your risk.

And you should tax-manage your portfolio to keep as much of your gains as possible out of the prying hands of the IRS.

I often refer to this as your “Asset Location Strategy.”

Put your tax-inefficient securities – like taxable bond funds, real estate investment trusts and high-dividend-paying stocks – in your IRA or other qualified retirement plan, where they will compound tax-deferred.

And hold your tax-efficient assets – like individual stocks, index funds and municipal bonds – in your nonqualified accounts, where they will compound with little or no annual tax consequences.

I spent 16 years working as an investment advisor to high net worth individuals. I have spent the last 20 as an investment strategist and financial writer.

And I can promise that if you follow these seven basic steps, you will do better than 95% of investors – and almost certainly reach your investment goals.

You’ll also enjoy another major benefit: less stress and anxiety.

Why? Because you are focused on what is both important and within your decision-making capabilities.

As the philosopher and poet Kahlil Gibran famously said, “Our anxiety does not come from thinking about the future, but from wanting to control it.”

About Alexander Green

Alexander Green is the Chief Investment Strategist of The Oxford Club, the world’s largest financial fellowship. For 16 years, Alex worked as an investment advisor, research analyst and portfolio manager on Wall Street. After developing his extensive knowledge and achieving financial independence, he retired at the age of 43.

Since then, he has been living “the second half of his life.” He runs The Oxford Communiqué, one of the most highly regarded publications in the industry. He also operates three fast-paced trading services: The Momentum Alert, The Insider Alert and Oxford Microcap Trader. In addition, he writes for Liberty Through Wealth, a free daily e-letter focused on financial freedom.

Alex is also the author of four New York Times bestselling books: The Gone Fishin’ Portfolio: Get Wise, Get Wealthy… and Get On With Your Life; The Secret of Shelter Island: Money and What Matters; Beyond Wealth: The Road Map to a Rich Life; and An Embarrassment of Riches: Tapping Into the World’s Greatest Legacy of Wealth.