2022 Investment Outlook

Our 2022 investment outlook promises to be just as interesting as 2021. That’s quite a statement, considering that we began 2021 at the peak of a global pandemic, with businesses, schools and workplaces shuttered and most people sheltering at home.

Governments continued to provide unprecedented monetary and fiscal stimulus last year, which lit a spark under economies and markets, especially in the U.S. When all the numbers are in, economists forecast that U.S. GDP for 2021 will come in at 5.6%, the best figure since 1984.

And that produced near-record corporate earnings, which, coupled with massive liquidity (extra money flowing around the economy from all those stimulus checks and low interest rates), sent the S&P 500 Index up 27%.

It also produced a whopping 70 all-time highs in the S&P 500 last year. That’s the most new highs in a single year since 1954.

And while energy and real estate were the best-performing sectors in 2021, every S&P 500 sector rose last year by double digits due to the stimulus and earnings performance. That’s the first time in history that’s happened.

Hang On for a Choppier 2022

So, considering the year 2021 was, how can 2022 possibly produce anything even remotely as dramatic?

Well, there are many open questions about markets and the 2022 investment outlook. How these play out will have major consequences for your portfolio. Consider:

- Stimulus is coming to an end. The Federal Reserve has clearly signaled it will take its foot off the gas by reducing its bond purchases and raising short-term rates several times this year. Federal government stimulus, in the form of checks and major spending bills, looks to be a thing of the past. Notably, the passage of Build Back Better, President Biden’s massive infrastructure bill, appears unlikely.

- For stocks to continue rising, we’ll need a successful “hand off” this year from the Fed and the government to consumers and businesses, both of which will need to keep spending money to keep the economy and markets moving upward.

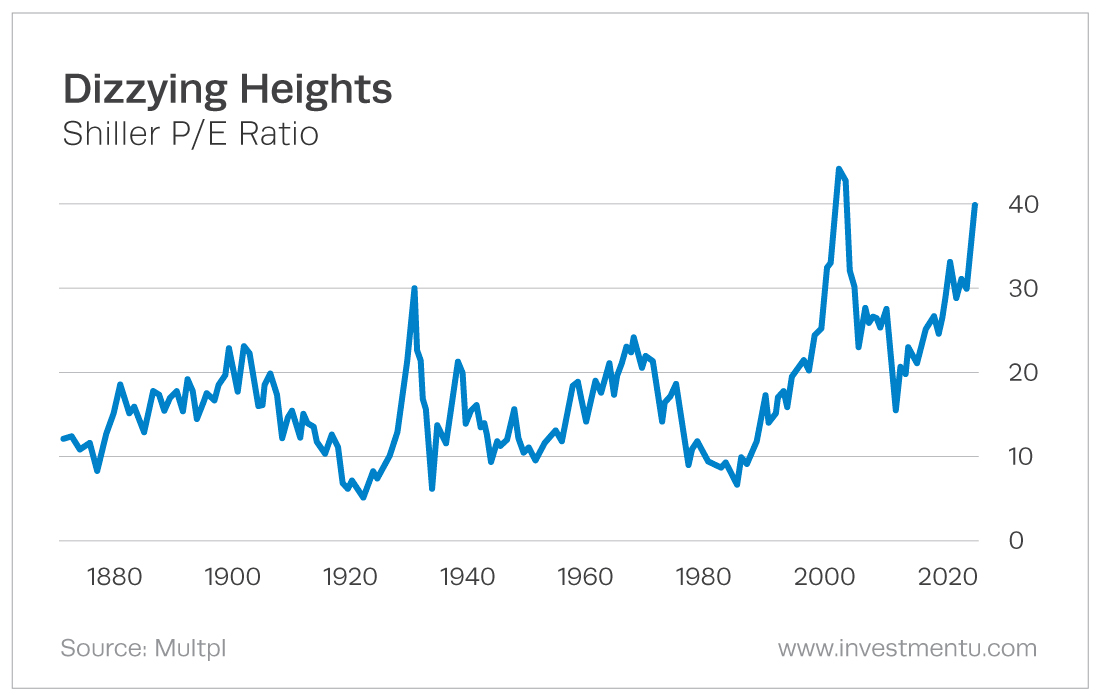

- Valuations of stocks are already stretched. The Shiller cyclically adjusted price-to-earnings (CAPE) ratio stands at 40.02, the second highest it’s been in well over a century (the dot-com bubble was the highest). Take a look at the chart below to see for yourself.

2022 Investment Outlook – What should we expect this year?

Wondering how this year will play out? Our IU Einsteins are already on the case.

In his monthly newsletter, The Oxford Communiqué, Chief Investment Expert Alexander Green says value stocks should trounce growth stocks in 2021, in a reversal of what we’ve seen during the pandemic. (And he recommends a stock that gives the best of both worlds, value and growth.)

And if you’re interested in finding out more about how Alex sees 2022 shaping up, you’ll want to check out this video presentation.

In it, Alex discusses a single cheap stock that could be the cornerstone of your retirement portfolio. And don’t forget, Alex is the one who invested in Apple (Nasdaq: AAPL), Netflix (Nasdaq: NFLX) and Amazon (Nasdaq: AMZN) back when they were companies no one was paying attention to. Just click here to learn more.

Meanwhile, in Oxford Growth Investor, Trends Expert Matthew Carr and Energy Expert David Fessler make their top 10 forecasts for 2022, some of which you probably wouldn’t suspect. Following their advice will very likely help you hedge your portfolio against the market volatility we expect this year. And next week we’ll get Income Expert Marc Lichtenfeld’s 2022 investment outlook. Interestingly, 2022 is expected to be decisive precisely because it will be divisive.

I don’t expect double-digit gains from every sector this year. In fact, some sectors and stocks will suffer due to their sensitivity to rising interest rates, inflation and a potential rotation into different classes of stocks, while others will benefit from these same factors. As usual, our IU Einsteins will be right on top of these trends. We hope you keep reading!