3 Unique Ways to Play This Historic Melt-Up

Earlier this week, I asked this question in The War Room…

How long can this melt-up last?

The answer…

A lot longer than anyone expects.

This prompted me to introduce a new strategy – a strategy I’d like to share with you here, right now in today’s Trade of the Day.

It goes like this…

Let’s assume for a moment that we are indeed close to a “blow-off top” in the markets.

If that’s the case – then why don’t we really lean into it?

In other words, let’s play some stocks that can really amplify a final blow-off rally.

What could that group look like?

Well, look no further than the group of high short interest stocks.

“Short interest” is the number of shares that have been sold short – but have not yet been covered (or closed out).

So it’s logical to conclude that stocks with a high short interest are ones that the majority of investors are bearish on (meaning they think these stocks will go down).

But here’s the interesting part…

When investors get overly pessimistic, that can often lead to the exact opposite effect.

You see, abnormally large short interest could actually lead to a very sharp price increase.

It may sound counterintuitive – but it’s an event known as a “short squeeze.”

A short squeeze is a situation where a heavily shorted stock moves higher, which then forces the short sellers to close out their short positions – thus adding even more to the upward trajectory of that stock.

And right now, based on where the market is trading, I think that we could see many of these short squeeze situations taking place.

Here’s how you can capitalize…

Earlier this week, I ran a scan for high short interest stocks – and here are three that came to my attention:

- Peloton: 47 million shares short

- Match Group: 31 million shares short

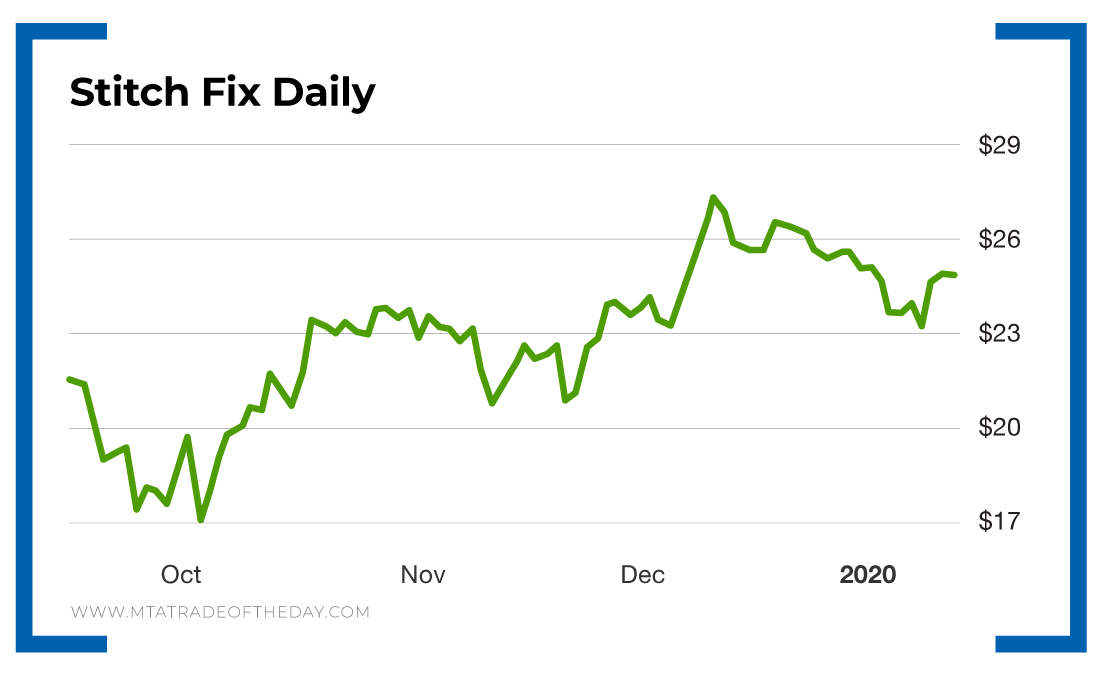

- Stitch Fix: 23 million shares short.

Action Plan: I’m sure longtime War Room members would recognize all three names – as we’ve successfully played them all before.

Going forward, if the markets want to continue zooming higher, then it now makes sense to track these high short interest names – because amplifying the final blow-off move could be a lucrative trading tactic in the weeks ahead.

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.