Time to Own the “Tesla of Space”

Do you want an exciting new play?

If so, let’s take a look at a company that Investor’s Business Daily (IBD) calls the “Tesla of space.”

And just to add in some wordplay, IBD says it’s “skyrocketing.” (Pretty clever, huh?)

IBD is talking about Virgin Galactic (NYSE: SPCE), the company that aims to commercialize space travel by developing spacecraft for both private individuals and researchers.

Virgin Galactic operates as a holding company – engaging in “the business of owning and operating privately built spaceships.”

In other words, the company designs manned, passenger-carrying spaceships that can fly you to space, safely – without the need for expertise or exhaustive training.

Now, let me perfectly clear…

Does Virgin Galactic have any noteworthy earnings?

No.

Does it have any revenues?

Hardly.

Its current price-to-earnings ratio is an eye-popping 161.58.

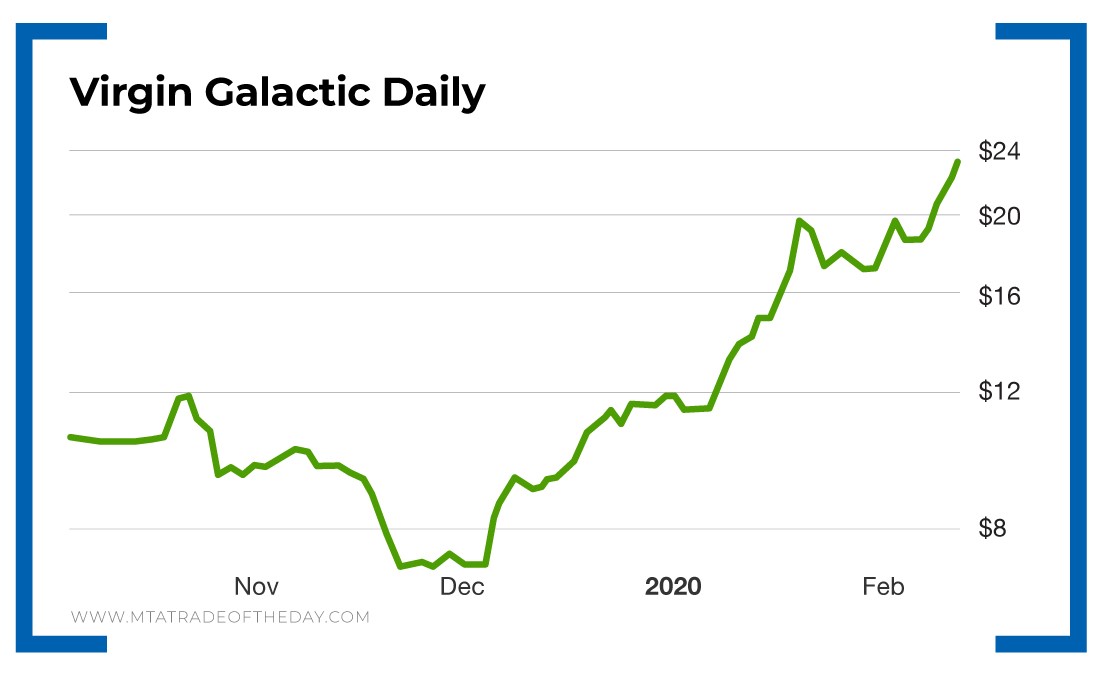

However, since its latest earnings release on November 15, Virgin Galactic stock has more than doubled.

And over the last 10 days – call purchases are outpacing put purchases by a factor of 6-to-1.

Just look at the stock chart…

As you may have guessed, its founder is Sir Richard Charles Nicholas Branson, and clearly Wall Street doesn’t seem to care much about valuation these days.

Instead, Wall Street wants growth, uniqueness and vision.

And guess what? Virgin Galactic has all of these qualities.

On February 6, Barron’s reported, “2019 was a record year for ‘blank check’ companies.” Blank check companies are special purpose acquisition companies (SPACs) that have the sole purpose of raising money from public and private investors in order to identify an acquisition target and buy it – typically within two years.

Last year, 1 in 4 new initial public offerings (IPOs) were SPACs – collectively raising $13.6 billion. No wonder Barron’s said this structure is “booming on Wall Street.”

Action Plan: In The War Room this morning, members made their first call play on Virgin Galactic. If you’d like to start trading Virgin Galactic with us, then you’re invited to join me in The War Room!

And if not, do yourself a favor and set aside some purely speculative money – and establish a new stock position in Virgin Galactic right now. If you’re up for speculating, then the company that IBD calls the “Tesla of space” should be the newest addition to your portfolio.

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.