Buy This Exact Stock – on This Exact Date

Today I’d like to share with you one of my first companies to buy when this pandemic clears up… Anheuser-Busch (NYSE: BUD).

Here’s why…

On a global scale, Anheuser-Busch has an estimated global market share of 28%. That’s massive.

As I’m sure you know, liquor stores remain open right now – as they’re deemed “essential” – during this stay-at-home mandate.

So it’s not a surprise to learn that in the month of March, overall alcohol sales from liquor stores were up 55% from 2019 levels.

But at the same time, since bars and restaurants remain closed, alcohol companies are still under a great deal of pressure, despite being recession-resistant sin stocks.

In particular, Anheuser-Busch gets 25% of its total revenues from bars and restaurants – and that entire segment of the company’s business will be virtually zero from mid-March through June.

Over in China, sales from duty-free stores (plus other shops in travel locations) dropped and will continue to drop up to 80% through June.

So you have strong March sales from liquor stores combined with zero sales coming in from the bar, restaurant and travel location segments.

As a result, Anheuser-Busch recently withdrew its earnings outlook for 2020 – and Pernod Ricard forecast a 20% drop in profit.

As of today, the company carries a forward price-to-earnings ratio of 12.97.

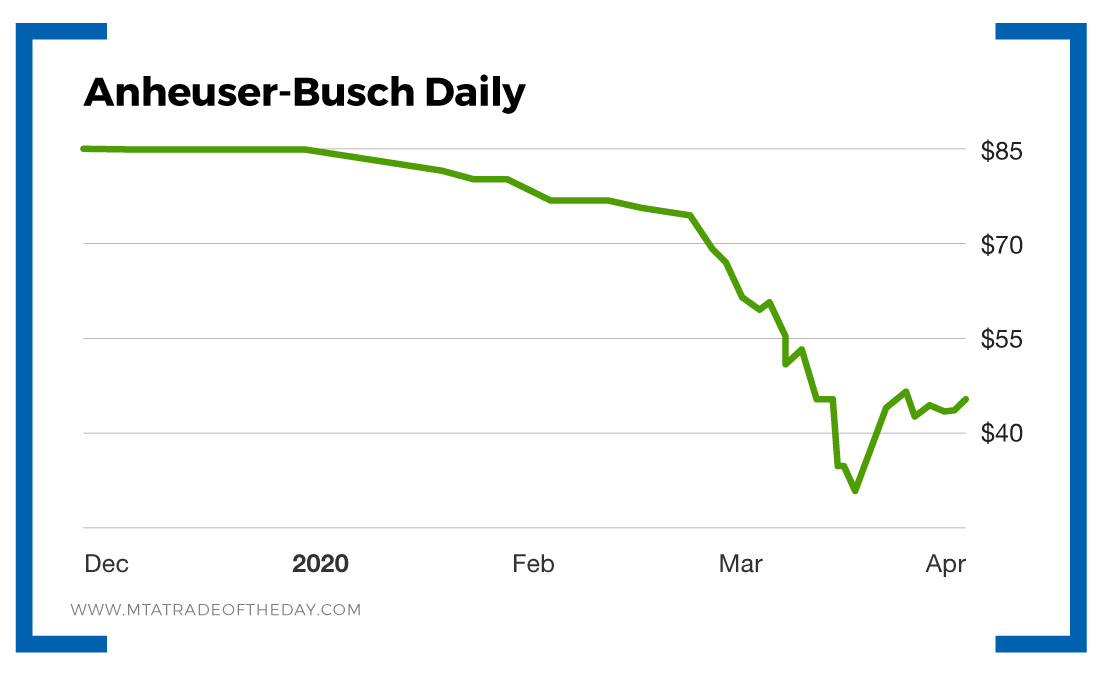

Anheuser-Busch’s share price is just under $45, which is 57% below its 52-week high.

So, in my view, when this entire world mess gets cleaned up, Anheuser-Busch will be a screaming buy. I’m targeting sometime in early May to start the accumulation process.

Action Plan: Why not buy Anheuser-Busch right now?

Well, it’s a timing issue. You see, historically speaking, 80% of bear market moves have retested the lows before truly bottoming and bouncing.

So I think the exact time to start accumulating shares of Anheuser-Busch won’t come until early May – once we retest the lows here in April. It’s just a safer move. Let’s say Monday, May 4. That’s when it makes sense to start adding shares.

To get in on the action, join me in The War Room today!

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.