Our Next Lockdown Winner – Now Revealed

As I’m sure you know, we’ve given you a long list of pandemic winners here in Trade of the Day…

War Room members started by getting into Clorox before anyone else…

They were some of the first to move into Teladoc Healthand Zoom…

Followed by HormelFoods, Flir Systems, AMC Entertainment, Bloomin’ Brands, Bed Bath & Beyond, Pfizer, Ulta Beauty and Tilray.

The point is…

Throughout this lockdown pandemic, Karim and I have successfully navigated members through this market volatility with extreme precision – and tremendous profitability.

And today, with my newest pick, I have every intention of keeping that trend going…

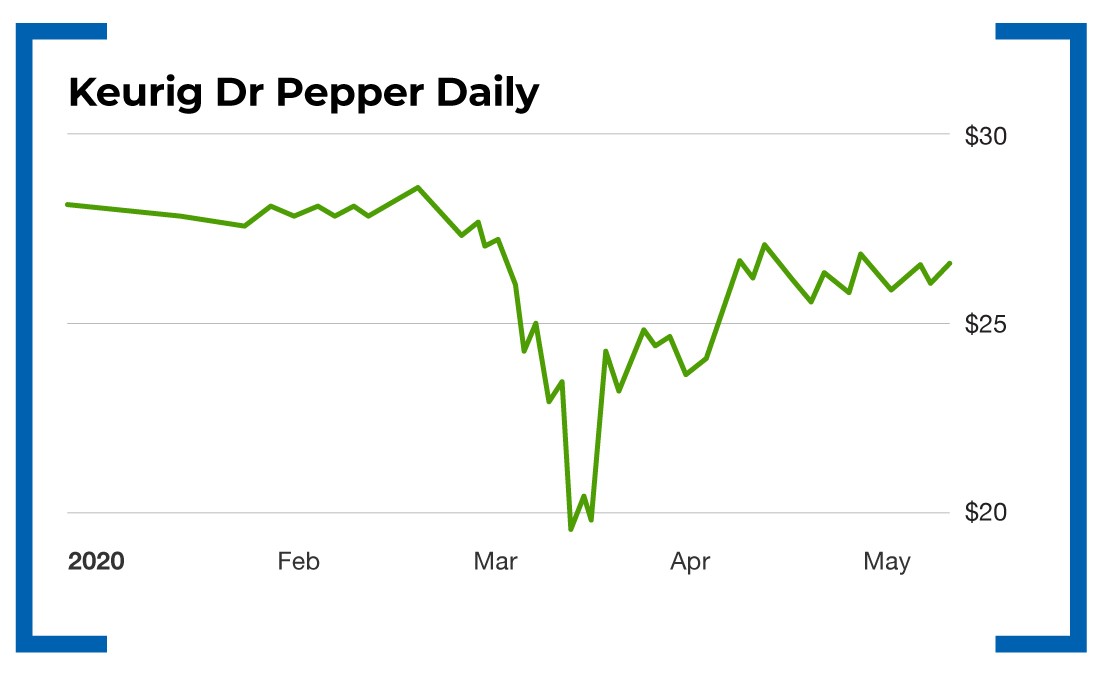

You see, one new stay-at-home position that I really like right now is Keurig Dr Pepper (NYSE: KDP).

I’m confident that working from home will now represent a new normal in the U.S.

And if this is the new reality, then it’s easy to understand why one of the first things every new at-home worker will do is upgrade their coffee maker.

With an 80% share of the popular K-Cup, single-serve coffee market, Keurig Dr Pepper stands to really capitalize.

In fact, it’s one of the rare companies actually growing sales and margins right now.

Back on April 29, Keurig Dr Pepper beat revenue expectations by 2.5%, reporting sales of $2.6 billion.

Not only that, but adjusted net earnings of $0.29 per share beat the consensus estimate of $0.27 – outperforming the prior year’s adjusted earnings of $0.25 per share.

If it’s growing year over year – in this environment – then that’s pretty damn strong.

Even when coffee shops reopen, the value argument holds up. Instead of spending $4.50 for a coffeehouse latte, making one for yourself at home for pocket change continues to favor Keurig Dr Pepper.

And coffee is just one piece of its business empire…

It has Snapple, Mott’s, Hawaiian Punch, Yoo-hoo, Vita Coco, Evian, Canada Dry and 7UP… just to name a few!

Right now, the most bullish analyst values Keurig Dr Pepper at $33 per share, while the most bearish analyst values it a $25. So the risk versus reward at current levels works in your favor.

Action Plan: For our next work-at-home winner, I like the idea of owning shares of Keurig Dr. Pepper at current levels. Oh, throw in a forward annual dividend yield of 2.28%, and that idea only gets stronger.

Get a position now!

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.