A Secret Way to Own Amazon

As I’m sure you know, Amazon trades for more than $3,100 per share.

If you want to own 100 shares, you’re looking at dropping $310,000.

What’s a better way to own Amazon without taking out a second mortgage on your house?

In my view, one of the very best collections of stocks comes from an exchange-trade fund (ETF) called the Consumer Discretionary Select Sector SPDR Fund (NYSE: XLY)

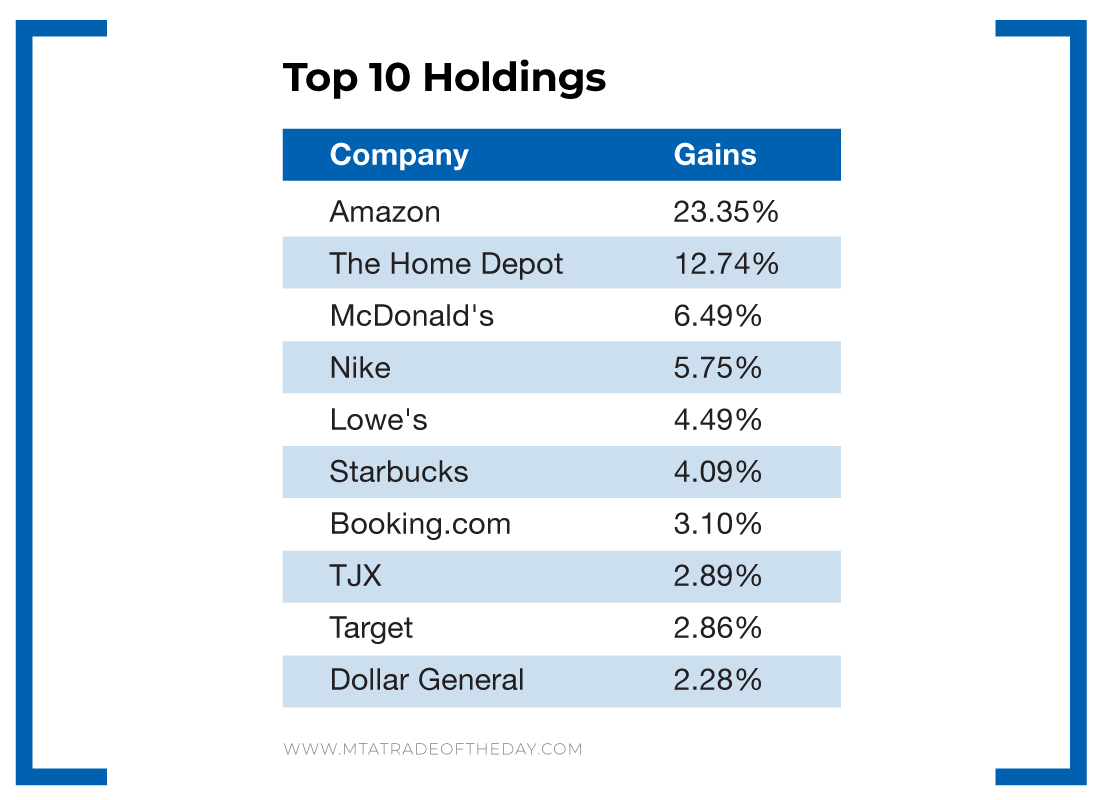

For around $147 per share, here’s what you get:

I love this collection of companies.

I love this collection of companies.

It’s one of the strongest ETF baskets I’ve seen in quite a long time.

First and foremost, you’re getting one-quarter of your total investment in Amazon – all for around 96% less than the cost of one Amazon share.

You also get exposure to the red-hot housing market with Home Depot and Lowe’s.

Then comes McDonald’s and Nike – both of which have been strong performers lately.

Looking specifically at Nike, it just reported $10.6 billion in revenue, which far surpassed Wall Street’s expectation of $9.1 billion and triggered a powerful upside move.

From there, you round it out with Starbucks, Booking.com, Target and Dollar General – all of which have been strong during the pandemic (and will come out of it even stronger).

But don’t take my word for it.

Just consider this performance…

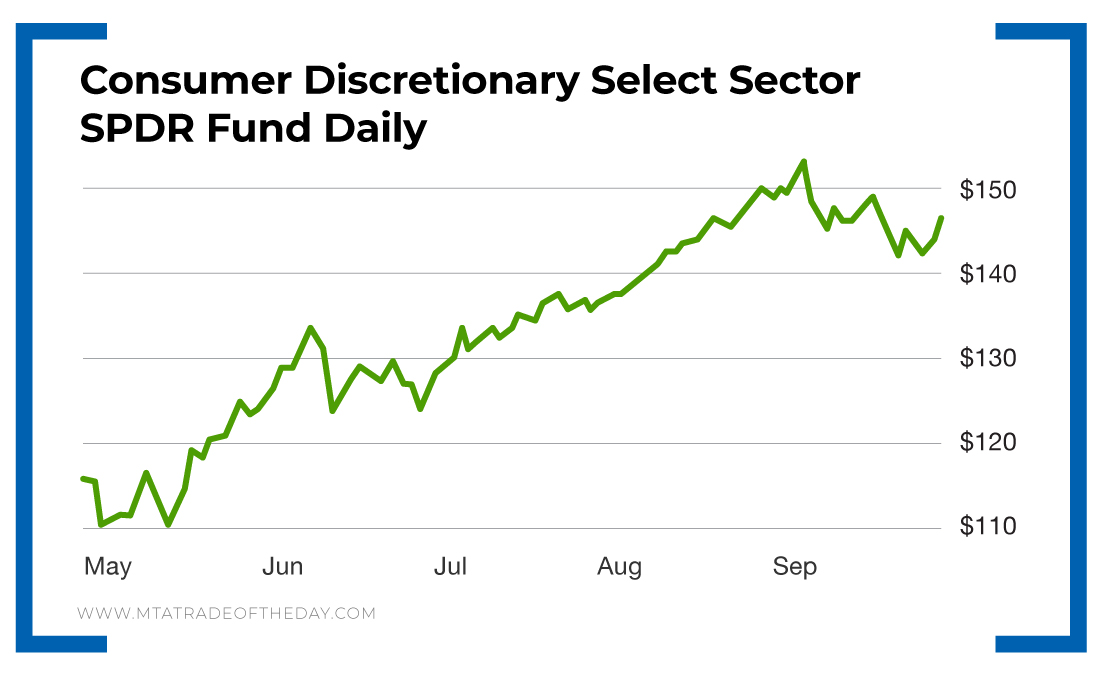

- Year to date, the S&P 500 has returned 3.57%.

- Year to date, the Dow has returned negative 3.11%.

And then you have the Consumer Discretionary Select Sector SPDR Fund, which has a year-to-date return of 15.8%.

That’s a remarkable difference, which goes to show you how important stock selection can be.

P.S. Join us on Instagram! We just launched an Instagram page – and all Trade of the Day members are invited to join. It’s totally free! Just go here and click “Follow.” (If you don’t already have an account, you’ll need to make one.) And that’s it! You’re in! On this page, we plan to post charts, videos, and even some funny and entertaining memes. It’ll be a great experience and will keep us all plugged in together – even on the go. So take a quick second and follow us now!

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.