Webull Review

With so many brokerages out there, it can be hard to decide which one to use. About a year ago, I found out about the investing platform called Webull, and have been using it ever since. Today I’ll break down the platform for you in this comprehensive Webull review.

Getting Started

As with any brokerage platform, you’ll need to setup an account. This will require an email address or a mobile phone number to get started. After that you’ll need to fill out the application. Here’s what information you’ll need to provide:

- Name (First, Middle and Last)

- Age

- Gender

- Marital Status

- Social Security Number

- Country of Citizenship

- Phone Number

- Address

- How Important Liquidity Is To You

- Yearly Income

- Approx. Net Worth

- Approx. Total Value of Cash and Liquid Investments

- Drivers License or State ID

- ID Number

- Photo of ID

Verification should happen fairly quickly after you provide this information. Some have reported completion within an hour. Others may have to wait longer, depending on how long it takes Webull to review and verify the provided information. I was approved within a few hours.

Is Webull Safe?

WeBull is regulated by the Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA). This should help ease any concerns of those looking to signup for an account. As brokerages go, Webull is about as safe as you can get. There are also SIPC (Securities Investor Protection Corporation) protections in place for investors which top out at $500,000 and include a $250,000 cash limit.

Who is Best Suited for Webull?

As with any product or service, individual investors should determine if Webull is a good fit for them. I primarily use the mobile app and find it to be very streamlined, well organized and easy to use. There is also a desktop app which accents the Webull slogan “Enjoy Tech. Enjoy Investing.” The amount of research provided by Webull also lends itself well to new investors. Most importantly, Webull is a platform for active investors who like to manage their own accounts. Therefore, if you’re less hands-on, Webull is probably not for you.

Pros and Cons

| Pros | Cons |

|---|---|

|

|

Webull Review: Pricing

Webull offers 0% commission trades and no minimum deposits. There are also no fees for ACH (Automated clearing house) deposits and withdrawals. There are fees for wire transfers, so you’ll want to keep that in mind. In addition, there are some regulatory fees you’ll want to be aware of. “Webull does not charge commissions for trading stocks, ETFs and options listed on U.S. exchanges. However, fees are still applied by the SEC, FINRA and OCC, the regulatory agencies. Webull does not profit from these fees.”

For more info on pricing, visit https://www.webull.com/pricing

Webull Review: Notable Features

- News – The Webull News feed is great. It provides up-to-date news on each stock as well as comments from Webull users, so you can make informed trading decisions.

- Market Overview – The markets section of the Webull app shows you data on U.S., Global and Crypto by default. There are about a dozen other international markets available as well.

- Support – In addition to chat functionality, Webull offers email and limited phone support.

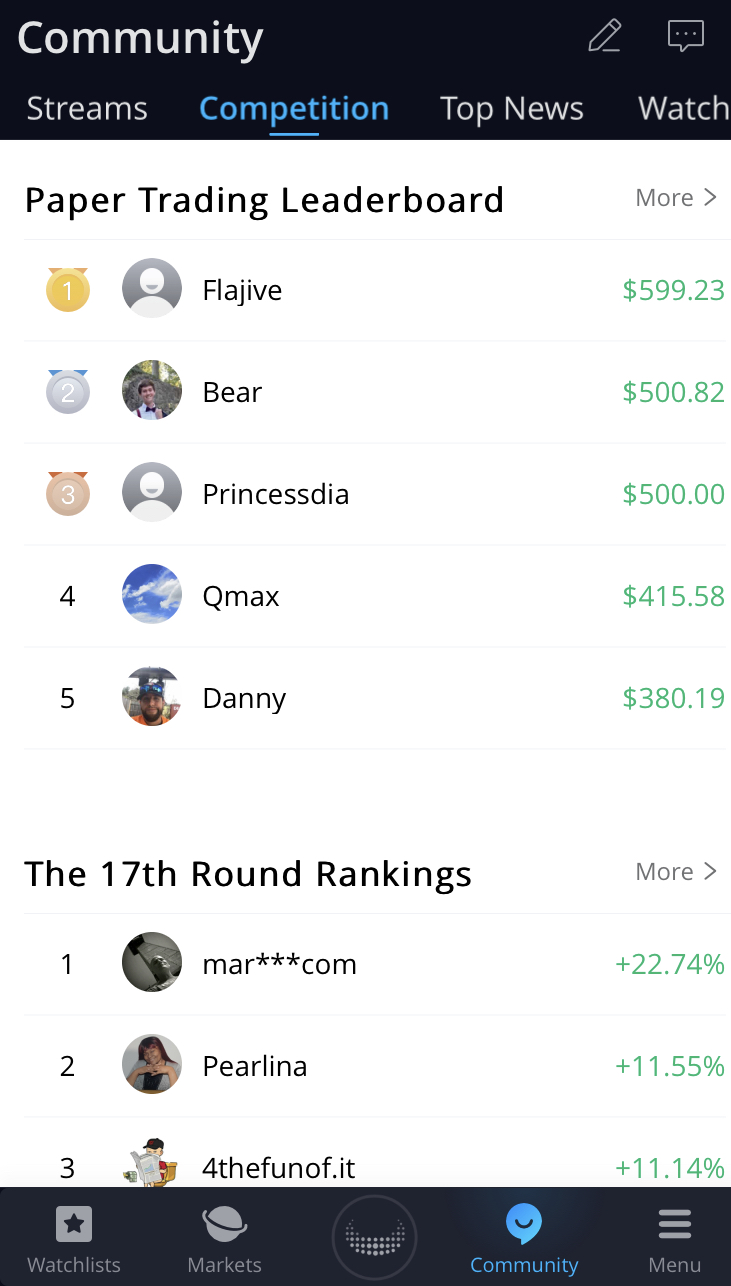

- Paper Trading – Perfect for new investors. Practice trading with “fake money” to get your feet wet before investing for real.

- Portfolio Performance Review – Easy to understand charts and graphs monitor your current and past trades.

- Calendar – The calendar section allows you to see Earnings, Dividends and Splits.

- Stock Screeners – With Webull stock screeners you can create custom criteria which will allow you to filter the stocks you want to see. So if you want to see “High Dividend Yield Bank Stocks” or “High Market Value U.S. Stocks”, you can do that.

- Watchlist – The watchlist feature is also really great. When you “star” certain stocks, you add them to your watchlist. You can monitor their performance, even if you aren’t invested.

- Extended-Hours Trading – This is a feature normally reserved for larger platforms, but Webull has it.

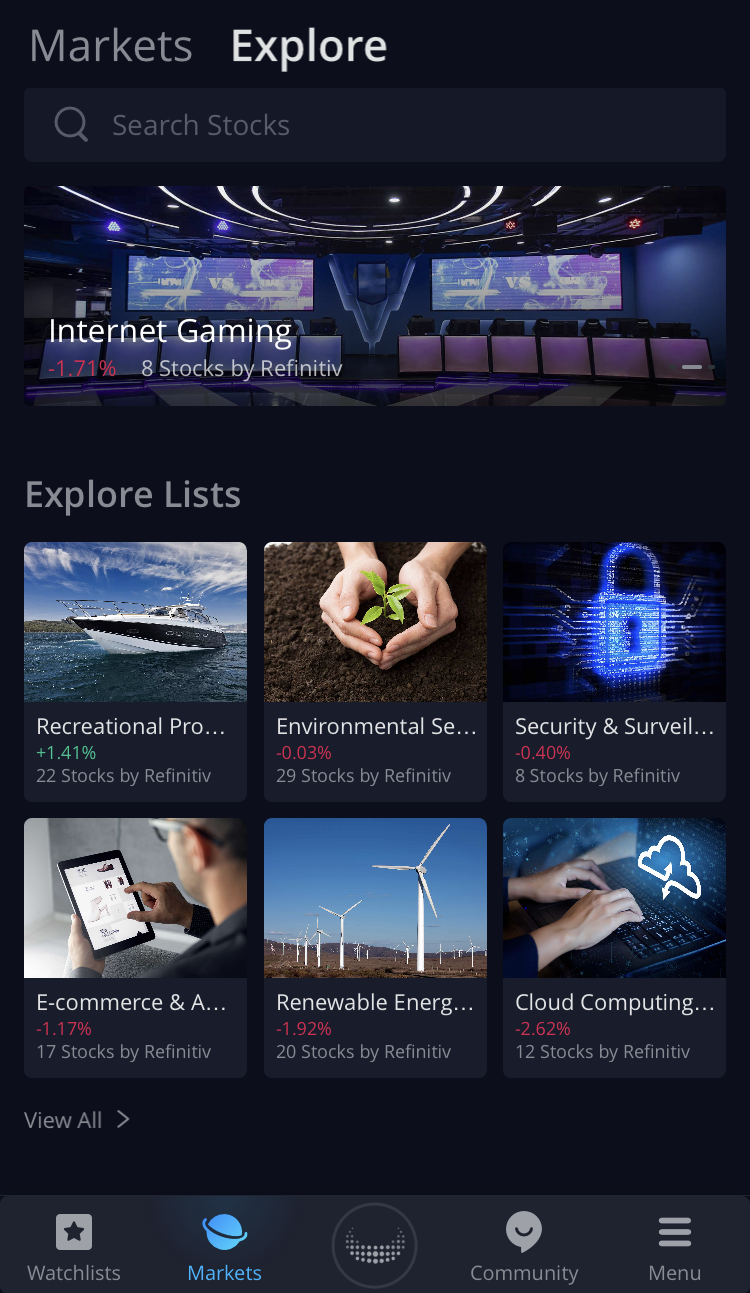

- Explore Section – This is by far one of the biggest assets we found during our Webull review. From the explore section, you can access market lists, screeners, the WeBull IPO center, calendar, 52 week high/low report, high dividend stocks, earnings surprises and hot stocks.

Webull vs Robinhood

Investment U writer Brian Reiser recently finished his review of Robinhood’s trading platform. Here is where these two platforms stand apart.

These are only a few of the most recognizable differences between Webull and Robinhood. As with any platform, one of the most major factors is familiarity. For instance, our Robinhood review noted the lack of research available through the app. If this is something that concerns you, you may want to conduct your own Webull review, as this is an area where their platform excels. However, Robinhood allows dividend reinvestment, which is an extremely important and valuable investment strategy to have at your fingertips.

Webull Review: Final Thoughts

Above all, Webull is a fantastic app. There are a lot of bells and whistles on the tech side of their UX, but when it comes down to it, Webull is a reliable trading platform that investors of all levels will love. A friend of mine put it this way…”If Webull had fractional shares, there would be no reason to use any other trading platform.”

In conclusion, I definitely recommend giving Webull a try. Both the mobile and desktop apps are extremely reliable and as I mentioned earlier, Webull is regulated by the SEC and FINRA, so you should have no concerns on that end.

We hope you enjoyed this Webull review article. Visit Investment U often for more on apps for trading stocks or the latest investment opportunities. To get our latest trades every day – for FREE, sign-up for our Trade of the Day newsletter below.