Aerojet Rocketdyne – a Speculative Small Cap Play Worth Buying

Lately, I’ve been getting suggestions from Trade of the Day subscribers who are asking for more small cap stock picks.

Sure, seeing all of the options winners we’ve had in The War Room is great, but there’s also room for stock plays here in Trade of the Day.

On Tuesday, I explained why Flutter Entertainment will be a small cap winner in the $150 billion sports betting sector.

But today, I’m going to offer you another play to keep on your radar (or perhaps you can even accumulate some shares at current levels).

The company is called Aerojet Rocketdyne (NYSE: AJRD).

It’s a defense company that makes liquid fuel, solid fuel, air-breathing and electric propulsion engines, which are basically all of the things that make rockets and missiles go up.

This company is one of Mario Gabelli’s top picks from the recent roundtable discussion he did with Barron’s. I have to admit, out of every pick made from the entire roundtable, this was the one name that really caught my attention – because of its uniqueness, its market position and the demand for the product it’s offering.

You see, since no existing defenses can stop hypersonic missiles, every country wants them, including the U.S., Russia and China. And the Pentagon’s defense budget just increased from $716 billion up to $738 billion.

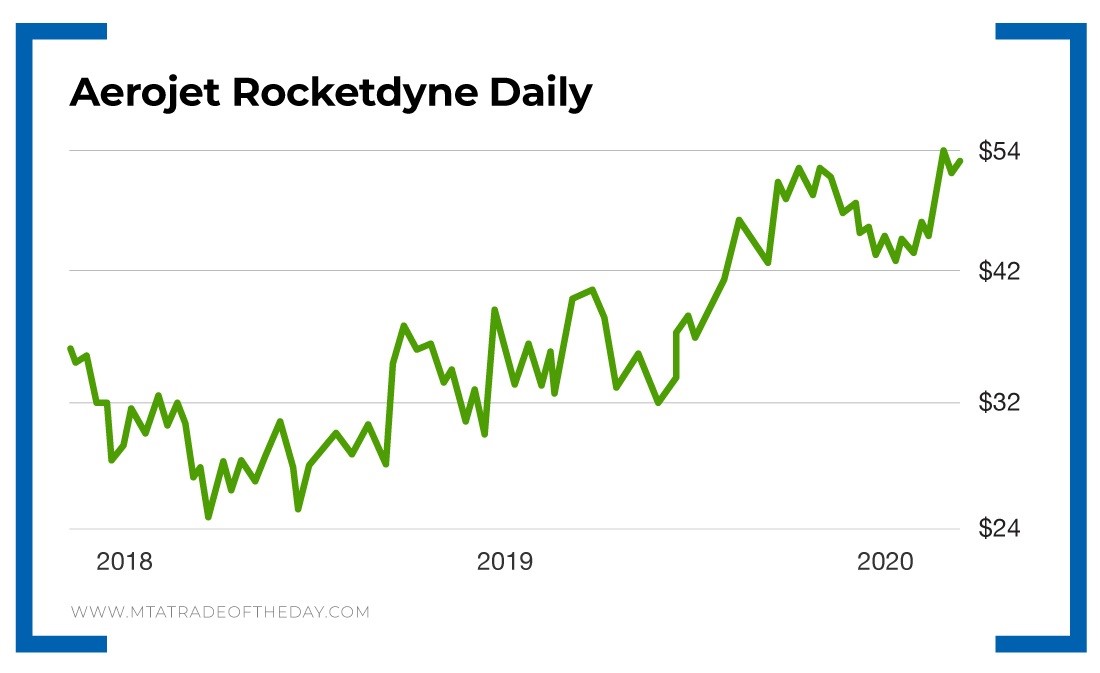

With a market cap of $4.16 billion, Aerojet Rocketdyne stands to meet this demand from every major military country in the world. Over the last 52 weeks, Aerojet Rocketdyne shares have gone up 36%.

On a two-year chart, the stock is still within an established upside trend that’s now about to break to new 52-week highs.

Throw in additional demand from projects like Space Force, Blue Origin and SpaceX, and it certainly looks like Aerojet Rocketdyne has a lock on a market with plenty of deep-pocketed customers.

Action Plan: I don’t think that demand for liquid fuel will be going down anytime soon. If anything, demand will only increase – especially if we get any sort of geopolitical flare-up going forward.

No matter the defense buyer, Aerojet Rocketdyne will be the company to buy from. With a solid stock chart, this is a name worth adding to your portfolio at current levels.

If you want to start trading picks like this, join me in The War Room!

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.