Buy This ETF Immediately If Trump Wins

Last week, Karim wrote about the three investing themes that’ll work during an extended Trump presidency: guns, gold and energy.

And as you know, his three picks were the following:

- Smith & Wesson Brands (Nasdaq: SWBI)

- Kirkland Lake Gold (NYSE: KL)

- Energy Select Sector SPDR Fund (NYSE: XLE).

Those are three strong picks.

But today, I’d like to also chime in – and give you the very best pick to immediately buy if Trump pulls off another crazy upset.

You see, in my opinion, the VERY BEST name to buy in this situation is the SPDR S&P Aerospace & Defense ETF (NYSE: XAR).

Here’s why…

It mirrors the returns of the S&P aerospace and defense sector. Year to date, it’s down 16.56%. So it’s one of the true “bargains” available to you right now.

But unlike most defense plays, which hold the bigger names – such as Raytheon, Lockheed Martin, General Dynamics or Northrop Grumman – the SPDR S&P Aerospace & Defense ETF is appealing to me because it offers you exposure to one of the most promising sectors around: space.

Take a look at its top 10 holdings:

- Cubic (NYSE: CUB)

- Mercury Systems (Nasdaq: MRCY)

- Virgin Galactic (NYSE: SPCE)

- Maxar Technologies (NYSE: MAXR)

- Axon Enterprise (Nasdaq: AAXN)

- Boeing (NYSE: BA)

- BWX Technologies (NYSE: BWXT)

- Aerojet Rocketdyne (NYSE: AJRD)

- Teledyne (NYSE: TDY)

- Curtiss-Wright (NYSE: CW).

Allow me to note some highlights…

- Virgin Galactic is the space tourism name that’ll soon be flying commercial passengers on Mach 3 – at three times faster than the speed of sound.

- Maxar Technologies offers you the world’s top satellite technology.

- Aerojet Rocketdyne offers you the world’s top rocket engine technology.

Oh, and you also get Axon Enterprise, which sells nonlethal Tasers and body cameras – and I believe these will soon be found on every law enforcement officer in America.

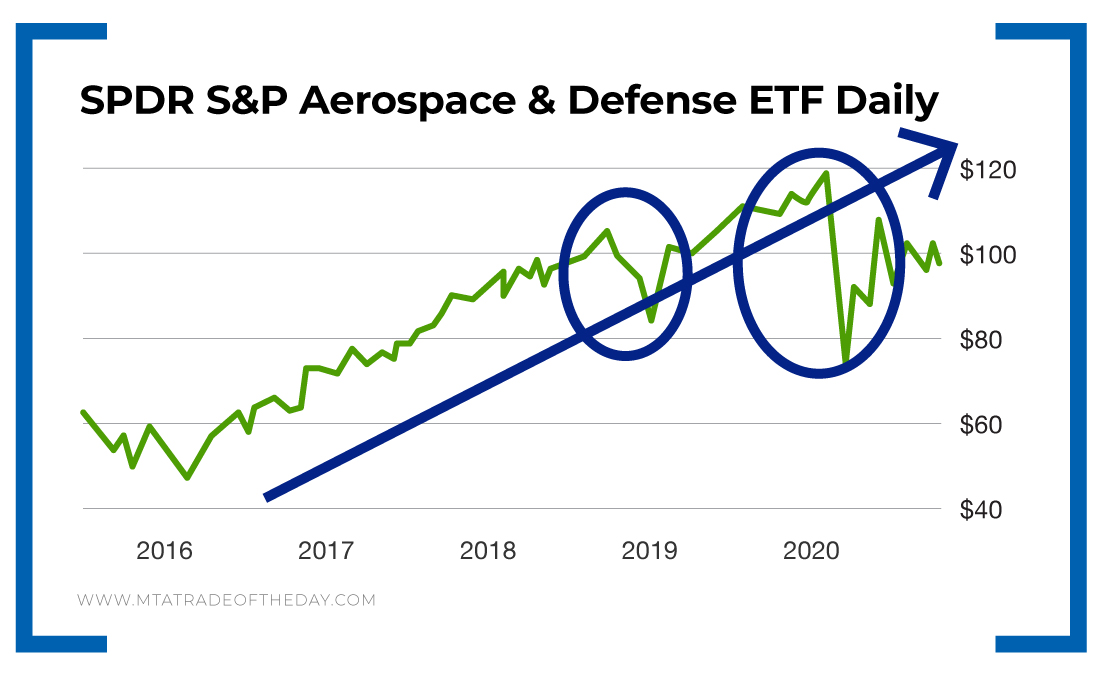

From a chart perspective, consider its past two sell-offs…

In late 2018, this collection of companies dropped over a two-month period – only to fully recover and achieve new highs over the following 10 months.

And most recently, the COVID-19-based sell-off in March and April has already seen the SPDR S&P Aerospace & Defense ETF begin to recover, which is ongoing right now. If the last sell-off and bounce pattern mirrors that of 2018, then it’s reasonable to think it could soon retest and move above the previous high around the $120 level.

Action Plan: If Trump pulls off another crazy upset – or even pulls close in the polls – the SPDR S&P Aerospace & Defense ETF would be the top name on my buy list.

No other stock gives you a better collection of defense and space – both sectors that’ll continue to grow in 2021 and beyond.

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.