What to Read Before You Invest

These were the secrets that started it all…

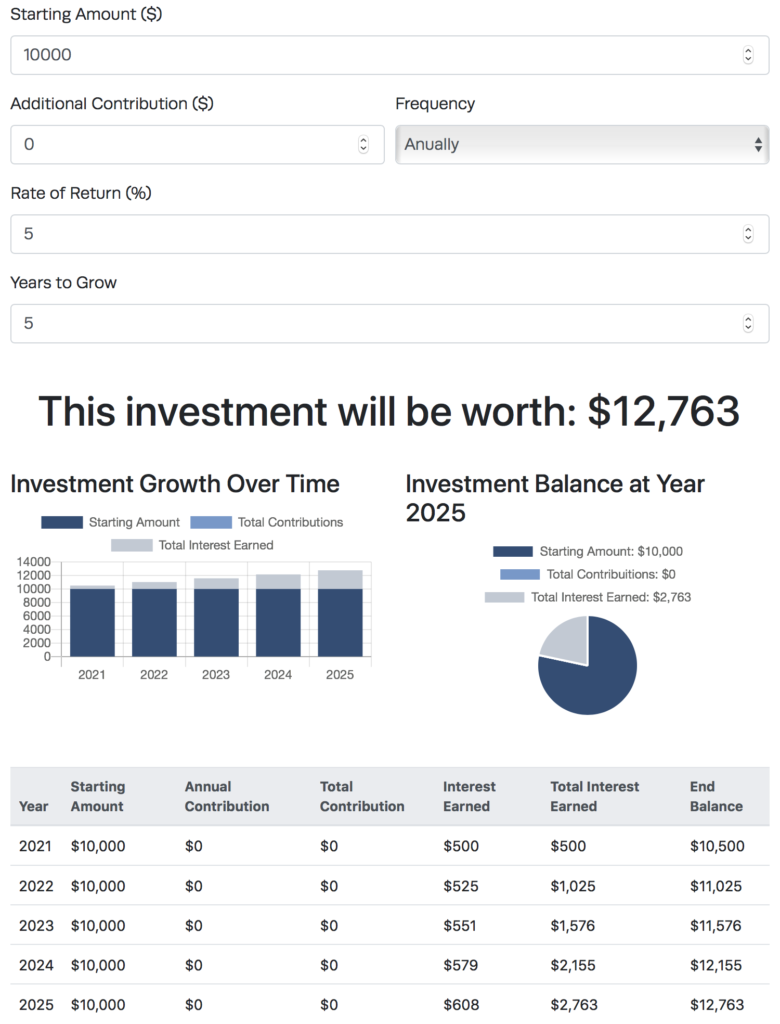

The CD calculator below lets you know how big your portfolio can become after one, two or five years. Using the free calculator, you can look at the growth potential of your investment over time with a certificate of deposit. As you enter the variables, the CD calculator automatically updates. You’ll see how the investment and interest compound each year.

For a better understanding of the CD calculator inputs, here’s a breakdown…

If you’re interested in learning more, check out this complete overview on CDs. It gives a complete overview, including various types of CDs.

You invest $10,000 in a CD at a fixed interest rate of 5%. The term of maturity is 5 years. Here are what the results look like for the CD’s total interest and end balance…

When the loan matures, you will get back the initial investment of $10,000 as well as interest. The return on the CD for the period of five years is $2,763. Your maturity proceeds total to $12,763.

The best way to maximize your gains is to make a larger principal investment and to invest in a CD for a longer period of time. A higher interest rate is generally associated with a longer loan term. A CD could be the perfect option if you have some extra cash you want to keep safe and make a little money on.

CDs are virtually risk-free investments. As a result, you’ll see lower returns than other assets and there are many investing opportunities out there. That’s why Investment U has brought together some of the best minds in the investing world. You can sign up for our free e-letter below to gain some insight from them. Our experts offer a wide range of investing advice and tips.

Become a smarter, more confident and more successful wealth builder with the free Investment U e-letter.

By submitting your email address, you will receive a free subscription to the Investment U e-letter, and offers from us and our affiliates that we think might interest you. You can unsubscribe at any time. Privacy Policy

These were the secrets that started it all…

Investors with a low budget can use risk tolerance to inform their investing strategy.