The Best Options for Yield-Hungry Investors

Are the boys over at Deutsche Bank reading our stuff?

Just as we published our thoughts on the world’s yield crisis, they published some words of their own.

We’re not sure what it means when the chief economist at one of the world’s most powerful banks agrees with us… but we reckon it’s not good.

“Normally the business cycle is the key driver of asset prices… but not at the moment,” said Deutsche Bank’s Torsten Slok. “How can the S&P 500 be so high and credit spreads so tight when rates markets are so worried about the growth outlook and therefore the corporate earnings outlook?”

At first, we thought we should send him our essay from yesterday.

But it appears he may already have read it.

After all, he concluded his note to clients (which provided more questions than answers) with a few bullish words: “In short, because of unlimited central bank safety nets… the S&P 500 may not decline, and credit spreads may not widen next time we enter a recession.”

That’s good news, right?

Hardly.

Woes of a Broken System

What’s happening these days is far from natural.

The stock market is supposed to reflect the future earnings potential of the companies it represents. The S&P 500 is not supposed to act as a telltale to the Fed’s policy or the effectiveness of Washington’s latest idea.

Prices are supposed to rise on good news… and fall on bad news.

Clearly, that’s not the case these days.

It makes investing a much more dangerous game than a record-breaking bull market would make it appear.

Blindly jumping into stocks – especially in search of yield – could get an investor in trouble.

And that’s the rub of it all. Unless we want to sit on a pile of cash and get steamrolled by inflation, we have to invest in stocks.

It’s a must.

But we must do it carefully.

Here’s How…

Traditionally, dividend-paying stocks have been a go-to asset of choice for investors looking for a bit of outsized yield.

Historically, the strategy worked well. If you’re buying for the long term, a bit of extra cash in your pocket each quarter is certainly better than none.

But where bond yields go… so go dividends.

Here’s proof…

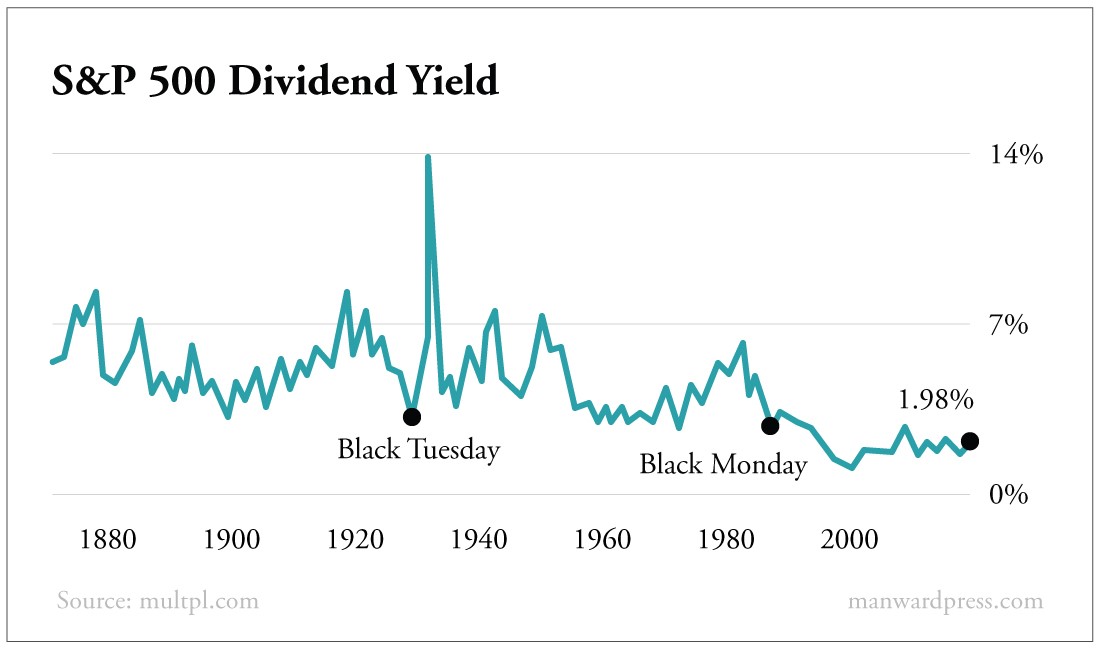

The S&P 500 has boasted an average annual dividend yield of about 4.3%. Today, it’s less than half that figure… just 1.98%.

In fact, if we chart the yield over the last 140 years or so, we see it looks an awful lot like the action from the 10-year Treasury… which currently pays 1.5% and comes with no risk.

Again, blame the big boys.

Dividends aren’t producing the payouts like they used to because everybody is on the hunt for yield. When they find it, they bid up the stock and pull down its yield.

It’s why higher-risk assets like master limited partnerships (MLPs) and real estate investment trusts (REITs) are more popular than ever.

The average MLP (which mainly tracks the energy market) would have paid you about 7% over the last decade.

That’s good.

But if you would have invested at the top of the oil market in 2014, your stake would be down by 30% or more these days.

That’s not good.

With reward, we’ll remind you, comes risk.

With the relatively steady price of real estate these days, it’s no surprise REITs offer a bit less risk… and a lot less yield.

Right now, the average pays about 3.5%.

But last year, we’ll remind you, was the first year in several that REIT values climbed faster than the S&P 500.

Another Option

Given the difficulties of finding reliable income streams that meet their rather high annual needs, it’s no wonder the world’s pension funds are trying out new strategies.

Conservative options strategies are now part of the everyday game for long-term money managers.

That’s not always been the case. But starting in about 2011 (when managers began to realize record-low rates were here to stay), we saw a bevy of government-run funds jumping into the idea.

That year, a simple buy-write strategy (covered calls) outperformed the market by about 8%.

A recent editorial by Frank Tirado, a vice president at the Options Industry Council, shared his point of view on the subject.

“Traditional low-risk methods used by pension funds to generate returns are proving to no longer be practical,” he wrote. “As bond yields keep falling, more pension funds are broadening their investment scope and looking at new strategies to better meet their funding obligations, and that includes the implementation of income-generating and risk-mitigating exchange-listed options strategies.”

He went on to list the billions of dollars states like New Jersey, Wisconsin, Texas and South Carolina are investing in income-generating options strategies.

We hope you’re starting to see the trend.

As the folks at the Fed worked to destroy the notion of interest rates over the last 35 years, we went from bonds to dividend stocks to specialized dividend stocks and now to income-generating options strategies.

The pain along the way is real.

Investors who didn’t keep up with the trend suffered. They were promised 8% and, more likely, got 2%. Their wealth failed to grow, taking hopes and dreams with it.

We must pride ourselves in thinking differently. In times like these, it’s our Know-How that will ensure we’re not left behind.

If you’re still investing as if old-fashioned interest rates will build your wealth… or worse, aren’t investing at all… please pay attention.

It’s time for something different.

Interest rates aren’t coming back.

The hunt for yield is here to stay.

About Andy Snyder

Andy Snyder is the founder of Manward Press. An American author, investor and serial entrepreneur, Andy cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. In the years that have followed, he’s become sought after for his outspoken market commentary.

Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world – from four-star ballrooms to Capitol hearing rooms – and has rubbed shoulders with lawmakers, lobbyists and Washington insiders. He’s had lunch with John McCain… fished with America’s largest landowner… and even appeared on the Christmas card of one of Hollywood’s top producers.

Today, Andy’s dissident thoughts on life, Liberty and investing can be found in his popular e-letter, Manward Financial Digest, as well as in the pages of Manward Letter. He also is at the helms of the award-winning VIP Trading Research Services Alpha Money Flow and Venture Fortunes. Andy resides on 40 bucolic acres in rural Pennsylvania with his wife, children and a steadily growing flock of sheep.