COVID-19 Just Saved This Heavily Shorted Stock

This might sound really, really strange…

But there’s one company out there right now that might’ve just been “saved” by the coronavirus.

No, the company doesn’t make ventilators.

And no, it hasn’t discovered a vaccine.

But Bloomberg calls it “the next best thing in the COVID-19 pandemic.”

What am I taking about?

The company is Blue Apron (NYSE: APRN) – and its amazing story of “rebirth” is the basis behind today’s Trade of the Day.

So let’s wash our hands and dive in…

Quite simply, Blue Apron operates a direct-to-consumer platform that delivers original recipes and fresh and seasonal ingredients straight to your doorstep.

The company essentially sends you a box full of every meal ingredient you need. You unpack it all, get the included recipe card and then make the entire meal in your own kitchen.

A wine delivery and pairing service is also offered to accompany these meals – just to top off the experience.

Now, even though Blue Apron is based in New York, the coronavirus lockdown has given the company a second chance at life.

You see, in a recent Securities and Exchange Commission filing, Blue Apron CEO Linda Findley Kozlowski admitted that the company was considering its options in light of potential dissolution.

And no wonder. The stock went public in 2017 – and has been trading lower ever since. Its 52-week high was above $28, and its 52-week low was around $2.01. Growth had stagnated. Operating margins were down 11.45%.

In short, Blue Apron Holdings was toast.

But then, the coronavirus hit.

And you know what happened next…

People were staying home.

Bars and restaurants started closing.

And in response, everyone wanted their meals delivered.

That’s when Kozlowski noted “a sharp increase in consumer demand.”

From a stock perspective, this sparked a crazy upside move.

You see, a lot of investors thought that Blue Apron was going bankrupt. And therefore they shorted the stock. As it stands today, 48% of the stock’s float is currently sold short.

That’s where things get interesting…

You see, when a heavily shorted stock starts to receive unexpected buying interest, the shorts get spooked and they cover their position. This creates a “short squeeze” situation – which is one of the most powerful upside trigger catalysts you’ll see on Wall Street.

Case in point…

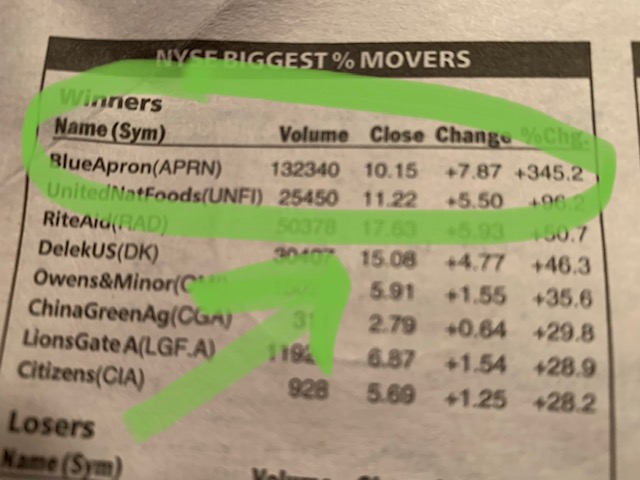

In one week, shares of Blue Apron moved up 345%.

In early March, it was the biggest weekly gainer on the entire New York Stock Exchange!

That’s right! Once troubled and left for dead, Blue Apron shares have jumped more than fourfold from their March 13 low.

And Blue Apron isn’t the only meal delivery service that’s on fire. Over in Europe, Berlin-based HelloFresh stock is up 70% this year. So this appears to be a global trend that’ll only get stronger in the weeks and months ahead.

Action Plan: Once a floundering home-cooking meal delivery service, Blue Apron is now getting a surprise lifeline thanks to the COVID-19 quarantine. The company just announced that it’s “staffing up” to meet a higher demand as cities and states require residents to stay in.

What better way to get your meals than delivered to your doorstep? As amazing as it sounds, there could be more room for this stock to go. After all, there is a major short squeeze in play right now, so this upside push could have legs.

If you’d like to play Blue Apron and other trades LIVE, as they happen in real time, you’re invited to join me in The War Room!

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.