CureVac IPO: Coronavirus Vaccine Firm Going Public?

A CureVac IPO is on investors’ minds after the company filed to go public. CureVac’s current project is a coronavirus vaccine. So investors want to know how they can get in on the action.

There isn’t any CureVac stock yet. But it is on the way. With CureVac’s newest discovery, the biotech firm has great potential for investors. Here’s what we know…

CureVac IPO: The Business

Dr. Ingmar Hoerr founded CureVac in 2000. It’s a leading biotech company based in Tübingen, Germany. The company uses messenger RNA (mRNA) technology. It helps develop cancer therapies and treatments for rare diseases. CureVac started working on its first mRNA-based vaccine in 2011.

One of CureVac’s competitors is U.S.-based Moderna. In 2018, Moderna made history with the largest biotech IPO in history. It raised $604 million. That gave it a valuation of $8 billion.

Dan Menichella, CureVac’s CEO at the time, said, “mRNA technology has the potential to revolutionize the way we protect against and treat disease… We feel this IPO will likely shine more attention on us as [a] scientific leader in the space.”

But mRNA technology is a difficult concept. Let’s take a deeper look at what the CureVac IPO would be funding…

CureVac Uses mRNA for Coronavirus Vaccine

CureVac uses mRNA molecules to instruct human cells to produce therapeutic proteins. These proteins trigger a response from the immune system. The company is looking to use this against cancer and infectious diseases.

However, it appears CureVac may have found a vaccine for something else: the coronavirus.

The company uses a low-dose vaccine technology. It’s shown promise in early-stage rabies trials. In Phase 1, the company induced immune responses in humans using a 1-microgram dose. CureVac plans to use the same technique to create a coronavirus vaccine.

“We are very confident that we will be able to develop a potent vaccine candidate within a few months. We can rely on the data of a Phase 1 rabies study in which we were able to immunize all participants with a very low dose,” said Menichella, according to the press release. “On this basis, we are working intensively to achieve a very low dose for the [COVID-19] vaccine as well. In addition, CureVac has a GMP-certified production facility which enables us to produce up to 10 million vaccine doses in one production run.”

A production run usually lasts several weeks. It’s possible a person might need more than one dose. But a single campaign would still be able to serve millions of people.

Currently, CureVac is selecting vaccine candidates based on quality criteria and biological activity. It will pick the top two to go to human clinical trials. CureVac is partnering with the German Paul Ehrlich Institute for accelerated development of a vaccine. It’s also talking to other European health authorities. The company started clinical trials with healthy adults in June 2020.

After the company announced its potential vaccine, investors were looking for CureVac stock. Now a CureVac IPO will finally hit the market after attracting a lot of global attention.

Trump vs. European Union Coronavirus Vaccine Scandal

On Sunday, March 15, a German newspaper called Welt am Sonntag published a story about the Trump administration. It claimed Trump offered a large sum of money for the vaccine when Menichella visited the White House on March 2. The article also stated that Trump wanted the U.S. to have exclusive rights.

The next day, the European Commission (EC) offered up to $80 million to support CureVac. The money would help increase development and production of a coronavirus vaccine in Europe.

“I am proud that we have leading companies like CureVac in the EU,” EC President Ursula von der Leyen said in a statement. “Their home is here. But their vaccines will benefit everyone, in Europe and beyond.”

But CureVac was quick to respond. The same day the newspaper published its article, CureVac released another press release. It stated that the company rejected acquisition rumors and is focusing on a worldwide vaccine.

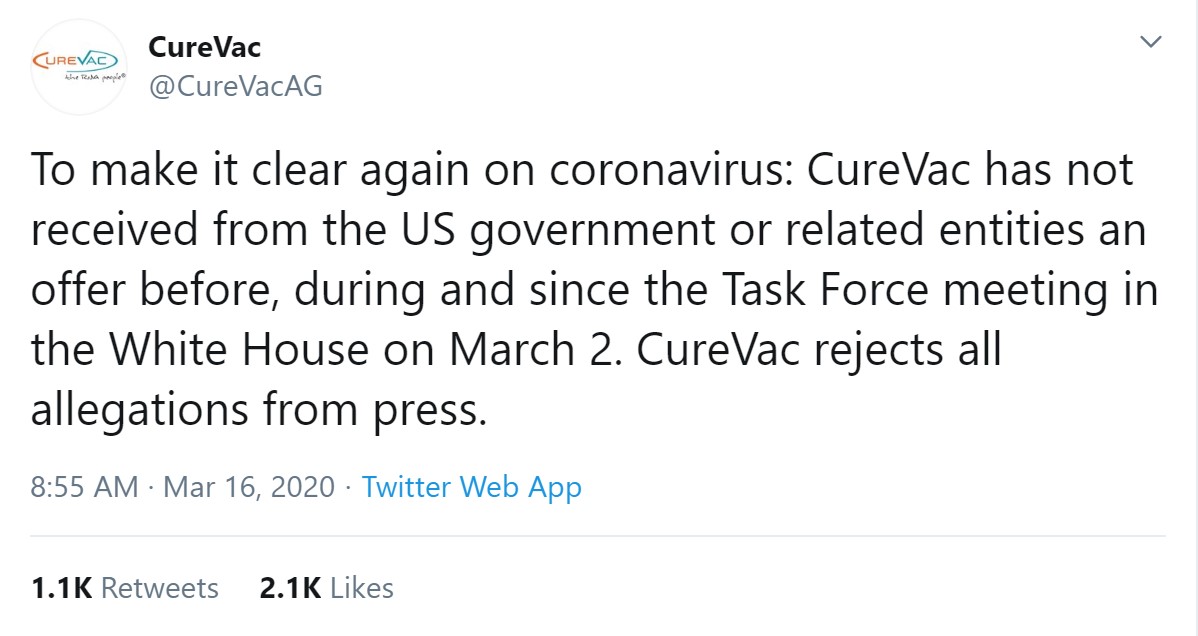

In addition, on March 16, CureVac sent out a tweet:

Also, four days before the newspaper article, Menichella stepped down as CEO with no explanation. Founding CEO Ingmar Hoerr will take back the CEO position in Menichella’s absence. Many speculated about whether this was related to the White House meeting and Trump offer.

However, it turns out Menichella is having health issues. They prevent him from keeping his position, but the company hopes he’ll return later.

Although Hoerr will take over, CCO Franz-Werner Haas is currently acting CEO. Haas firmly put an end to the rumors surrounding the Trump administration and CureVac: “There was and there is no takeover offer from the White House or governmental authorities. [Not with regard] to the technology nor to CureVac at all as a company.”

So while German health officials were quick to confirm the Trump rumors, CureVac was quicker in shutting them down.

But the good news is that the story pushed the EC to grant CureVac more funding. In June, the German government disclosed its plans to invest $338.5 million in CureVac.

And even better news is that investors are getting a CureVac IPO.

CureVac IPO: The Details

The company filed for a CureVac IPO on July 24, 2020. The company also announced a private agreement with Dietmar Hopp, co-founder of software company SAP. He agreed to purchase $116.4 million worth of shares at the company’s IPO.

On August 10, CureVac announced it will sell 15.3 million shares in the offering. The price range is $14 to $16. CureVac hopes to raise $245 million in addition to Hopp’s contribution. The company lists what the proceeds will be used for in its prospectus:

- A complete Phase 2 clinical trial for CureVac’s leading oncology program, CV8102

- A complete Phase 2 clinical trial for CureVac’s lead vaccine program, CV7202

- Funding clinical development of its mRNA vaccine program for COVID-19 with completion of the Phase 2 clinical trial

- Advanced development of other clinical programs

- Investing in further development of the mRNA technology platform

- Funding expansion of CureVac’s manufacturing capabilities

- Working capital and general corporate purposes.

You can find more information on CureVac in its SEC filing.

If you’re looking for investment opportunities, you’ve come to the right place. Sign up for our free e-letter below to receive helpful tips and insights on trends researched by our experts. There’s something for everyone, whether a beginner or experienced investor.

U.S. health officials have said a coronavirus vaccine it would take up to 18 months to develop. But hopefully the CureVac IPO can help speed up the timeline.

About Amber Deter

Amber Deter has researched and written about initial public offerings (IPOs) over the last few years. After starting her college career studying accounting and business, Amber decided to focus on her love of writing. Now she’s able to bring that experience to Investment U readers by providing in-depth research on IPO and investing opportunities.