Where This Franken-Market Is Headed Next

It will get harder from here.

Those are the words of Fed Chief Jay Powell last week as he prepared for what will be one of his biggest meetings yet.

Next week, like a team of docs working on Frankenstein’s monster, the Federal Reserve will gather in Washington to discuss where to cut next. The voting members will close the door, sit around a long oval table and then nervously look at each other as they realize they have quite a sick patient lying in front of them.

They’ve got to piece it together. It must not die.

Big money is on the line.

If they don’t act, things will eventually get better. The market’s maggots and vultures will decompose this mess.

But the near-term pain and convulsions will be immense.

If the docs sharpen their knives and continue to cut, the acute pain may go away… but the chronic disease will linger.

We know what happens next.

[mw-adbox]

Cut Until It Hurts

Give a man a scalpel… and he’ll start slashing.

“We do think it will get harder from here because of those areas of the economy that are so directly affected by the pandemic still,” Powell told the press last week.

“We think that the economy’s going to need low interest rates, which support economic activity, for an extended period of time,” he told NPR. “It will be measured in years.”

Frankenstein’s monster will live on.

But the notion begs a question… especially after the tech-rattling market of late.

Are stocks a buy?

Should we really risk our money by investing in businesses when the surgeon holding the knife says things are going to get worse?

You know our answer.

It’s coming to a bumper sticker near you… Dow 100K.

Listen, our Dow 100,000 theory isn’t rosy. It’s bullish only in the sense that stocks are going up.

They won’t rise because firms are setting sales records or seeing lines out the door. This isn’t a call based on innovation or economic progress.

The Fed hates that stuff. It’ll slam on the brakes.

No, the reason the Dow will rise from 28,000 to 100,000 looks much the same as the reason it rose from 7,000 to 28,000.

Funny Money

You’ll recall that over the last decade, the economy never took off.

We never saw annual growth of more than 3%. And yet stocks returned an average gain of 12% or so during the time.

The old-school boys would have you believe the market was underpriced after the Great Recession and merely climbed back to where it was supposed to be. They’re saying the same thing now.

But that’s like drilling a hole in our skull to get rid of a headache.

To the folks who believe in spirits and demons, it makes fine sense.

To the pragmatic… it’s just plain crazy and doesn’t fit the facts.

If market inefficiency were the driver of the great bull market of the last decade, the snapback would have been much quicker and then would have leveled off to match the growth in GDP.

A lot of folks think that’s where we’re at today. They believe the market has recovered from the panic-induced sell-off and is flatlining right alongside the economy.

But that was not the case over the last decade… and certainly won’t be the case for the next decade.

Not by far. Not with the Fed sharpening its scalpel.

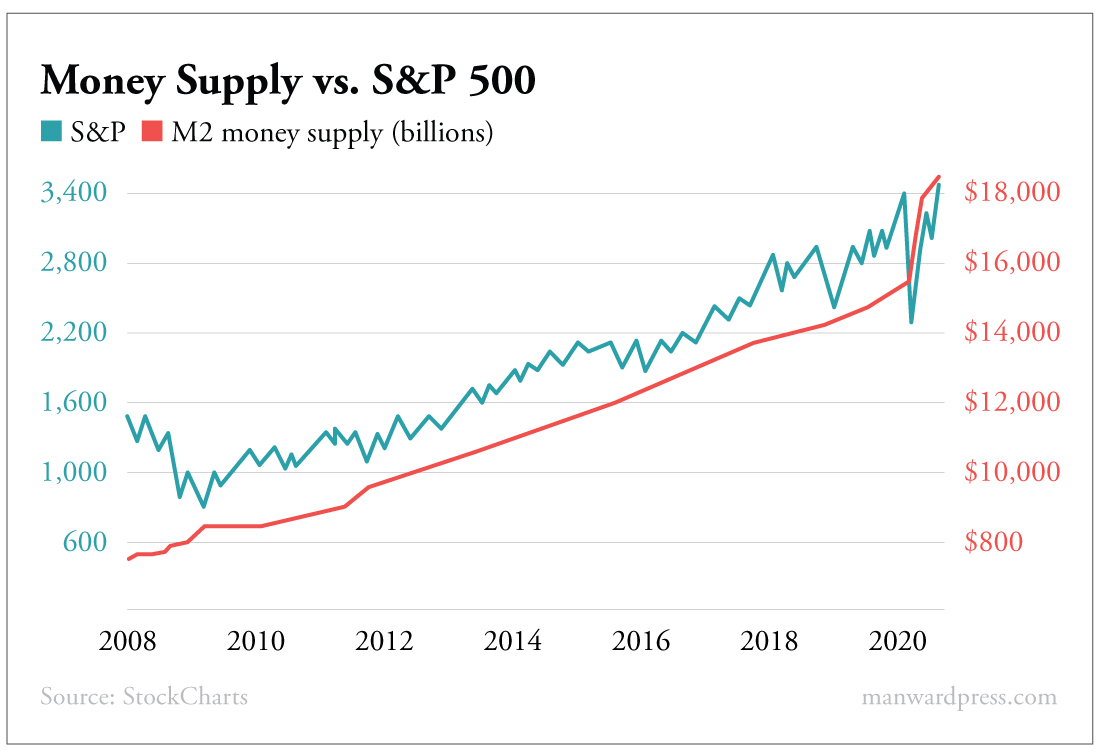

For proof, we need to merely open our eyes and look at this chart.

The image is clear. The higher the world’s supply of American cash… the higher the stock market zooms.

The image is clear. The higher the world’s supply of American cash… the higher the stock market zooms.

That red line represents the supply of liquid dollars – think cash, bank accounts and short-term, cash-like investments. As it zooms higher, so does the teal line… the S&P 500.

There are a few things that can make that line move higher.

More Funny Money

The Fed can cut open the chest of its patient and squeeze its heart directly by printing cash and pumping it into the economy. It did that earlier this year when it printed trillions of dollars and gave it to anybody who asked… and many who didn’t.

But the monetary hacks don’t always have to use such “forceful” and messy methods.

For most of the last decade, the Fed relied on a stiffer chemical concoction. It plugged an IV into the arm of the patient, swung the valve wide open and walked away.

The medicine – ultra-low interest rates – allowed banks to make massive amounts of loans. And every time they did, the Fed created new money.

That’s the beauty of ditching gold and relying on a “fractional” reserve banking system. Banks can lend what they don’t have… and they can do it a lot.

Before the COVID-19 crisis, American firms had piled up a record-shattering $10 trillion in debt… or roughly half the nation’s GDP.

It’s anybody’s guess how much debt is out there after this fiasco of a year, but some estimates now put it at $19 trillion.

It’s bad news.

In fact, the only good news in it all is that it’s not just one or two companies tipping the scale. It’s across the board.

The docs at the Fed can’t just let one or two patients succumb to their self-inflicted wounds. It’s got to take action to save them all.

It has only one choice.

Keep slicing.

The Fed has no choice but to keep the flow of money accelerating. That means – look at chart above – stocks have only one direction to go.

There will be ebbs and flows. The last 12 years were full of them.

But the overall direction is up.

Dow 100K… here we come.

Be well,

Andy

About Andy Snyder

Andy Snyder is the founder of Manward Press. An American author, investor and serial entrepreneur, Andy cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. In the years that have followed, he’s become sought after for his outspoken market commentary.

Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world – from four-star ballrooms to Capitol hearing rooms – and has rubbed shoulders with lawmakers, lobbyists and Washington insiders. He’s had lunch with John McCain… fished with America’s largest landowner… and even appeared on the Christmas card of one of Hollywood’s top producers.

Today, Andy’s dissident thoughts on life, Liberty and investing can be found in his popular e-letter, Manward Financial Digest, as well as in the pages of Manward Letter. He also is at the helms of the award-winning VIP Trading Research Services Alpha Money Flow and Venture Fortunes. Andy resides on 40 bucolic acres in rural Pennsylvania with his wife, children and a steadily growing flock of sheep.