Flutter Entertainment Is a Small Cap Winner in the $150 Billion Sports Betting Sector

Sports gambling… It’s here to stay.

According to the American Gaming Association, $150 billion is bet – illegally – on sports each year.

But starting now, various states across the country are getting set up to legalize sports gambling so they can collect tax revenue on it.

As investors, this presents us with an opportunity…

Which companies will emerge as the winners in this new, legalized sports betting environment?

That’s the focus of today’s Trade of the Day… because I have one name that I’d like you to put on your speculative radar, and I believe it’s best positioned to capitalize on this emerging trend.

This is a company that trades on the U.S. over-the-counter (OTC) bulletin board – and also in the United Kingdom.

It’s called Flutter Entertainment (OTC: PDYPY).

Here’s why I think it’ll emerge as one of the winners in the legalized sports gambling sector…

When it comes to modern-day gambling, the key component of success (or failure) hinges on the ability to have the best mobile betting technology.

Gone are the days when bettors flocked into the sports book of a casino to walk up to a window carrying cash to place their bets.

Now they want to do it all using their mobile, handheld devices.

Mobile betting typically includes proposition (prop) bets and in-game bets, all with up-to-the-second betting lines.

And when it comes to mobile technology, Flutter Entertainment is the best.

You see, the company bought a 61% interest in FanDuel in 2018 – and it has the option to increase its stake to 80% in 2021 and 100% in 2023.

FanDuel is a “gateway” to sports betting – as it uses fantasy football statistics and allows users to (potentially) turn that information into winning bets.

Right now, FanDuel gets 40% to 50% of its wagers on in-game bets, which occur live, as a sporting event is happening. For instance, at halftime during the 49ers and Packers game (where the 49ers were leading 27-0), anyone who thought that the Packers would make a comeback and win the game could’ve bet on the team at 30-to-1 odds. (Spoiler alert: The Packers lost.)

FanDuel CEO Matt King says…

We talk about infinite betting. If somebody wants to make a bet, we want to offer it. For an average NFL game, the typical Las Vegas sports book offers 50 different bets. We offer 250.

This sort of in-game betting sparks urgency, immediacy and thus more betting.

That’s why Flutter Entertainment is in such a strong position.

Just look at these Super Bowl prop bets – the last one is crazy…

- Will the winning team dump Gatorade onto the head coach to celebrate victory?

- Will Chiefs quarterback Patrick Mahomes have more (or less) than 305 passing yards?

- Will 49ers tight end George Kittle have more (or less) than 70 1/2 receiving yards?

- Will 49ers running back Raheem Mostert total more (or less) than 79 1/2 combined rushing and receiving yards?

- Will Chiefs coach Andy Reid eat a cheeseburger before the end of the Super Bowl broadcast? (A winning “yes” bet pays $1,200.)

The point is this…

The betting options are endless – and Flutter Entertainment stands to maximize every single one of them.

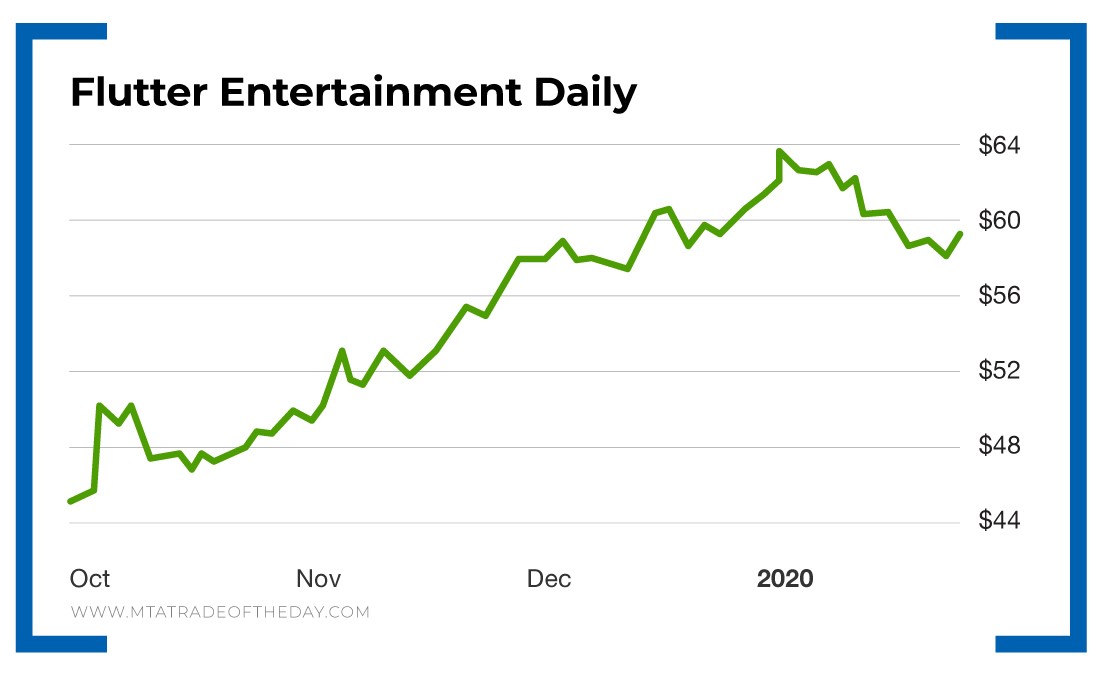

Action Plan: If you believe that sports gambling is in the early growth stage, then adding some shares of Flutter Entertainment to your portfolio sounds like a winning bet.

To get in on all the trading action, join me in The War Room!

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.