Goldco Review: A Reliable Precious Metals Investment Company

Are you looking for a trustworthy company to invest in precious metals?

Goldco is a legitimate precious metals investment company that has been in business since 2006. With an exceptional track record of success, Goldco is a solid choice for anyone looking to invest in gold, silver, platinum, or palladium.

One of the things that sets Goldco apart from other precious metals companies is their commitment to education. They understand that investing in precious metals can be complex and confusing, so they provide a wealth of information to help their clients make informed decisions. They offer free guides and reports to help you stay up to date on the latest trends and developments in the industry.

Goldco also has exceptional customer service. They have a team of knowledgeable and friendly precious metals specialists who are available to answer any questions you may have and guide you through the process.

Annual Fees and Pricing

Goldco offers transparent pricing with no hidden fees. They have low markups and competitive buyback prices, making them a cost-effective option for precious metals investors. However, Goldco annual fees may vary depending on the products and services you choose. One thing that sets them appart is their buyback guarantee. Other vendors will simply brush you off or attempt to sell you more instead of helping.

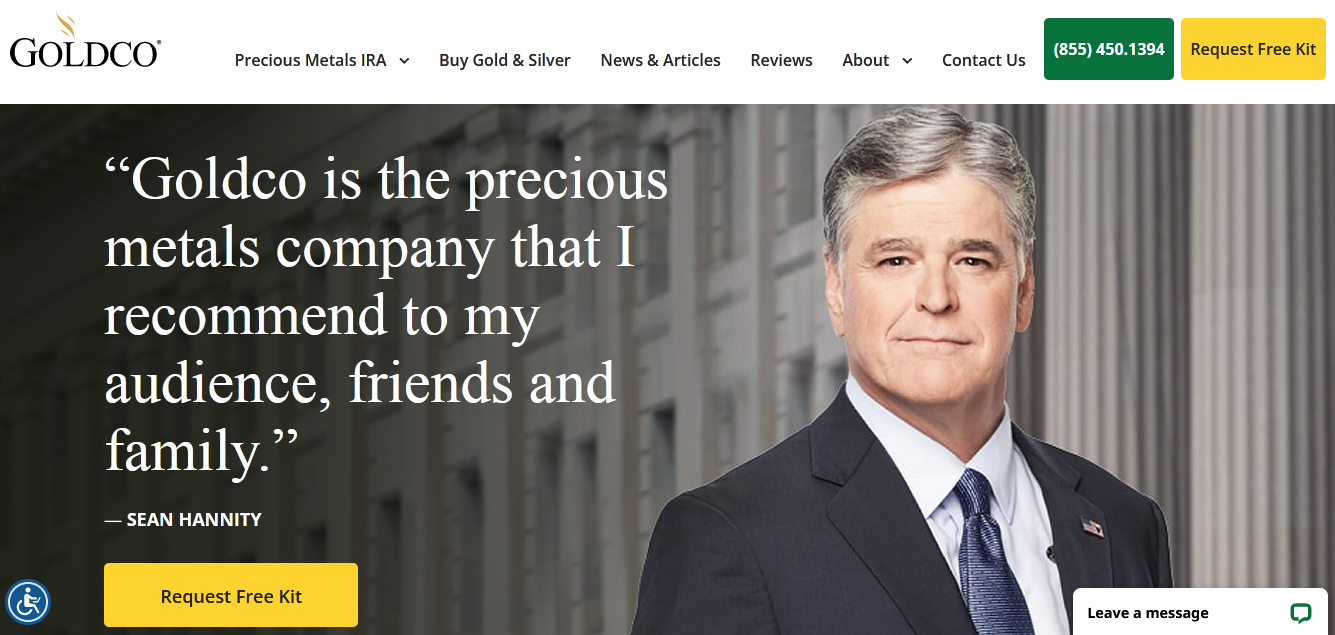

Sean Hannity’s Endorsement

Sean Hannity, a well-known political commentator, is a spokesperson for Goldco. While this endorsement may have helped Goldco gain more visibility, it’s important to note that Goldco’s reputation and success are not solely based on celebrity endorsements.

Minimum Investment and Company Type

Goldco has a $25,000 minimum investment requirement. They offer a range of products and services to fit the needs of investors with various investment goals and budgets. Goldco is a precious metals investment company that specializes in helping customers invest in gold, silver, platinum, and palladium.

Investing in Gold

Investing in gold can be a smart financial move for investors looking to diversify their portfolios. While gold prices can fluctuate, it historically holds its value over time, making it a reliable store of wealth. However, investing in gold should not be seen as a get-rich-quick scheme, and it’s important to consider the risks and potential rewards.

Gold is an important part of a balanced portfolio and should be balanced with other stocks, assets and alternative investments.

Gold vs. Cash

Buying gold can be a better option than saving cash in certain economic conditions. Gold is a tangible asset that can hold its value over time, whereas cash can lose value due to inflation. However, investing in gold is not without risks, and it’s important to carefully consider your investment strategy.

Losing Money and Value of Gold

As with any investment, there is a risk of losing money when investing in gold. Gold prices can be volatile, and investors should carefully consider their investment goals and risk tolerance before making a purchase. However, gold has historically held its value over time, and it can be a smart addition to a well-diversified investment portfolio. Click here for details.

About Russ Amy

Hey there! I’m Russ Amy, here at IU I dive into all things money, tech, and occasionally, music, or other interests and how they relate to investments. Way back in 2008, I started exploring the world of investing when the financial scene was pretty rocky. It was a tough time to start, but it taught me loads about how to be smart with money and investments.

I’m into stocks, options, and the exciting world of cryptocurrencies. Plus, I can’t get enough of the latest tech gadgets and trends. I believe that staying updated with technology is key for anyone interested in making wise investment choices today.

Technology is changing our world by the minute, from blockchain revolutionizing how money moves around to artificial intelligence reshaping jobs. I think it’s crucial to keep up with these changes, or risk being left behind.

some even call me the Finpub God?