The Highest Stock Price in American History

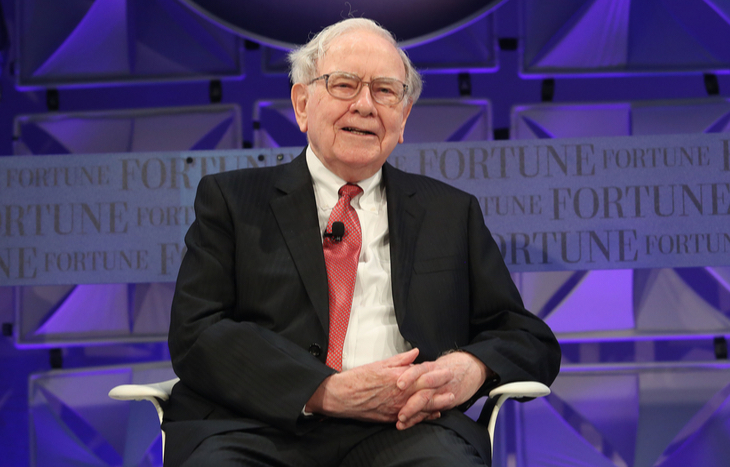

The highest stock price of all time comes from a company that needs no introduction. In fact, it’s run by the most famous investor in the world.

This multinational company shows no signs of slowing down anytime soon. Therefore, what business is behind these record-breaking shares?

The Highest Stock Price of All-Time

The record holder for the highest stock price in American history is Berkshire Hathaway (NYSE: BRK.A) at $487,255 per share. This happened during trading on January 18, 2022.

It was a monumental day for Warren Buffett. The business tycoon entered the record books and he’s most likely to break his own record in the future. However, it may take more time than we originally expected.

After reaching an all-time high in early 2022, Berkshire Hathaway stock took a major dip. In fact, the entire stock market fell off a cliff. Enter the Coronavirus pandemic.

COVID-19 took hold of the U.S. in March of 2020. The country was forced to shut down, slowing the economy to a near halt. As a result, the stock market plummeted.

However, Berkshire Hathaway is still the holder of the highest stock price. Market volatility was running rampant across the stock market and no company was safe from falling share prices. Yet, this was somewhat expected due to the Coronavirus shutdown. Many of the country’s largest companies were forced to decrease production and lay-off parts of their workforce.

Everyone was losing money, from top to bottom. However, Americans are resilient. And despite every hardship, the economy is slowly returning and the stock market is beginning to respond. Berkshire Hathaway stock is currently trading around $475,000 per share.

Why is Berkshire Hathaway Stock So Expensive?

Berkshire Hathaway has the highest stock price because the company decided against splitting its stock. As a result, the company’s massive growth has led to record-breaking share prices.

A stock split occurs when a company decides to split its existing stock into multiple shares to boost liquidity. Some of the world’s biggest companies, such as Tesla (Nasdaq: TSLA) or Apple (Nasdaq: AAPL), have made stocks splits in the recent past.

Berkshire Hathaway doesn’t follow this formula. But, in 1996, it did begin to offer Class B shares. The Class B shares follow a similar growth pattern to the Class A shares. However, the Class B shares went through a 50-for-1 stock split in January of 2010.

As of March 2022, BRK.B shares are trading just over $300. These shares give smaller investors a path into Warren Buffett’s crown jewel. It also gives larger investors the flexibility to convert Class A shares into Class B at any time.

Berkshire Hathaway is also one of the largest shareholders of Apple, Bank of America (NYSE: BOA) and Coca-Cola (NYSE:KO). The stock’s exploding growth is also affected by Warren Buffett’s investing genius.

Top 5 Most Expensive Stocks Ever

Now that you know Berkshire Hathaway’s Class A stock is the most expensive in American history, who’s next in line? Well, for starters, the drop off from first to second is massive.

For example, the top five highest stock price list includes:

- Berkshire Hathaway (NYSE: BRK.A) at $487,255 in January 2022

- NVR (NYSE: NVR) at $5,982 in December 2021

- Seaboard Corporation (NYSE: SEB) at $4,699 in April 2019

- Amazon (Nasdaq: AMZN) at $3,773.08 in July 2021

- Alphabet/Google (Nasdaq: GOOGL) at $3,037 in November 2021

As you can see, there’s a major drop off after Berkshire Hathaway. Moreover, the majority of these share prices came in 2020. The stock market is heading in the right direction once again. So, will we see more record-breaking gains in the near future?

Investing in Expensive Stocks

Investing in America’s most expensive stocks isn’t an option for most people. However, stock splits present an opportunity for the taking.

Berkshire Hathaway has proven to be the stock market’s ultimate force. With the highest stock price in history, you can expect Warren Buffett’s holding company to continue setting the bar very high.

Read Next: Cheapest Stocks Under $1 on the Market

About Corey Mann

Corey Mann is the Content Manager of Investment U. He has more than 10 years of experience as a journalist and content creator. Since 2012, Corey’s work has been featured in major publications such as The Virginian-Pilot, The Washington Post, CNN, MSNBC and more. When Corey isn’t focusing on Investment U, he enjoys traveling with his wife, going to Yankees games and spending time with his family.