How to Lock In Winners With Gold Stocks

It seems like a lifetime ago, but last July I began telling War Room members to take positions in gold stocks.

Since then, members have been in and out of Barrick Gold, Newmont, Sandstorm Gold, Americas Gold and Silver, Osisko Gold Royalties and Equinox Gold, including some “off balance sheet” plays like Yamana Gold, Sibanye-Stillwater and EMX Royalty Corp.

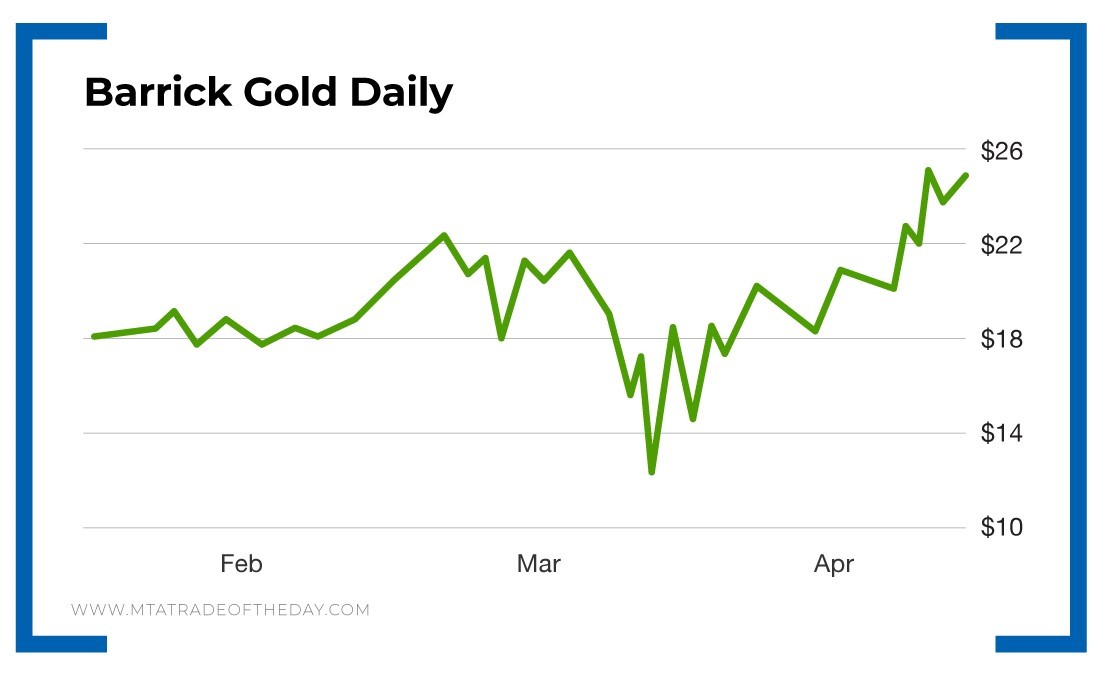

On Friday members closed out our most recent trade recommendation on Barrick Gold (NYSE: GOLD). They did it with a spread trade using Long-Term Equity Anticipation Securities (LEAPS) options expiring in 2022.

Gold Stocks and Positions Move with Gold Prices

There was no need to wait for another 14 months, as the price of gold has been screaming. The metal alone is up almost 50% since I first recommended it to members.

In The War Room, we recommend both short- and long-term positions. Bryan handles the short stuff, and he’s been banging out profits left and right even in this crazy market. And he’s put out some timely calls on gold as well using the leveraged Direxion Daily Gold Miners Index Bull 2X Shares ETF (NYSE: NUGT).

Gold and gold stocks are on a bull run right now. And while it will pull back now and again, I believe the trend will stay intact for some time to come. Why? Well, for these three reasons…

First, the Federal Reserve is printing trillions of dollars. More than $6 trillion new dollars have been printed since the beginning of March. That new money printed out of thin air will increase the cost of living for everyone at some point. You can’t increase supply by that much and expect the U.S. dollar to retain its purchasing power.

If you want evidence of how inflation causes a decrease in purchasing power when you are printing money, just look back to 1970, when you could buy a three-bedroom home in a nice community for $30,000 and a fully loaded Mustang for $5,000. Today those would cost 10 times more.

The second reason is fear and the need for a “safe haven” investment. Gold has always proved to be that type of investment – safety is a big destination for a lot of money today.

The third and final reason is supply and demand. Right now, gold production at mints that make coins and bars is shut down. That means there is less gold on the market, which increases the price.

Action Plan: The move in gold prices is not over, and Bryan and I have more picks in the portfolio and in the pipeline.

It’s only with The War Room that you will get full coverage of gold stocks and every sector of the market in real time – when you can react immediately! What are you waiting for? Join me in The War Room today!

You can get access to the War Room by signing up for our Trade of the Day free e-letter below. It’s packed with useful trading insight.

About Karim Rahemtulla

Karim began his trading career early… very early. While attending boarding school in England, he recognized the value of the homemade snacks his mom sent him every semester and sold them for a profit to his fellow classmates, who were trying to avoid the horrendous British food they were served.

He then graduated to stocks and options, becoming one of the youngest chief financial officers of a brokerage and trading firm that cleared through Bear Stearns in the late 1980s. There, he learned trading skills from veterans of the business. They had already made their mistakes, and he recognized the value of the strategies they were using late in their careers.

As co-founder and chief options strategist for the groundbreaking publication Wall Street Daily, Karim turned to long-term equity anticipation securities (LEAPS) and put-selling strategies to help members capture gains. After that, he honed his strategies for readers of Automatic Trading Millionaire, where he didn’t record a single realized loss on 37 recommendations over an 18-month period.

While even he admits that record is not the norm, it showcases the effectiveness of a sound trading strategy.

His focus is on “smart” trading. Using volatility and proprietary probability modeling as his guideposts, he makes investments where risk and reward are defined ahead of time.

Today, Karim is all about lowering risk while enhancing returns using strategies such as LEAPS trading, spread trading, put selling and, of course, small cap investing. His background as the head of The Supper Club gives him unique insight into low-market-cap companies, and he brings that experience into the daily chats of The War Room.

Karim has more than 30 years of experience in options trading and international markets, and he is the author of the bestselling book Where in the World Should I Invest?