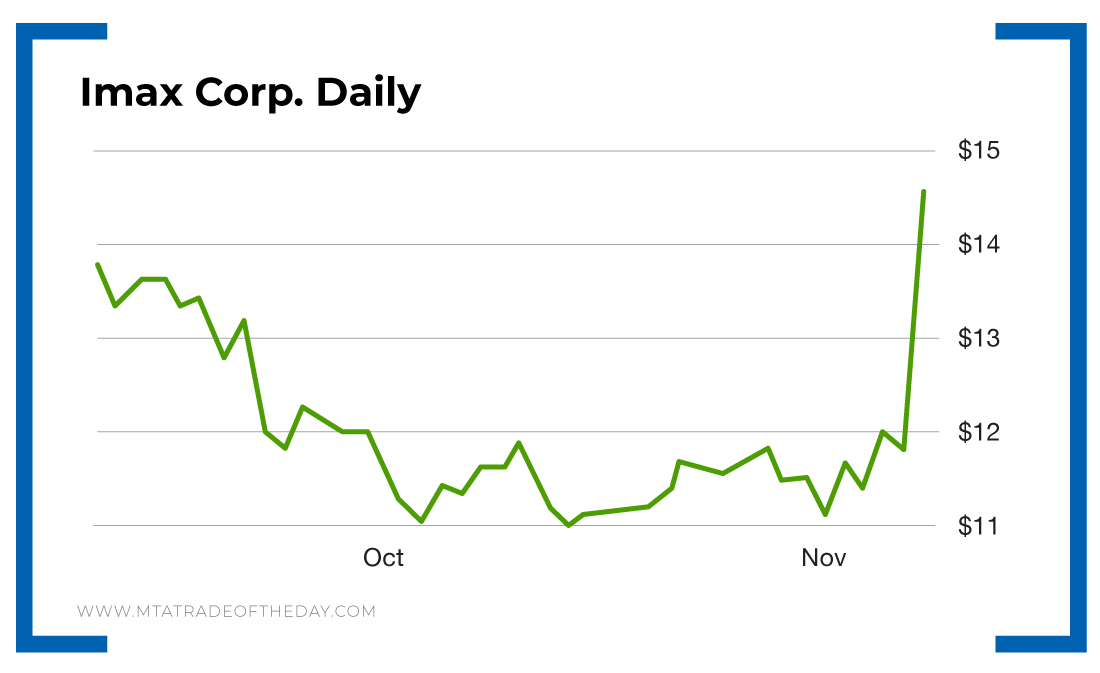

This $11 Pick From September Blasted Off Today

Back on September 21, I posted a Trade of the Day about Imax stock titled “Of Course We’re Making This Prediction.”

Here’s the backstory…

I started off that issue by asking you this question: Will you ever see a blockbuster movie in the theater again?

Most likely, you answered yes.

Then I said…

I’m willing to make the prediction that sometime in the future, we’ll all go to the movie theaters again and enjoy the next blockbuster Star Wars or Avengers movie. But here’s where I think we’ll see a subtle change. You see, going forward, I think going to the movies will be a bigger event than it was before COVID-19. In this new post-COVID-19 world, if you’re going to go through all the trouble, I think people will now start to “go big,” which could lead to a resurgence in Imax moviegoers.

Based on this view, I recommended getting positioned in Imax Corp. (NYSE: IMAX) going into 2021.

And here’s what happened today…

Imax Stock Takes Off

On the Pfizer vaccine news, Imax stock blasted 23% higher.

As I’m sure you know, Imax owns a network of 1,616 theater systems in 81 countries. The company owns all of the proprietary digital remastering (DMR) software to digitally enhance image resolution, visual clarity and sound quality of motion pictures for projection on its massive screens. It also designs, manufactures and installs all Imax theater projection systems.

Clearly, the COVID-19 pandemic crushed its business model. Back in late August, Imax reported an adjusted loss of $0.48 per share, which was far worse than the Zacks consensus estimate of a $0.12 loss per share.

But at the time, I thought picking up Imax stock at those lows was a bargain. In fact, I wrote, “When blockbuster movies return, Imax will benefit.”

And today’s promising vaccine news is a very big first step in restarting the moviegoing process.

Action Plan: If you’re holding Imax stock, take your profits. And if you want more of my top picks – delivered to you in video form every Wednesday afternoon – I invite you to join our new Trade of the Day Plus service.

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.