Investing in Art: Is It Good for Your Portfolio?

Investing in art is becoming more popular. Stock markets continue to be near all-time highs. And people continue to look for ways to minimize downside risk. Diversifying your portfolio by investing in artwork is one way to do that.

There are some definite advantages to investing in art. On the other hand, it’s definitely not wise for everyone. Every investor must decide whether art makes sense for their portfolio.

Does investing in art make sense for you? Let’s take a look at what it really entails and what you should know.

What Is the Art Market Like?

There are lots of ways to diversify your portfolio. Many people use nontraditional, even exotic assets. For example, an investor may invest in fine wines. Rare coins. Or even baseball cards.

But artwork has a special appeal for some people. And the numbers show that the market for works of art continues to rise.

For example, according to Art Market Research, art prices have risen more than 1,000% over the last 40 years. And according to Art Basel, global art market sales reached over $67 billion in 2018.

But how do you know if investing in art makes sense for you? Let’s take a closer look.

How to Choose Works of Art

One way to tell that art may be a good asset for your portfolio is if you already have a strong appreciation for it. With many investments, the traditional wisdom is “buy what you know.” But in the case of art, it could be “buy what you love.”

In fact, many art investors begin as collectors. It isn’t as much about making money as it is about appreciation of the artwork. But that passion for collecting can be turned into a moneymaking opportunity.

Period and Style

Your own personal taste can be a great starting point for deciding how to invest in art. Look for particular periods of time or styles of work that you enjoy.

Maybe you love the golden age of Dutch painting. Or perhaps you enjoy a modern American aesthetic. The options are limitless, so it is up to you to decide what you prize. It’s also for you to investigate what has the most likelihood for a great return on investment.

Some of the top selling artwork of 2019 included:

- Salvator Mundi – Leonardo da Vinci – circa 1500 – $450 million

- Interchange – Willem de Kooning – 1955 – $300 million

- The Card Players – Paul Cézanne – 1895 – $274 million

- Number 17A – Jackson Pollock – 1948 – $202 million

From Renaissance geniuses to postmodernist abstractionists, the world of fine art travels widely across time and place. Which means there are lots of great investment opportunities out there for you.

Medium

Another thing to consider is what media you are interested in. Do you enjoy oil paintings or acrylic? Also, there is a world of artwork beyond just paintings. You could get involved with buying sculptures or photography. There’s even a market for graffiti work!

On the other hand, if you don’t really care for art, it’s probably not worth the time, energy and money it takes to invest in it. So take your personal stance on it into consideration.

Originality & Rarity

Once you’ve determined the particular period and style of work, you have another choice to make. That is the specific types of individual work you want to buy. You have several options and some are worth way more than others. These breakdown as follows:

- Originals – These are the crown jewels of art investing. Originals are one-of-a-kind works. They sell for the highest prices by far, but they also offer the greatest potential for profit.

- Fine Art Prints – An art print is a higher-quality printed reproduction of a work of art. They can range in quality but are of higher quality than mass-produced art reproductions. Print will offer much lower returns than original artwork, however. The best quality print is called a giclée, and these are a bit more akin to originals. The more rare the print, the higher the value.

- Reproductions – These are simply mass-produced copies. They are not rare but they are quite affordable. However, they are worth little and you likely won’t make any profit.

If you’re serious about investing in art, originals are the way to go. Look for artwork in great condition and of high quality. If a work is pricey, it is usually worth paying for a professional appraisal.

Learning about the Art Market

According to philosophers like the famous Frances Bacon and Michel Foucault, knowledge is power. That is certainly true when it comes to investing in art. You don’t need to be a collector to invest. But you should take some time to study and learn about the art world.

There are lots of ways you can learn. For example, you can:

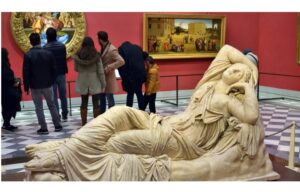

- Go to local or national museums and chat with curators.

- Visit local galleries and see what’s on display.

- Attend gallery opening events or art fairs where up-and-coming artists are showcasing their work.

- Browse helpful sites like Artnet and Sotheby’s.

- Take courses in art history at your local college or watch courses online.

Also, if you don’t have enough knowledge yourself, you can work with art experts to make more informed decisions. Individual consultants, art investment specialty firms and even major financial institutions all are equipped to help you with your art investing needs.

Consultants can help you determine the best periods or styles of work for you to invest in. They can also help you determine the fair market value of individual works of art. You don’t have to go it alone.

How do you go about finding work to invest in? There are several different places to go. Check out museums, galleries, search online or visit an auction house. It’s important to remember that with auction houses you will likely be charged a buyer’s premium above the actual sticker price of the work.

Art as Investment

Investing in art is not like day trading stocks. It is a long term investment. If you don’t have a time horizon of at least 10 years, it’s better to stay aside because you won’t likely see a profitable return. More than 10 years is even better.

There are a number of costs that you will need to account for when figuring out your total investment amount in a work. That goes well beyond just the sticker price of the work. For example, you need to take into account:

- Framing the work

- Sales tax

- Auction fees

- Storage (if not displayed)

- Environmental costs (if displayed to keep it in good condition)

- Auction fees

- Appraisal costs

- Consulting fees

- Insurance

And remember that art is only a small portion of a well-diversified portfolio. It’s a diversification and risk-minimizing move. It’s not going to net you your greatest gains. That’s what the stock market is for.

Never invest money in art that you can’t afford to lose. There are several reasons for this. For starters, it will leave you unprepared for financial emergencies.

Artwork is not guaranteed to appreciate in value over time. In fact, it can lose value. There is significant downside risk to art investing.

Moreover, art is never an essential component of a portfolio. Whereas some variation of cash, bonds and stocks is usually required for a well-balanced portfolio, works of art are not. Only invest in this area if it makes sense for you.

Investing in Shares of Art

One way to invest in art is to buy original work. But there is another way. You can invest in shares of artwork or acquire shares of art funds.

Buying shares from Masterworks is one way to do that. Masterworks is an exclusive community of art investors. Through Masterworks you can buy shares of work. Keep in mind that the company charges fees.

Masterworks operates by buying works of art and selling shares to investors. They keep you informed of how your investment is doing over time.

They invest in high-end works of art. Everything is authenticated by experts. And you don’t have to worry about costs of storage or keeping the work in prime condition. But the minimum investment for Masterworks is $1,000.

Investing in Art: The Bottom Line

Investing in art is not for everyone. It is an investment that often doesn’t pan out. It can be either a lot of work or expensive (or both). And in the long run you’ll likely do much better with stocks.

On the other hand, if you’re an art lover it can have appeal and some benefits. It helps diversify your portfolio. It can be a hedge against falling stock prices. And it gives you some great cocktail party chatter.

If you’re interested in this type of investing or want to know more about alternative asset classes, sign up for Investment U’s free daily e-letter. In it we talk about all kinds of investment opportunities from stocks to bonds and even investing in art.

About Brian M. Reiser

Brian M. Reiser has a Bachelor of Science degree in Management with a concentration in finance from the School of Management at Binghamton University.

He also holds a B.A. in philosophy from Columbia University and an M.A. in philosophy from the University of South Florida.

His primary interests at Investment U include personal finance, debt, tech stocks and more.