Miss Tesla’s Pop? Catch Up Immediately With One Click

In the spirit of full disclosure…

I drive a Tesla Model S, but I do not own Tesla (Nasdaq: TSLA) stock.

However, while shares of Tesla were exploding over the last few weeks, I was smiling.

Why?

Because I was still exposed to the explosive upside move using a cheap backdoor way to capitalize on the Tesla move – all for a fraction of the price.

And today I’m going to share this little gem with you.

Without exaggeration, this may be the most important Trade of the Day issue you’ll ever read – so please give me five minutes of your time so you can see what I’m about to reveal to you.

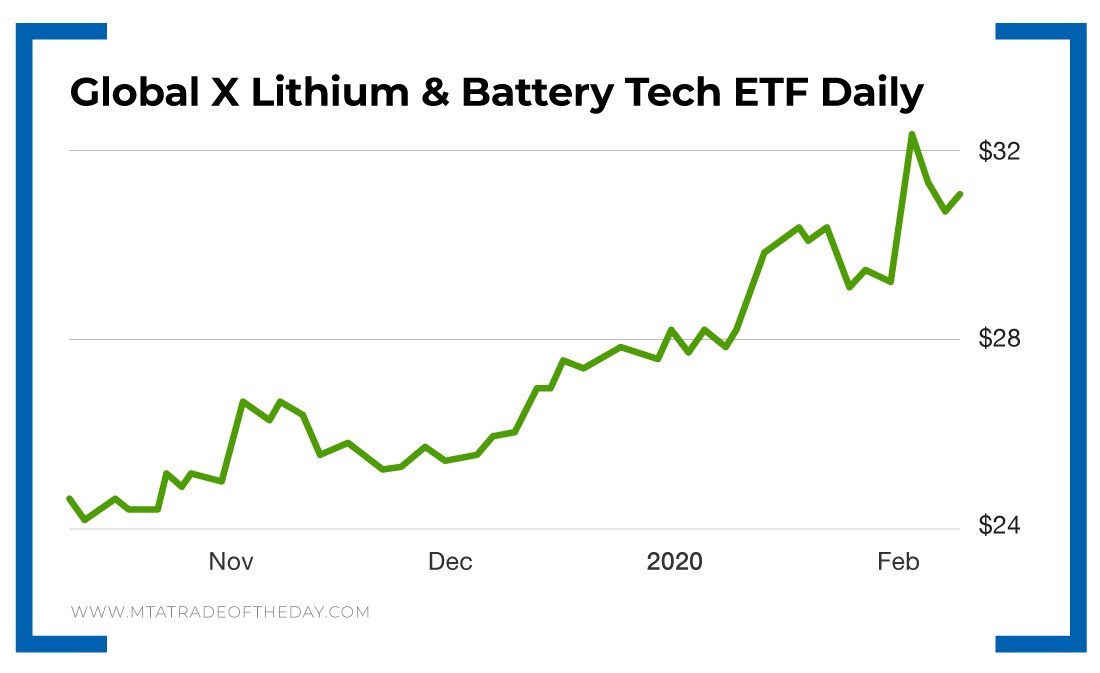

The investment I highly recommend making immediately is the Global X Lithium & Battery Tech ETF (NYSE: LIT).

It’s up 9.2% in 2020 and offers you exposure to many securities representing the full lithium cycle, from mining and refining the metal all the way through battery production.

Simply put, it’s a nondiversified way for you to have complete coverage of the market performance of global companies involved within the entire lithium industry.

Why is this so important?

Well, lithium is a soft, silvery-white alkali metal. It’s the lightest metal and a solid element. Like all alkali metals, lithium is highly reactive and flammable. And because of its relative nuclear instability, lithium is less common in the solar system than 25 of the first 32 chemical elements.

When it comes to industrial applications, lithium-ion batteries are essential for the rapid growth of electric vehicles.

In other words, the clean energy economy is here. It’s not going away. And the Global X Lithium & Battery Tech ETF gives you complete coverage to every single company that’s essential to making it happen.

For instance, Michael Bloomberg wants all new cars to be electric-driven by 2035 – and 15% of American trucks and buses to be pollution-free by 2030.

Now here’s the secret…

Look at the top 10 holdings in the Global X Lithium & Battery Tech ETF:

- Albemarle Corp.

- Sociedad Química y Minera de Chile

- Tesla

- Livent

- Samsung SDI

- Panasonic

- Simplo Technology

- GS Yuasa

- BYD

- LG Chem.

Notice how Tesla is in there?

It represents 9% of the entire Global X Lithium & Battery Tech ETF basket.

So if you missed the move on Tesla but you’d still like to have exposure to the stock, then this is a play that should be part of your core portfolio – starting today.

ActionPlan: A post on a Global X Lithium & Battery Tech ETF forum said, “Stay Long on this one. 18-24 months. Rewards will be huge given what the automobile industry is moving towards.”

I couldn’t agree more.

For more trade ideas like this and real-time trading instructions, join me in The War Room today!

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.