My Top Super Tuesday Stock Winner

This morning a strong Super Tuesday showing from Joe Biden – which included a series of key wins in southern states like Virginia, North Carolina and Arkansas – brought his delegate total to 566 (which is ahead of Bernie Sanders’ total of 501).

In response, the markets opened the day higher – and extended those gains throughout lunchtime.

But when it comes to this upside reaction, the more important part (in my view) is the fact that Elizabeth Warren suffered some key losses, which indicates that a concession from her campaign could be coming soon.

As you know, Warren is no Wall Street darling thanks to her proposals to break up big banks, break up some technology companies and also raise taxes.

So Biden’s win over Sanders and Warren’s struggles all combined to push the markets higher first thing this morning – and well into the afternoon.

So when it comes to this fluent political situation – which is becoming clearer and clearer by the day – it’s worthwhile for us to look at companies that stand to benefit (from both the emerging political candidates and the “stay at home” trend that’s happening due to the coronavirus).

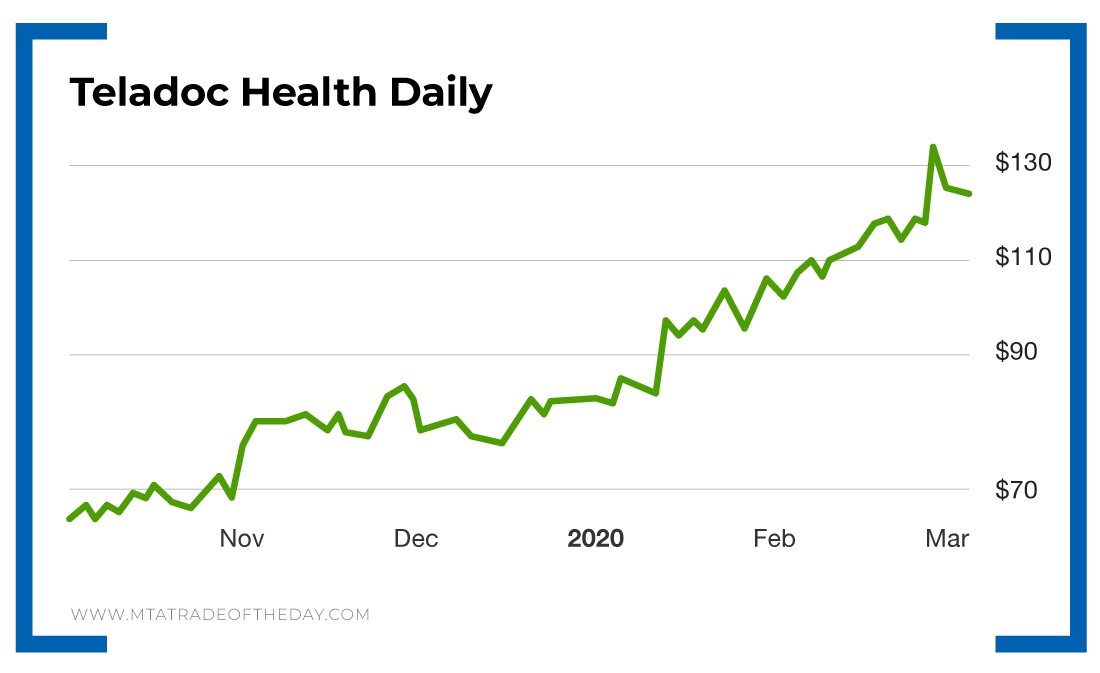

That’s why I’d like to bring Teladoc Health (NYSE: TDOC) to your attention today.

Teladoc Health specializes in “telehealth” services (which can also be referred to as “virtual healthcare” services).

The company’s platform enables both patients and providers to have an integrated “smart user” healthcare experience – using both mobile devices and the web. This allows them to serve patients in both the United States and internationally.

Think about it like this…

What’s worse than going into a disease-filled doctor’s office waiting room when you’re sick – and sitting next to the guy hacking up a lung or the kid sneezing his green boogers all over you?

Instead, how great would it be to seek medical treatment over Teladoc Health’s online portal?

To me, that sounds fantastic.

And if you look at Teladoc Health’s numbers, you’ll see that others are starting to realize this as well.

Teladoc Health’s paid memberships rose 61% in 2019, and that was before the coronavirus hit the markets!

Action Plan: I feel this is another “stay at home” winner to add to your buy list – especially since the company is in the healthcare field.

That’s a double benefit – making it worthy of a position in your ledger. If you want to get in on trades like this, join me in The War Room!

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.