Peloton and Twitter – Two Earnings Plays to Watch Immediately

Two companies are set to report earnings – and I believe both are primed for a big move.

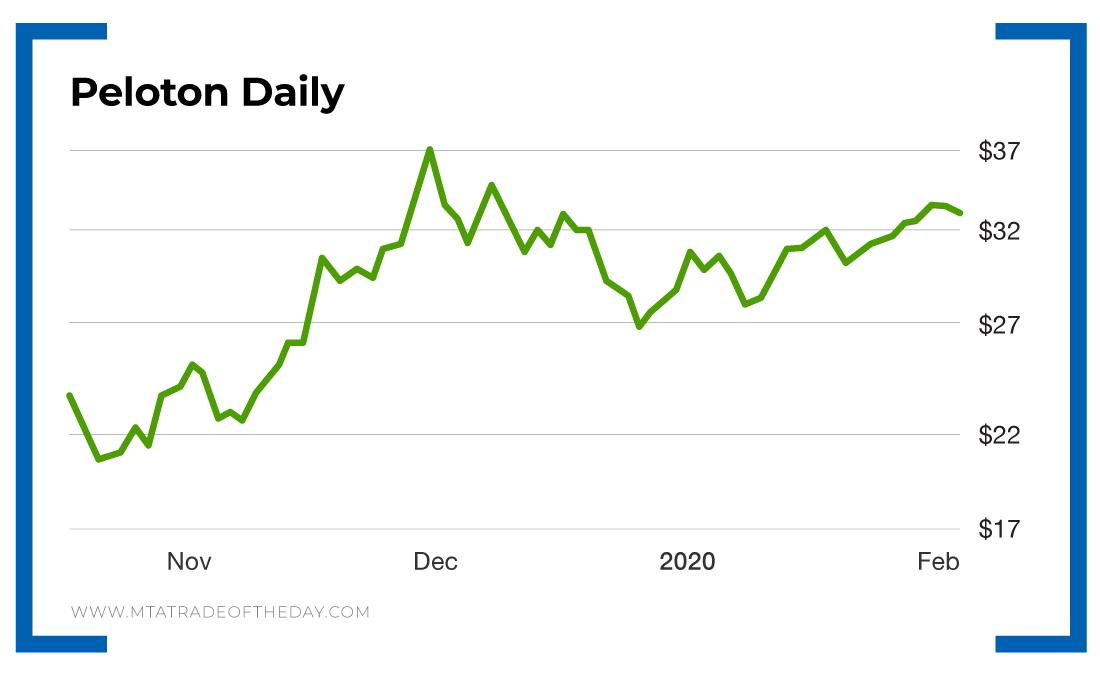

By the time you read this Trade of the Day issue, the first company will already have reported. And that company is Peloton (Nasdaq: PTON).

Going into the report, Peloton has been quite polarizing. Its 2019 sales growth is currently 110.3% – and Wall Street loves rewarding growth with a huge price premium. But on the other hand, Peloton was just downgraded by Bank of Montreal Capital Markets (before market open) with a $27 price target.

Even more dramatic, Citron Research set a $5 price target on Peloton, saying, “Unless Peloton invents a piece of equipment that works out for you – this is going to $5.”

Going into the earnings report, Peloton is expected to report earnings per share (EPS) of negative $0.32 on revenue of $423.45 million.

Will Peloton gap up or gap down tomorrow?

Is it a $5 stock… or a $50 stock?

This will certainly be worth tracking first thing in the morning.

The second company set to report earnings before the market open tomorrow is Twitter (NYSE: TWTR).

Over its last three earnings reports, Twitter has moved 21% lower, 5% lower and 14% higher. So clearly, this name makes tradable moves.

Going into the report, the expectation is that Twitter will report EPS of $0.28 on revenue of $997.35 million.

Will Twitter gap up or gap down tomorrow morning?

We’ll certainly be tracking and trading it in The War Room.

Action Plan: If you want to follow along, then pull up Peloton and Twitter tomorrow morning – and track the magnitude of each earnings move.

If you’d like to start trading these moves using our unique earnings methodology, then I invite you to join me in The War Room! And explore our newest presentation by clicking here!

About Bryan Bottarelli

Whether it was selling the Star Wars figures he collected as a little boy for 50 times their value or using the $125 he made cutting grass to buy a Michael Jordan rookie card that he later sold for $1,500, it was always clear that Bryan Bottarelli was a born trader – possessing the unique ability to identify opportunities and leverage his investments.

Graduating with a business degree from the highly rated Indiana University Kelley School of Business, Bryan got his first job out of college trading stock options on the floor of the Chicago Board Options Exchange (CBOE). There, he was mentored by one of the country’s top floor traders during the heart of the technology boom from 1999 to 2000 – trading in the crowded and lively Apple computer pit. Executing his trades in real time, Bryan learned to identify and implement some of his most powerful trading secrets… secrets that rarely find their way outside the CBOE to be used by individual traders.

Recognizing the true value of these methods, Bryan tapped into his entrepreneurial spirit and took a risk. He walked off the CBOE floor and launched his own independent trading research service called Bottarelli Research. From February 2006 to December 2018, Bryan gave his precise trading instructions to a small, elite group – most of whom have been followers ever since.

As a “play tactician,” Bryan uses his hands-on knowledge of floor trading to shape opportunities and chart formations into elegant, powerful and profitable recommendations. And by using the same hedging techniques taught by professional floor traders, Bryan is able to deliver his readers remarkable gain opportunities while strictly limiting their total risk.

Along the way, Bryan has developed a cumulative track record that could impress even the most successful hedge fund manager.

He now spends his days moderating one of the most elite trading research forums ever created: The War Room.