Is Qualcomm’s Dividend Safe? Check Out These Three Dividend Trends

Qualcomm (Nasdaq: QCOM) has had some drama in recent years. It’s faced big fines from regulators around the world. It’s also been in a huge legal battle with Apple. As a result, investors have been wondering… is Qualcomm’s dividend safe?

For one apparent answer, investors have bid up Qualcomm stock by about 70% this year. They seem to think the company is strong financially and has good prospects going forward. Following others doesn’t always lead to market beating outcomes, though.

To determine Qualcomm’s dividend safety, let’s look at some past trends. I’ll show you the dividend growth, yield and payout ratio over the last 10 years. And before we get to that, let’s look at some company highlights…

Qualcomm Business Highlights

Qualcomm is a $166 billion business. The company is based out of San Diego, California, and employs 41,000 people. Last year, the company had $24 billion in sales, and that works out to about $574,000 per employee.

Qualcomm develops semiconductors, software and services related to wireless technology. And its inventions helped launch the mobile revolution.

You can find Qualcomm’s technology in billions of devices around the world, such as smartphones, tablets and cars. The company also isn’t resting on its laurels. It has more than 9,000 patents pending.

This continued innovation has helped the company keep money flowing. The company has a long history, and from a financial point of view, it looks healthy. It has an A- credit rating and that allows it to issue cheap debt to grow the business and pay dividends.

Qualcomm Dividend History

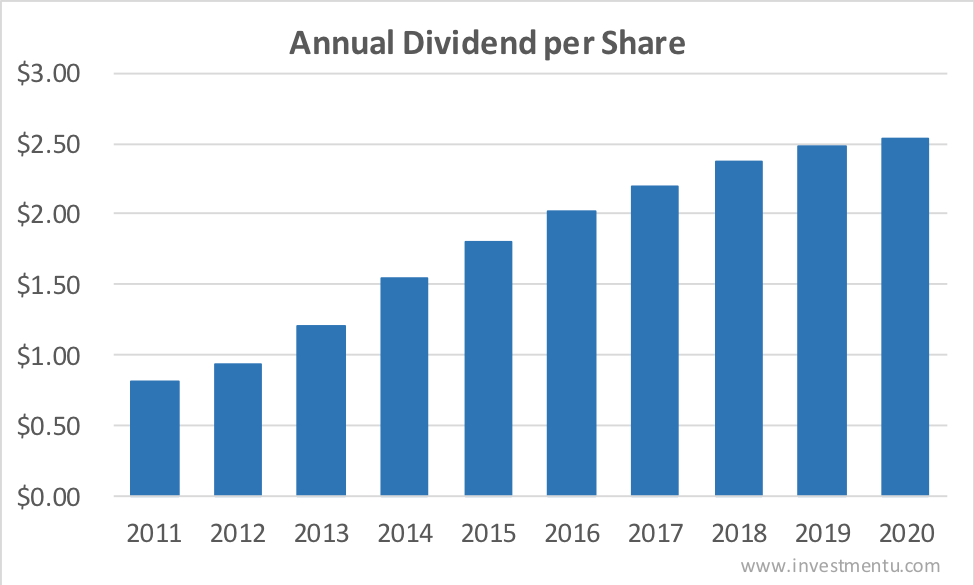

The company paid investors $0.81 per share a decade ago. Over the last 10 years, the dividend has climbed to $2.54. That’s a 214% increase. Here are the annual changes…

The compound annual growth rate (CAGR) is 12.1% over 10 years… But over the last year, the dividend climbed 2.4%. The slowdown in dividend growth isn’t a great sign. However, Qualcomm still might be a good income investment. Let’s take a look at the yield…

Current Dividend Yield vs. Average

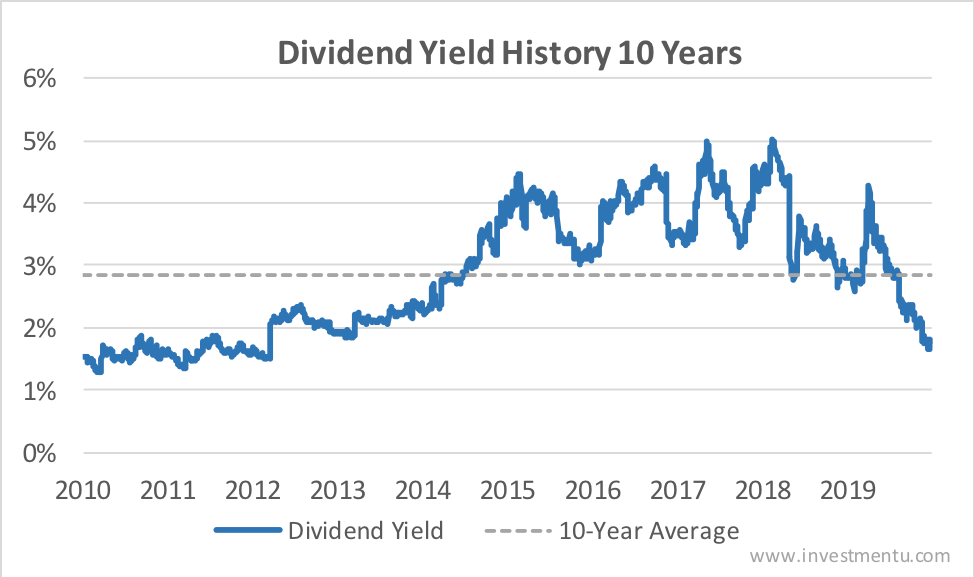

Qualcomm’s long history of paying dividends makes it one of the best dividend stocks around. This also makes the dividend yield a great indicator of value. A higher yield is generally better for buyers. Dividend safety is also vital, and we’ll look at that soon.

The dividend yield comes in at 1.78%, below the 10-year average of 2.83%. The chart below shows the dividend yield over the last 10 years…

The lower yield shows that investors have bid up the company’s market value. They might be expecting higher dividend payouts. But more often than not, the dividend yield reverts to the mean with share price changes.

Is Qualcomm’s Dividend Safe?

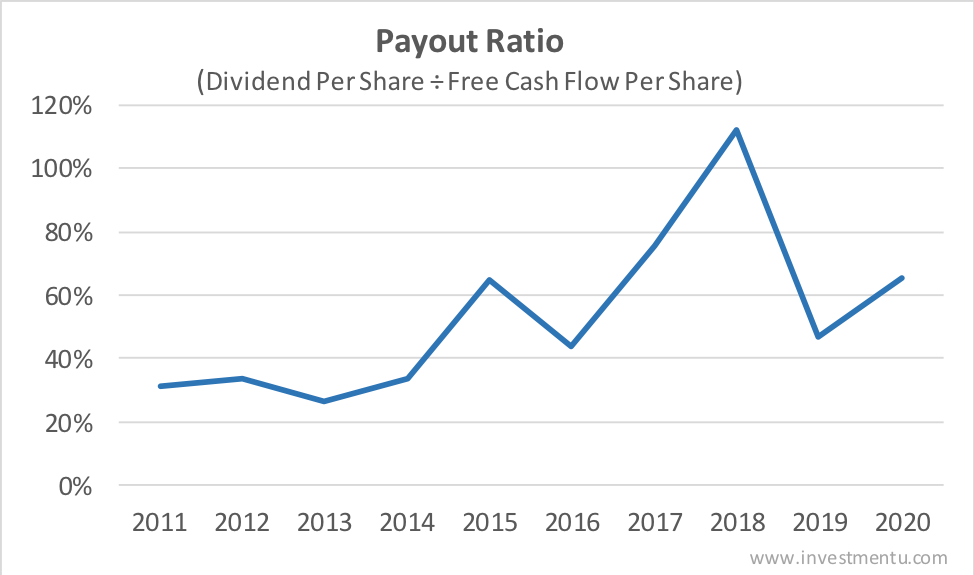

Often, investors look at the payout ratio to determine dividend safety. They look at the dividend per share divided by the net income per share. So a payout ratio of 75% would mean that for every $1 Qualcomm earns, it pays investors $0.75.

The payout ratio is a useful signal of dividend safety… but accountants manipulate net income. They adjust for goodwill and other non-cash items. So using free cash flow instead can be more reliable.

Here’s Qualcomm’s dividend payout ratio based on free cash flow over the last 10 years…

The ratio is volatile over the last 10 years and the trend is up. The last year shows a payout ratio of 65.4%. At this level, there is still plenty of wiggle room for Qualcomm’s board of directors to raise the dividend.

As long as there isn’t a big hit to the business, its dividend seems safe over the next few years. There’s also a good chance that it continues to climb higher. So as an income investor, it might be a good play. But as a value investor, Qualcomm’s share price has run a bit hot this year.

There are thousands of investment opportunities out there. To help sort through all this noise, you can sign up for the free Wealth Retirement e-letter. It’s packed with income investing tips and tricks from market experts.

On top of that, you might also find the free investment calculator useful. You can use it to predict how big your dividend investments and portfolio can grow.